NASDAQ futures are coming into Thursday flat after an overnight session featuring elevated range on extreme volume. Price held Wednesday’s range overnight. At 8:30am GDP data came out worse than expected and initial/continuing jobless claims data came out better than expected. As we approach cash open, price is coiled up just below the Wednesday midpoint.

Also on the economic calendar today we have pending home sales at 10am, 4- and 8-week T-bill auctions at 11:30am, and a 7-year note auction at 1pm.

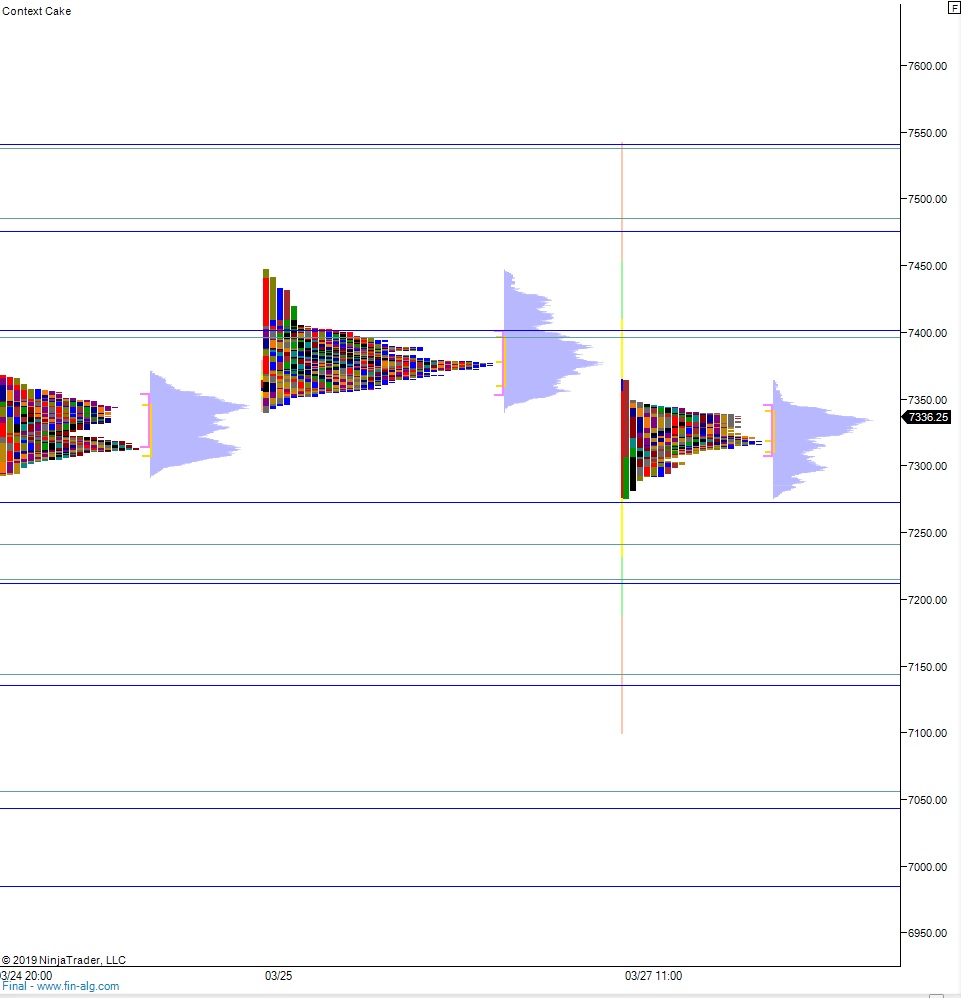

Yesterday we printed a normal variation down. The day began with a gap up and attempt higher which resulted in an excess high. Sellers then stepped in and drove the overnight gap shut then continued lower, tagging the weekly ATR band low before we bounced back to the mid. Price chopped along the midpoint for the rest of the day.

Heading into today my primary expectation is for sellers to press down through overnight low 7289.50 setting up a move to close the gap down at 7266.75 before two way trade ensues.

Hypo 2 buyers work up through overnight high 7346.75 setting up a move to tag 7400 before two way trade ensues.

Hypo 3 stronger buyers trade us up to the naked VPOC at 7415 before two way trade ensues. Stretch target is 7460.25.

Levels:

Volume profiles, gaps, and measured moves: