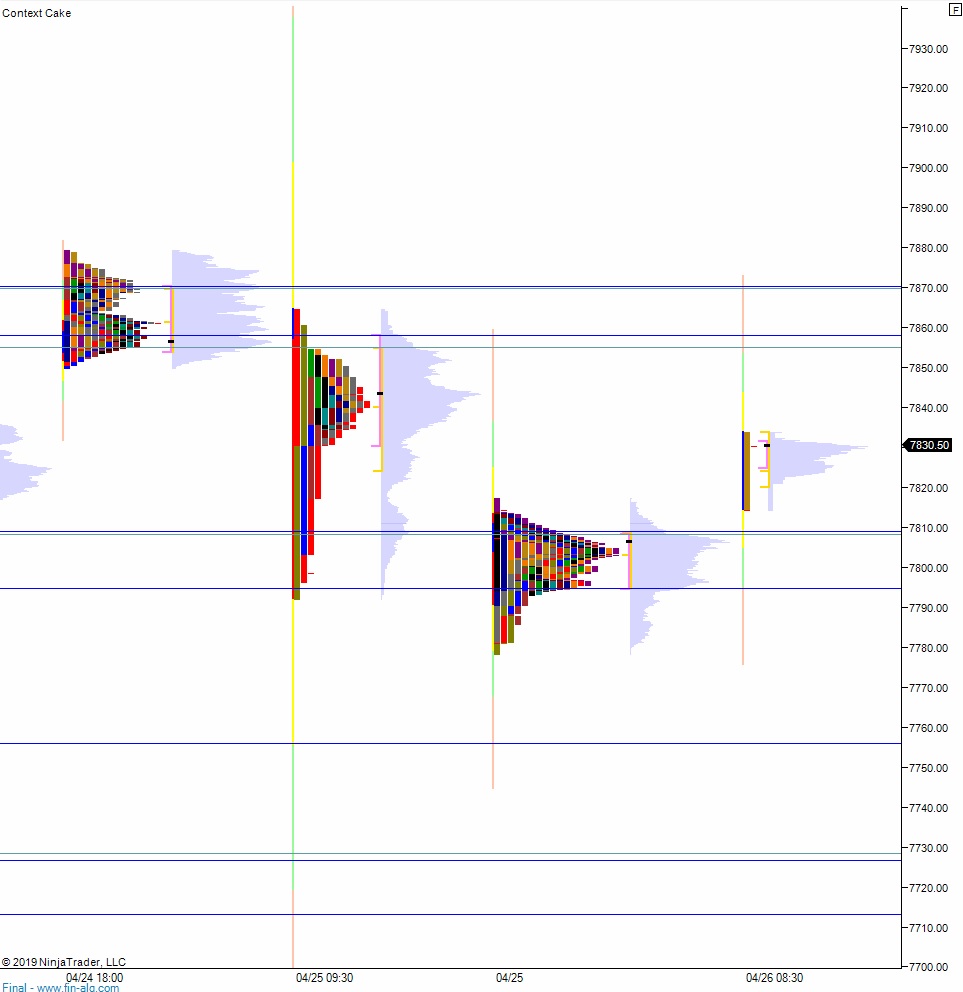

NASDAQ futures are coming into Friday gap up after an overnight session featuring elevated range on extreme volume. Price worked lower overnight, briefly probing below Thursday’s low before forming an excess low and coming into balance. Headed into the 8:30am GDP announcement price was hovering near unchanged. The 8:30am GDP data was much stronger than expected and caused a quick spike higher. As we approach cash open, price is hovering just below Thursday’s midpoint.

The only other economic event today is a final April reading of sentiment by the University of Michigan at 10am.

Yesterday we printed a normal day, which is anything but normal. THe day began with a gap up that sellers quickly resolved. The morning selling was quite dynamic and formed a wide range, ultimately probing below the Wednesday low and forming a sharp excess low before coming into balance above the daily midpoint. Then we marked time into the close. Amazon and Intel earnings came out and sellers made one more attempt lower but were unable to take out the IB low before the market closed.

Normal day.

Heading into today my primary expectation is for buyers to trade up to 7854.50 before two way trade ensues.

Hypo 2 sellers press into the GDP spike and close the gap down to 7798.50. Look for buyers down at 7794.75 and two way trade to ensue.

Hypo 3 stronger sellers trade down to 7756.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: