NASDAQ futures are coming into Thursday gap up after an overnight session featuring elevated range on normal volume. Price worked higher overnight, trading to new record highs. The overnight move came after earnings from Microsoft and Facebook exceeded investor expectations. At 8:30am durable goods orders came in better-than-expected and initial/continuing jobless claims data were mixed. As we approach cash open, price is hovering a few points off of all-time highs and about 20 point above Wednesday’s range.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am followed by a 7-year note auction at 1pm.

Amazon and Intel are set to report earnings after the bell, and investors are likely to take a cue from these heavy big-tech leaders.

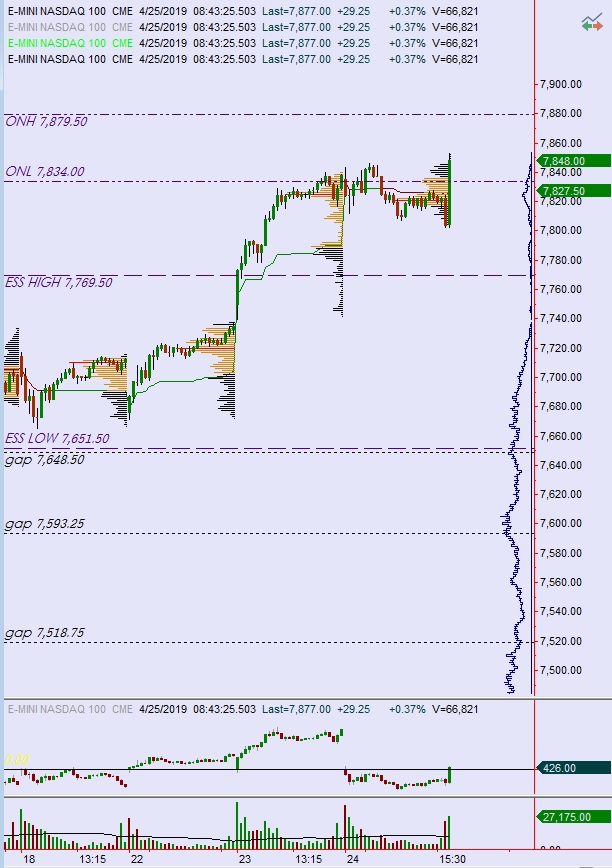

Yesterday we printed a neutral extreme up. The day began with a slight gap down and open two-way auction. Buyers managed to press price range extension up (and a few point above ATH) before lunch, then sellers stepped in and pressed the auction neutral. We then chopped along the bottom-side of the daily midpoint before a sharp move lower into the cash close. But before settlement, Microsoft earnings hit and we spiked back to ATH.

Neutral extreme up.

Heading into today my primary expectation is for buyers to gap-and-go higher. trading up to the 7900 century mark before two way trade ensues.

Hypo 2 sellers press into the overnight inventory and close the gap down to 7848. From here they continue lower, down through overnight low 7834 before two way trade ensues.

Hypo 3 stronger buyers trade up through 7900 and sustain trade above it, leading to a continued exploration of higher prices.

Levels:

Volume profiles, gaps, and measured moves: