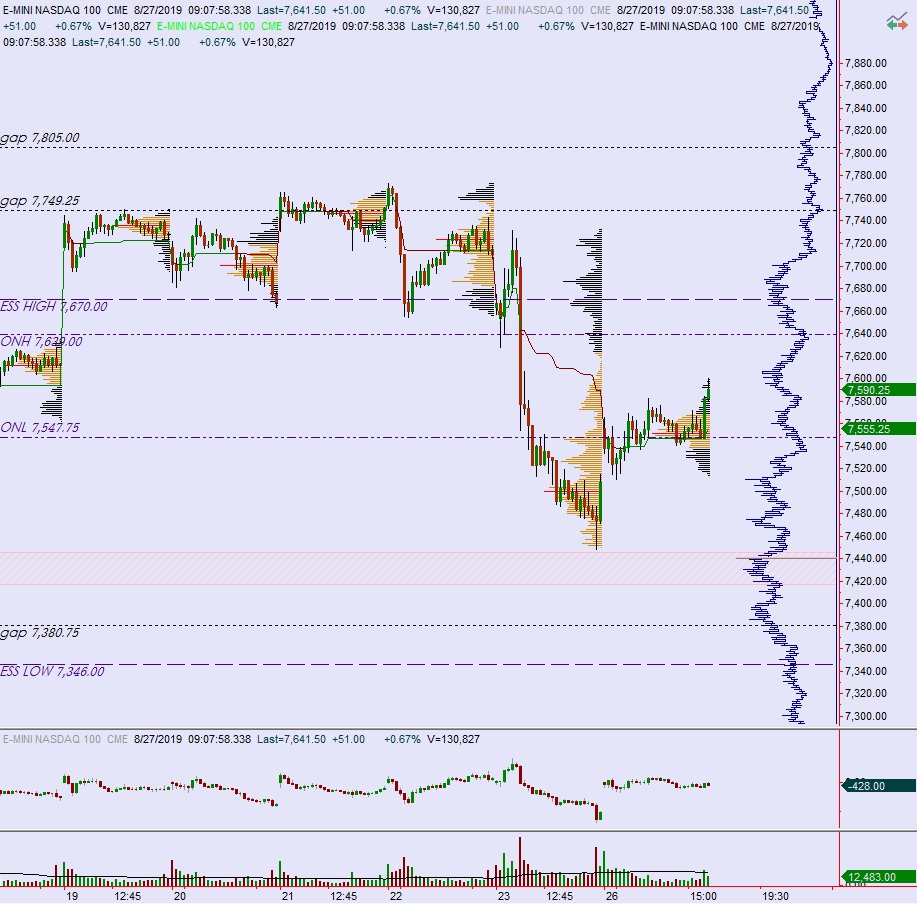

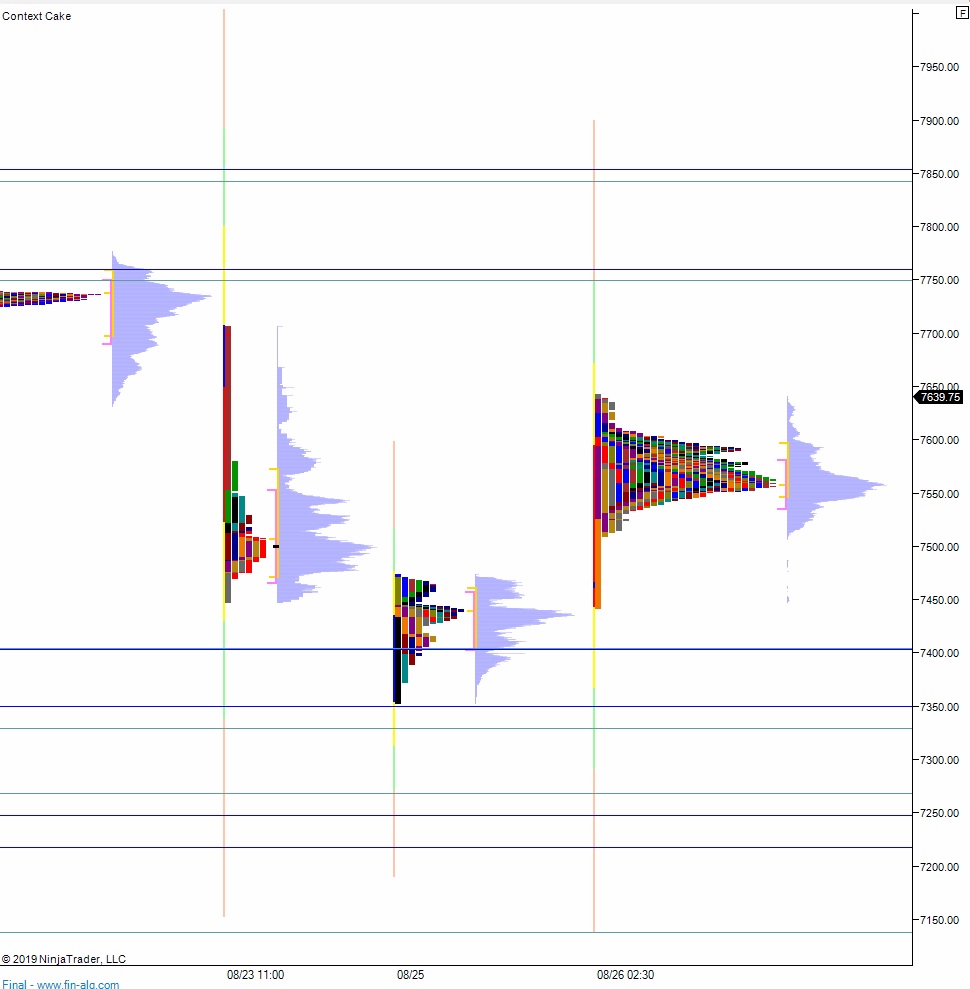

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme volume on extreme range. Price worked higher overnight, trading up beyond the high print from early Monday morning (globex) and well up into the Friday afternoon ‘tariff talk’ (tweet) induced sell-off. As we approach cash open, price is hovering in the upper quadrant of last Friday’s range.

On the economic calendar today we have consumer confidence at 10am followed by a 2-year note auction at 11:30am.

Yesterday we printed a normal variation up. The day began with a gap up that saw price open just below last Friday’s midpoint. Sellers worked into the overnight inventory and nearly closed the overnight gap, the market reversed 2.5 points ahead of the gap fill and began to auction higher. In a product as slippery as the NASDAQ, in these volatile conditions, I consider this a gap fill. Price then worked to range extension up before settling along the midpoint for most of the day. There was a late session ramp higher.

Heading into today, price is lingering into some single prints on the next profile to the left, these are pole climb conditions. Look for buyers to gap-and-go higher, trading up to 7670 before two way trade ensues.

Hypo 2 stronger buyers sustain trade above 7670 and continue the pole climb all the way up to 7734.50. Look for sellers up at 7750 and two way trade to ensue.

Hypo 3 sellers defend their news driven reaction from last Friday, pressing into the overnight inventory and closing the gap down to 7555.25 before continuing lower, down through overnight low 7547.75. Look for buyers down at 7450 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: