NASDAQ futures are coming into Monday with a slight gap up after an overnight session featuring normal range on elevated volume. Price worked sideways overnight, chopping along inside the Friday range. As we approach cash open, price is hovering near the Friday high.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

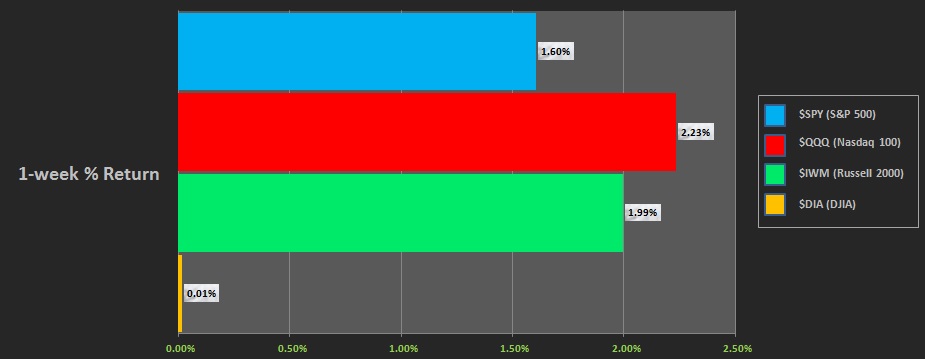

Last week featured a rally across the board, except for the Dow. We pretty much rallied all week while the Dow marked time. Here is the last week performance of each major index:

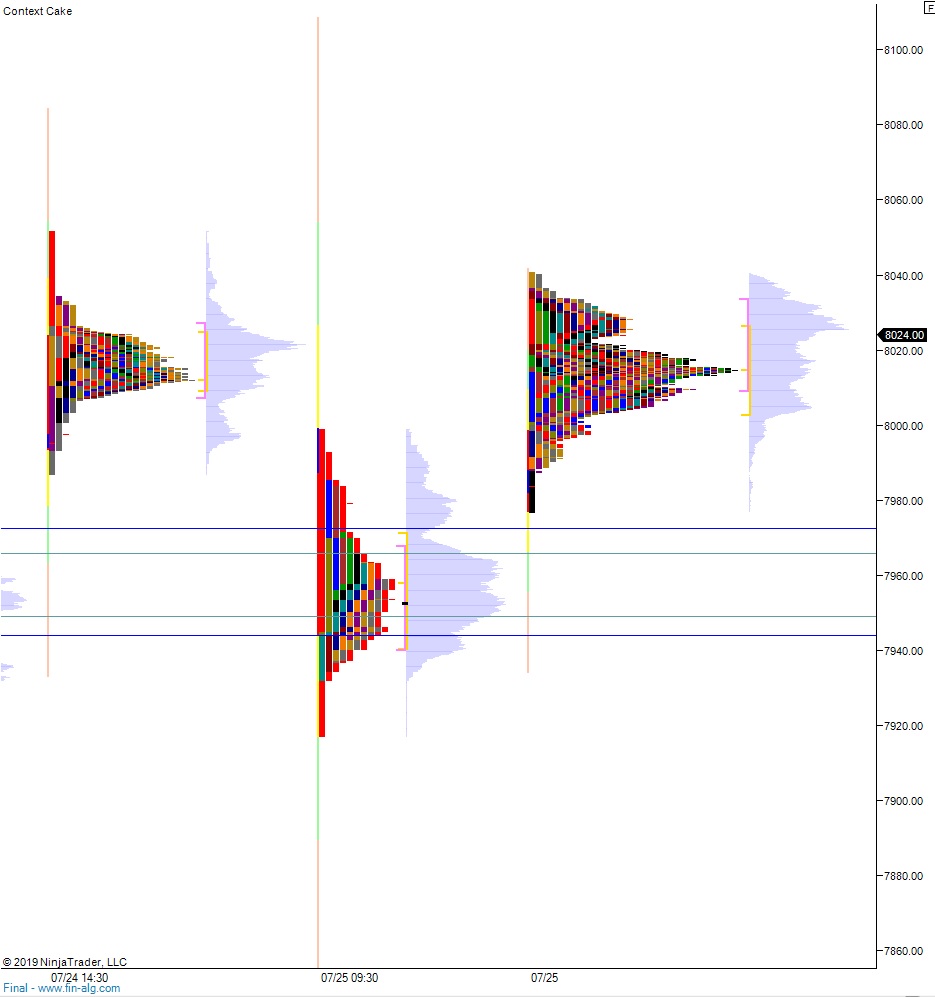

On Friday the NASDAQ printed a normal variation up. The day began with a gap up and push higher which stalled just a few points below record highs. Sellers faded the move through late morning but were unable to press range extension down. Instead buyers came back in and initiated higher prices, trading higher but not exceeding record high before some late-late afternoon selling back to the midpoint.

Heading into today my primary expectation is for sellers to press into the overnight inventory and close the gap down to 8017.50. From here we continue lower, down through overnight low 8002 to tag the 8000 century mark before two way trade ensues.

Hypo 2 buyers work up through overnight high 8031.75 setting up a move to target 8050 before two way trade ensues.

Hypo 3 stronger buyers trigger a rally up to the 8100 century mark before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: