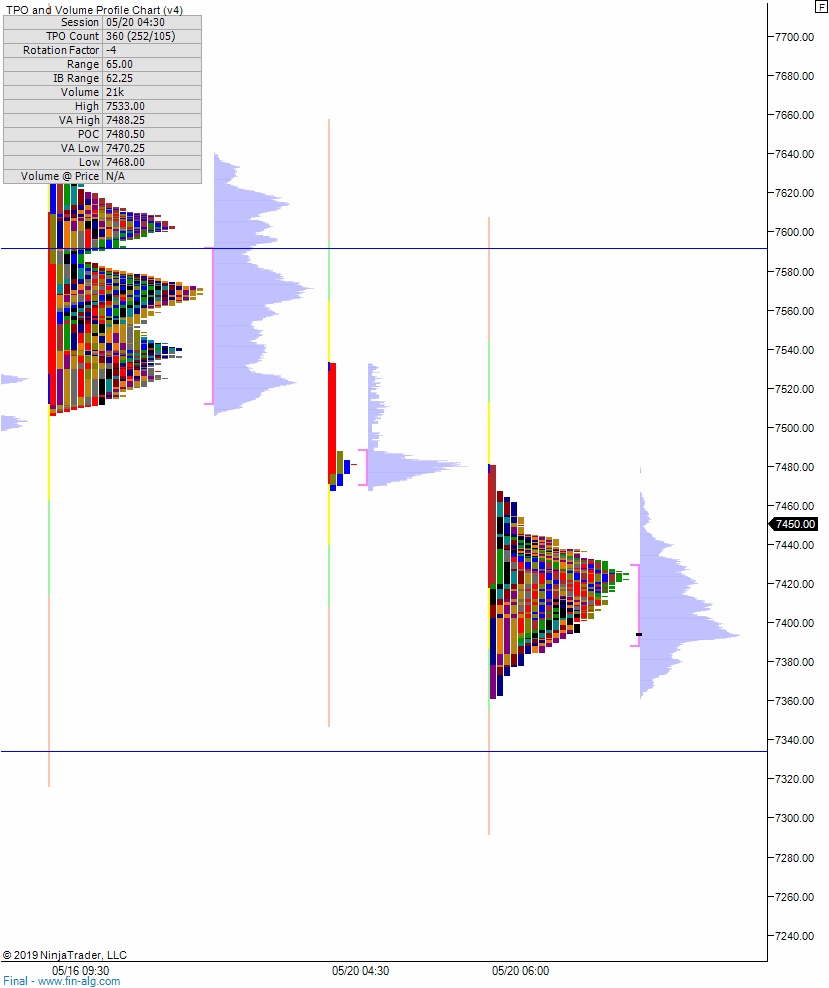

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, trading up beyond the Monday high before coming into balance. Then around 5am price traded up through the Monday high again. As we approach cash open, price is hovering just above the Monday high.

On the economic calendar today we have existing home sales at 10am followed by a 52-week T-bill auction at 11:30am.

Yesterday we printed a normal variation up. The day began with a gap down into the week (just like the prior two weeks). And early drive lower discovered a responsive bid and we spent the rest of the morning auctioning higher. The daily mid held as support for most of the day until late-day selling pressured the tape back down near the lows. Sellers were unable to press the market neutral. Instead we ramped back to the midpoint into the bell.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 7467.75 setting up a move to target the Friday gap at 7511.25 before two way trade ensues.

Hypo 2 stronger buyers trade us up to the naked VPOC at 7571 before two way trade ensues.

Hypo 3 sellers press into the overnight inventory and close the gap down to 7392.75 then continue lower, down through overnight low 7385.25. Look for buyers down at 7334 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves:

How about a few words on Tsla? I know you are big on sentiment. I’d say sentiment is at its all time worst with the Morgan Stanley call. The bottom must be near unless this company is really as bad as they say, which I highly doubt.

SOON