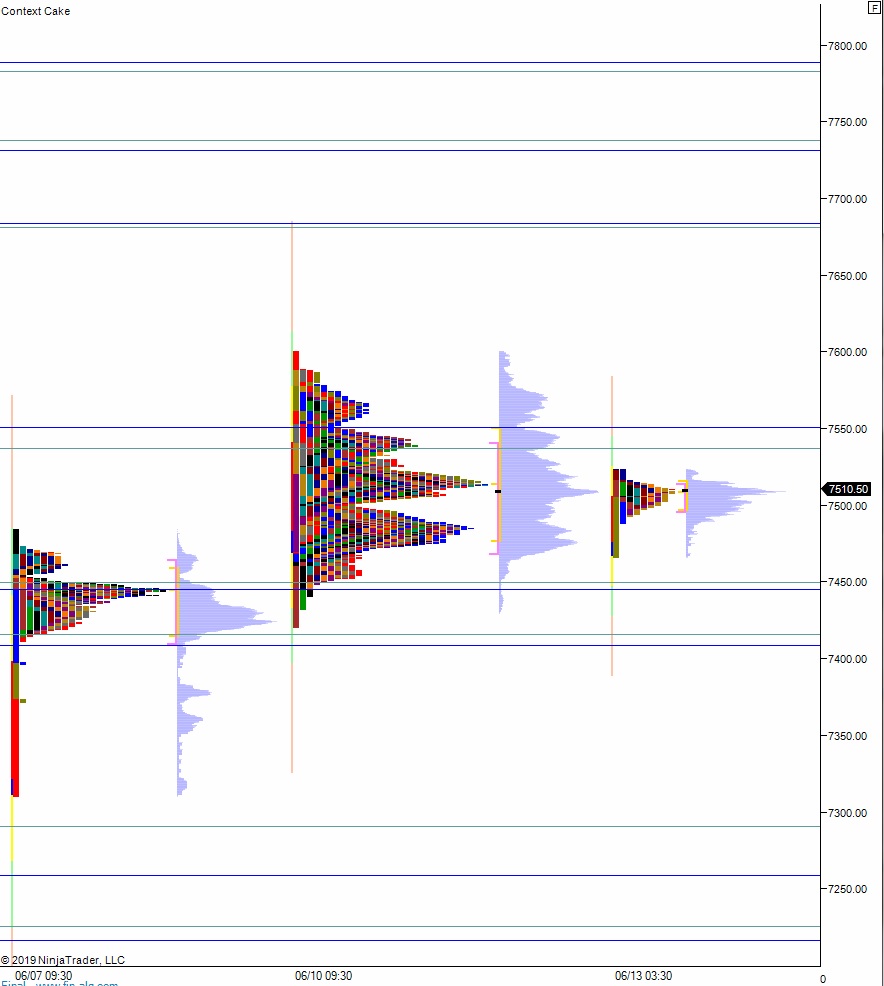

NASDAQ future are coming into Thursday gap up after an overnight session featuring extreme range and volume. Price was balanced overnight until about 10pm New York when sellers stepped in and spiked price lower. The action tagged the gap left behind from last Friday nearly to the tick before forming a sharp excess low and reversing the auction higher. By 6:30am price had traversed the entire Wednesday range and taken out the highs. At 8:30am initial/continuing jobless claims data came out worse-than-expected, and as we approach cash open price is hovering just below the Wednesday high.

Also on the economic calendar today we have 4- and 8-week t-bill auctions at 11:30am followed by a 30-year bond auction at 1pm.

Yesterday we printed a normal variation down. The day began with a gap down that buyers were unable to resolve during the open two-way auction. Instead sellers stepped in and worked price down through the weekly low by a few points but this did not trigger a liquidation down into the weekend gap. Instead price balanced out and marked time below the daily midpoint and into the close.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 7524. Look for sellers up at 7550 and two-way trade to ensue.

Hypo 2 stronger buyers sustain trade above 7550 setting up a move to target the open gap up at 7645 before two way trade ensues.

Hypo 3 sellers press into the overnight inventory and close the gap down to 7474. Look for buyers down at 7450 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: