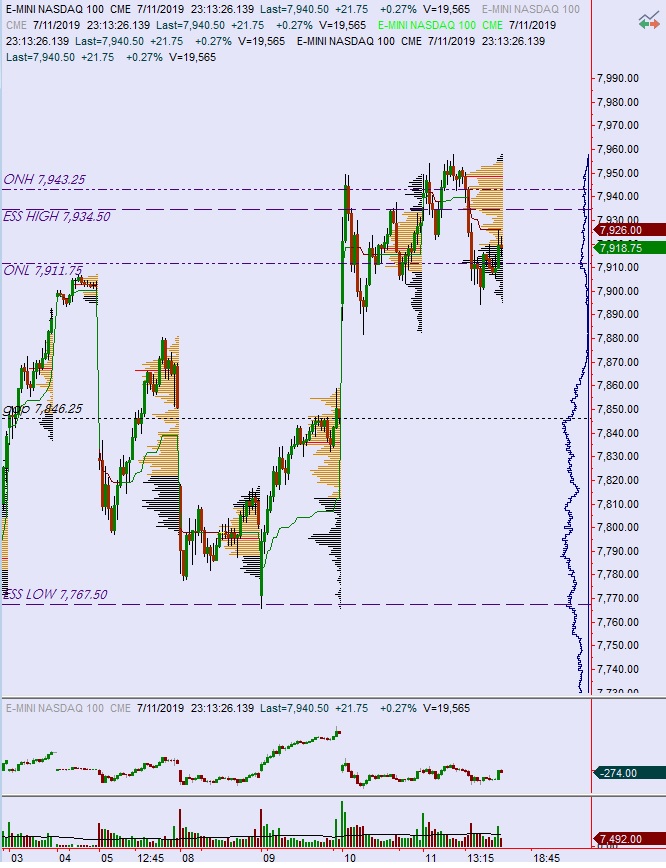

NASDAQ futures are coming into Friday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, reclaiming the Thursday midpoint and continuing a bit higher. As we approach cash open, price is hovering in the upper quadrant of Thursday’s range.

There are no economic events today.

Yesterday we printed a neutral day. The day began with a gap up and slight move higher, probing to a new record cash-session high but not to a new record high, which was set during Wednesday night globex. Aftermaking the higher price fell lower once, then rallied back to more highs (RE up) before sellers stepped in and drove price RE down and into a neutral print. The 7900 century mark was a wall and we rallied back to the midpoint by end-of-day.

Neutral.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7918.75. From here we continue lower, down through overnight low 7911.75. Look for buyers again down at 7900 and two way trade to ensue.

Hypo 2 gap-and-go higher, trading up through overnight high 7943.25 setting up a run to probe above record highs 7963.25 before two way trade ensues.

Hypo 3 stronger sellers trigger a liquidation down to 7846.25 Tuesday gap before two way trade ensues.

Levels:

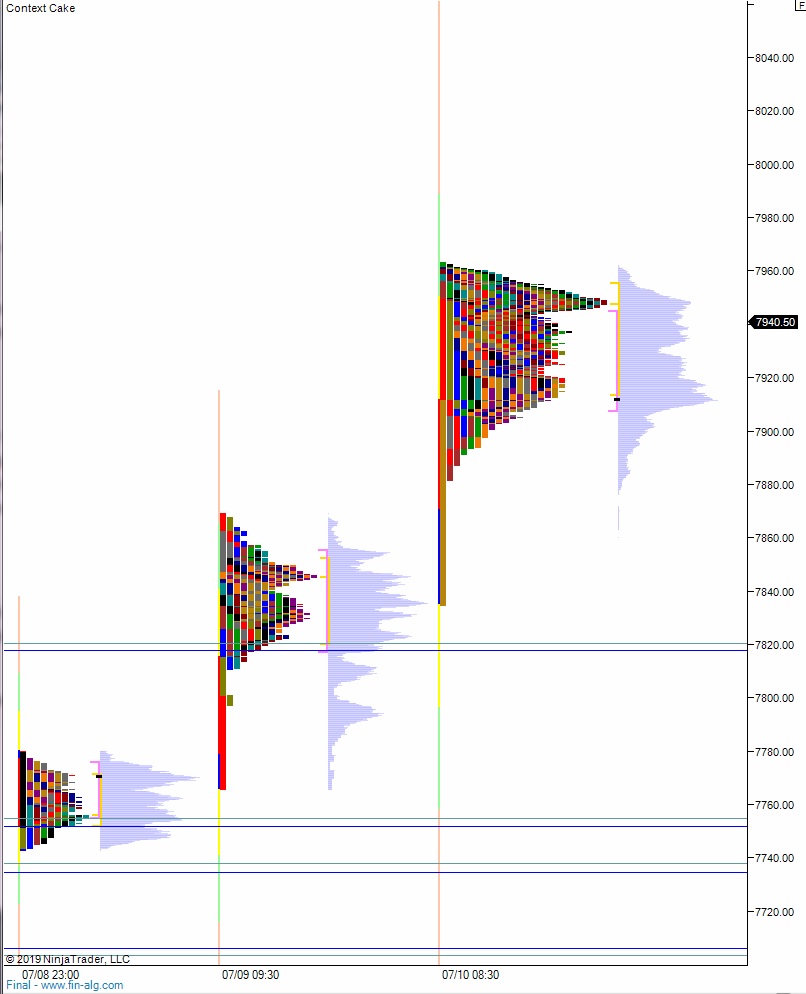

Volume profiles, gaps, and measured moves: