NASDAQ futures are coming into Thursday with a slight gap down after an overnight session featuring extreme volume on normal range. Price more-or-less marked time overnight, balancing along the bottom-side of Wednesday’s midpoint. At 8:30am initial/continuing jobless claims data came out better than expected. As we approach cash open, price is hovering below the Wednesday midpoint.

The only other economic events today are 4- and 8-week T-bill auctions at 11:30am.

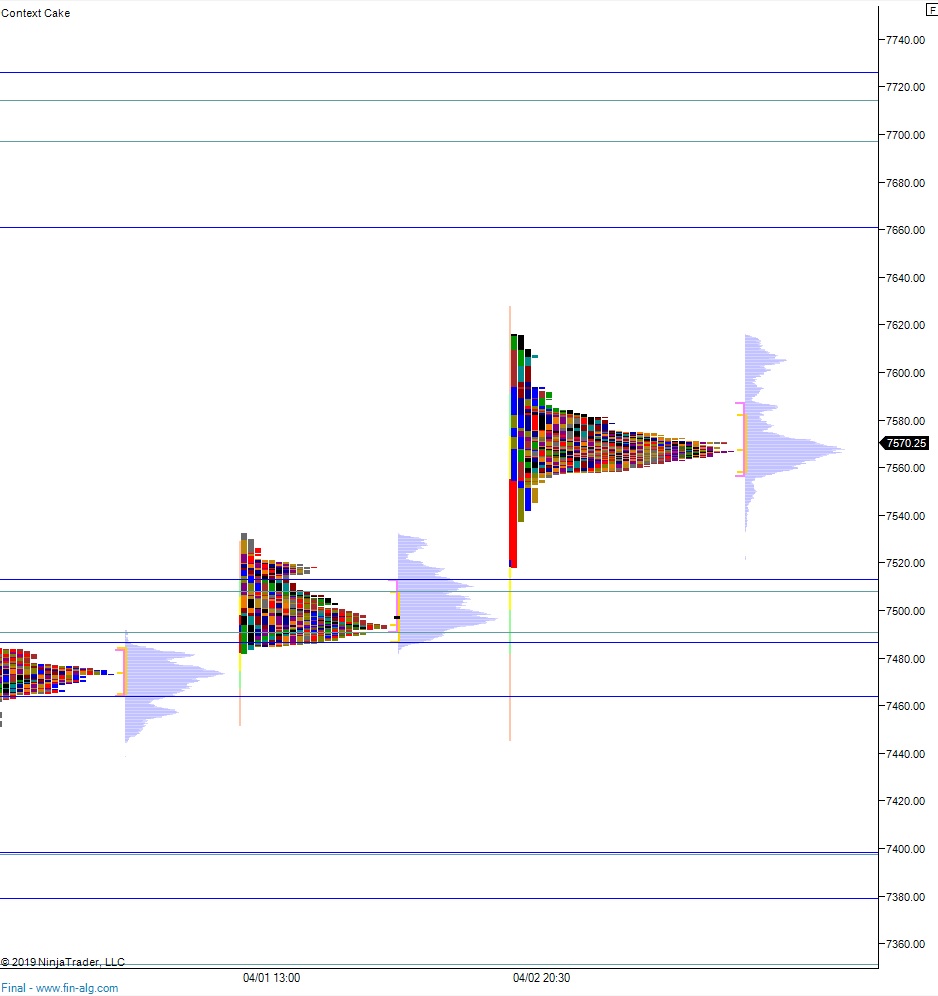

Yesterday we printed a neutral day. The day began with a gap up and out of range, and after about 30 minutes of 2-way auction buyers stepped in and drove price higher, trading just a bit beyond the 7600 century mark before discovering responsive sellers. Cum delta ran negative for much of the move despite heavy volume to the upside, meaning more orders were being executed on the bid than the offer, meaning the rally way being ‘sold into’. By about 3:30pm the market went neutral, and this set up a ramp back to the daily midpoint by end-of-session.

Neutral.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7594. From here we chop, marking time between 7600 and 7540.

Hypo 2 stronger buyers take out Wednesday high 7616.25 and sustain trade above it, setting up a move to target 7660 before two way trade ensues.

Hypo 3 sellers press down through overnight low 7558.25 and sustain trade below 7540, setting up a move to target 7513 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: