NASDAQ futures are coming into Thursday gap up after an overnight session featuring elevated range on extreme volume. Price worked higher overnight, trading up to a new record high before settling into balance. At 8:30am Consumer Price Index data came out better-than-expected and initial/continuing jobless claims data came out mixed. As we approach cash open, price is hovering in the upper quardrent of Wednesday’s range.

Also on the economic calendar today we have Powell’s semiannual testimony to the Senate at 10am followed by a 30-year bond auction at 1pm. Also, the only other Fed member who seems to move the needle, President of the Federal Reserve Bank of Minneapolis Neel Kashkari is set to give opening remarks at a town hall in South Dakota at 5pm.

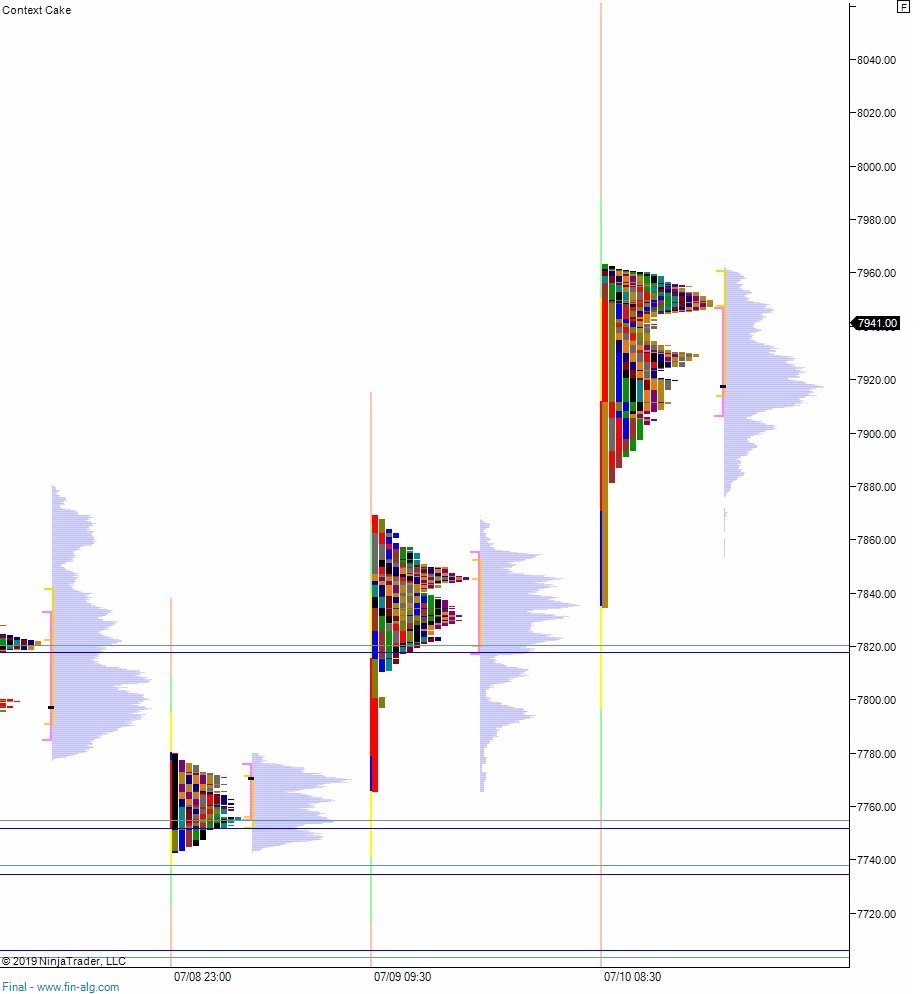

Yesterday we printed a normal variation down. The day began with a gap up that saw us begin the day just below record highs. There was a buying spike in the first hour of trade that made new record highs before sellers stepped in and worked us range extension down by a few points. However, this down move discovered a strong responsive bid and we spent the rest of the day chopping along above the midpoint.

Heading into today my primary expectation is for sellers to press into the overnight inventory and close the gap down to 7928.50. From here we continue lower, down through overnight low 7920. Look for buyers down at 7900 and two way trade to ensue.

Hypo 2 buyers press early on, trading up through overnight high 7963.25 setting up a run higher to tag the 8000 century mark before two way trade ensues.

Hypo 3 stronger sellers trade down to close the Tuesday gap down at 7846.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: