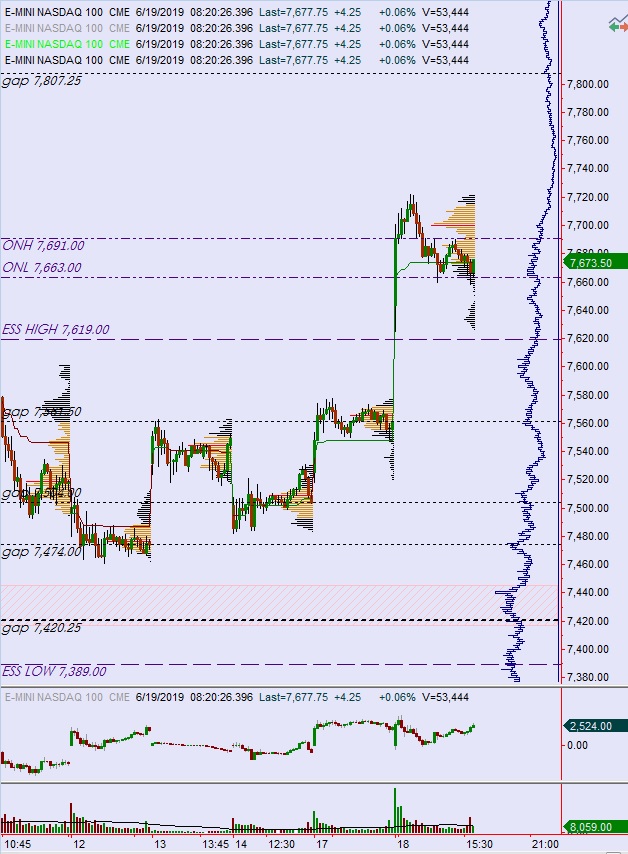

NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring normal range on elevated volume. Price marked time overnight, bobbing along the Tuesday midpoint for the duration of Globex. As we approach cash open, price is hovering above the mid.

On the economic calendar today we have crude oil inventories at 10:30am followed by the FOMC rate decision at 2pm which will be followed at 2:30pm with a press conference with Fed Chairman Powell. Investors down at the Chicago Mercantile are currently placing 24.2% odds of a 25 basis points rate hike. This is a live meeting.

Yesterday we printed normal variation up. The day began with a gap up and after a brief opening two-way auction buyers drove higher. Price rallied up into the 05/07 range, a day which marked the breakdown from a multi-day consolidation up near record highs. The 05/08 open gap was closed along the way. By late morning responsive sellers were discovered and we worked back down to the daily midpoint. We spent the rest of the day marking time along the mid, eventually closing right on it.

Heading into today my primary expectation is for buyers to press up through overnight high 7691 and sustain trade above it, setting up a test up through Tuesday high 7721.75. There’s open air until 7800 but look for sellers at 7750 and two way trade to ensue. Then look for the third reaction after the FOMC rate decision to dictate direction into the close.

Hypo 2 sellers press down through overnight low 7663 triggering a liquidation down through the Tuesday low 7625.25. Look for buyers down at 7611. Then look for the third reaction after the FOMC rate decision to dictate direction into the close.

Hypo 3 short squeeze ahead of the Fed. Buyers fully traverse the air gap, tagging 7800 before the meeting. Then look for the third reaction after the FOMC rate decision to dictate direction into the close.

Levels:

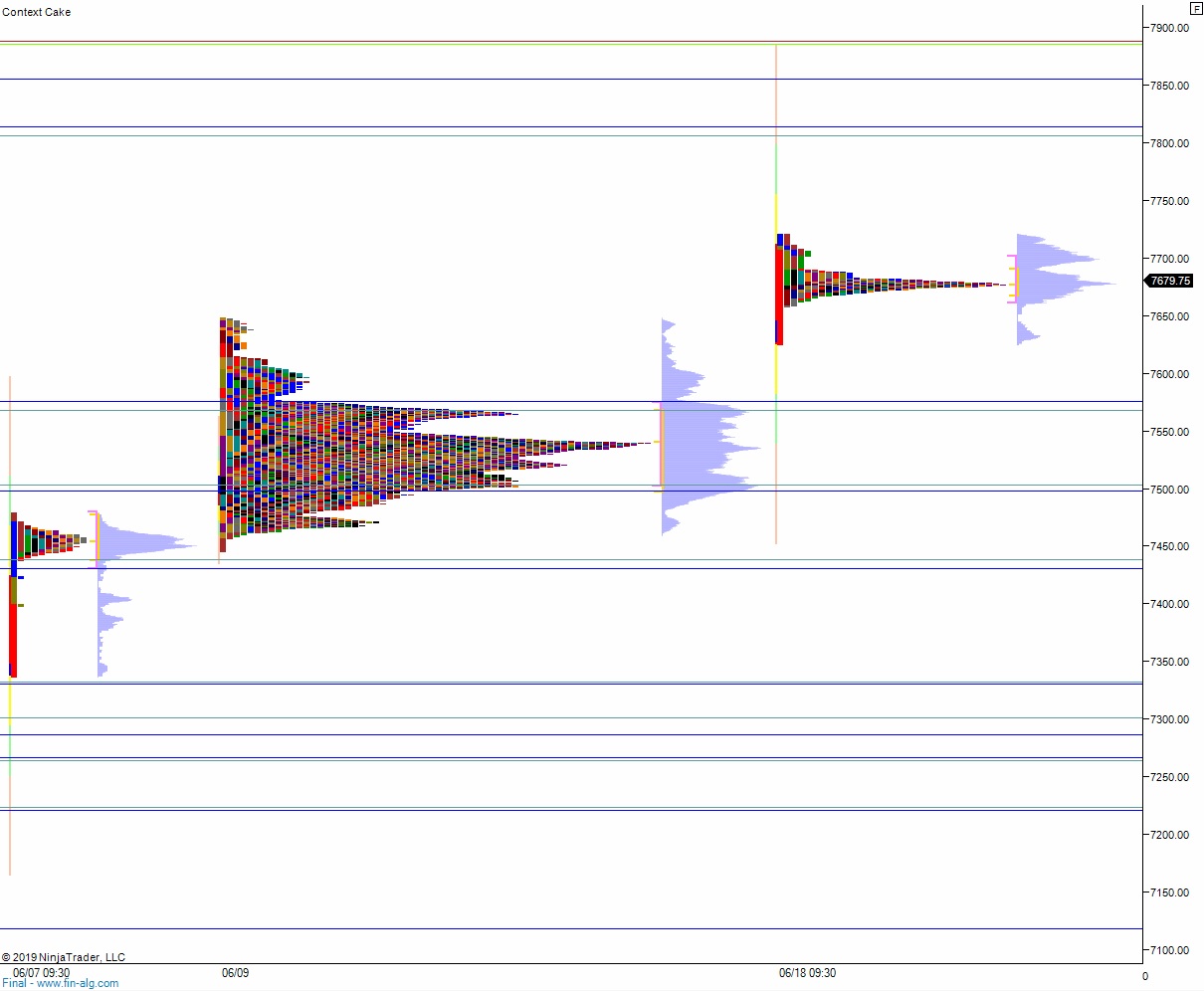

Volume profiles, gaps, and measured moves: