NASDAQ futures are coming into Thursday pro gap down after an overnight session featuring extreme range and volume. Price made a unidirectional move lower overnight, dropping and accelerating down through the week’s lows. At 8:30am initial/continuing jobless claims data came out mixed. As we approach cash open, price is hovering near the open gap left behind on Monday, May 13th.

Also on the economic calendar today we have new home sales at 10am, 4- and 8-week T-bill auctions at 11:30am, and a 10-year TIPS auction at 1pm.

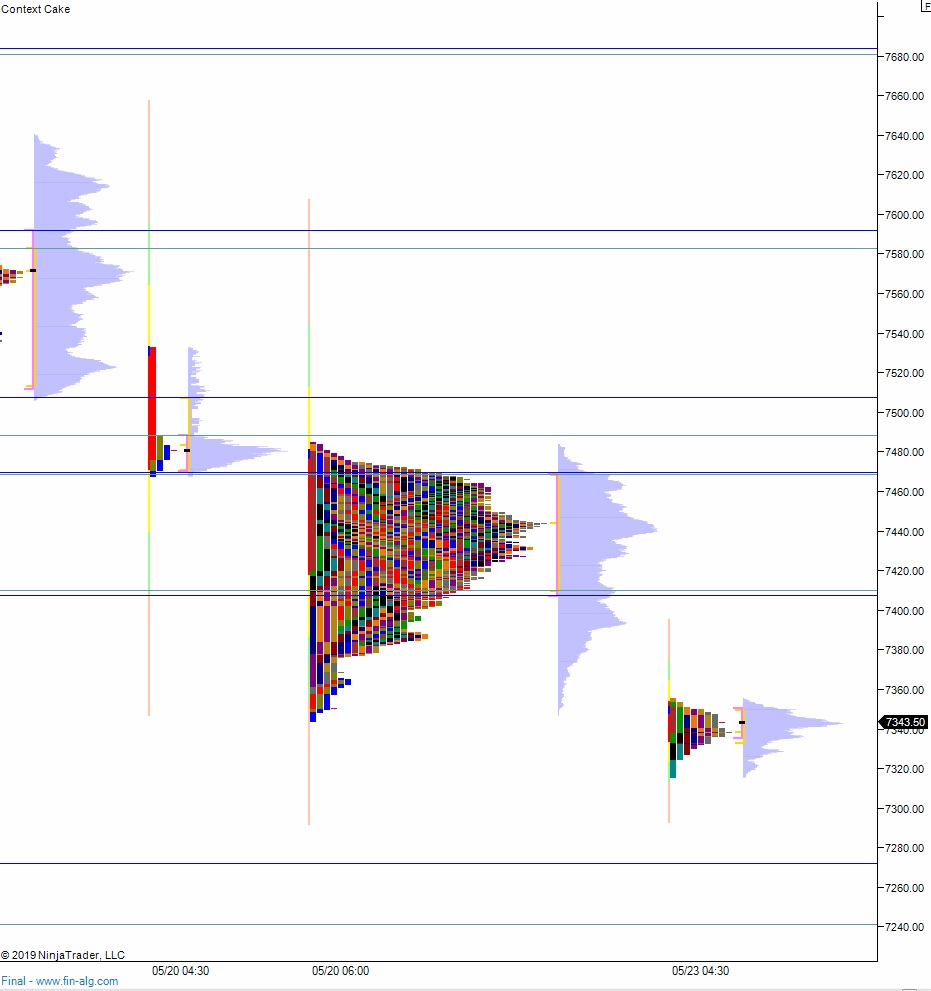

Yesterday we printed a normal variation down. The day began with a gap down out of range that buyers quickly bid up at the open. Buying continued through the early morning, closing the overnight gap before sellers stepped in and formed a sharp excess high. This led to us going range extension down ahead of the FOMC minutes. At 2pm the minutes came out and buyers stepped back in but were eventually overrun again by selling late in the session. The day ended with price in the lower quadrant of the day’s range.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 7400. Look for sellers up at 7407 and two way trade to ensue.

Hypo 2 stronger buyers work a full gap fill up to 7428.25 then continue higher, up through overnight high 7434.75. Look for sellers up at 7444 and two way trade to ensue.

Hypo 3 sellers gap-and-go lower, trading down through overnight low 7316 to tag the 7300 century mark. Look for buyers down at 7272 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: