NASDAQ futures are coming into Monday gap down after an overnight session featuring extreme range and volume. Price spiked lower overnight, with [pajama] traders having their first chance to digest the Mueller/Trump news which came out right after closing bell Friday. The Mueller news determined Trump had not colluded with the Russians. The selling went down through last week’s low, trading down into the 3/14 range before printing a mini failed auction and reversing higher. As we approach cash open, price is hovering right above Friday’s close.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

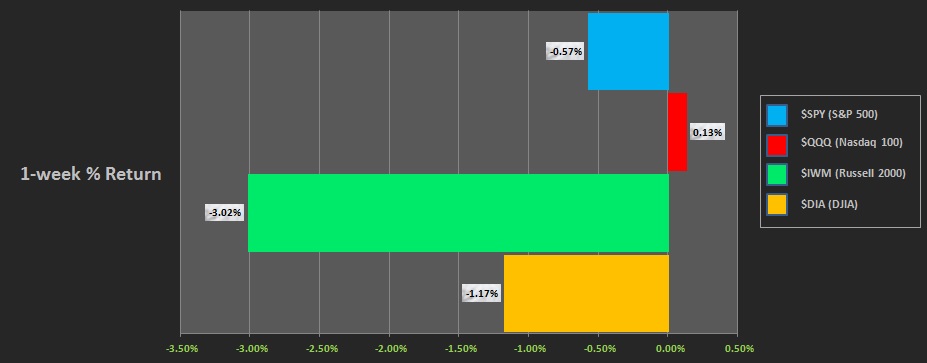

Last week featured a choppy sideways drift, with the major indices diverging and converging around each other during the week, accomplishing very little directional discovery. Accepting and building value instead. After the Wednesday afternoon FOMC rate decision [left unchanged, tone of statement dovish] buyer stepped in and drove price higher. The buyers continued to explore higher prices through most of Thursday. Aggressive pressure from sellers on Friday resulted in a big red daily candle print, which resulted in all indices except the NASDAQ to end the week at or near weekly lows.

Last week’s performance of each major index is shown below:

On Friday the NASDAQ printed a double distribution trend down. The day began with an exhaustion style gap down away from swing high (after a trend day up). After a two-way auction at the open price drove lower, erasing all of Thursday’s trend up by New York lunch. Then, after some very wide chop which was being bought along Wednesday’s naked VPOC, price eventually drove a bit lower to end the week near Wednesday’s low, and at Friday’s session low.

Double distribution trend down.

Heading into today my primary expectation is for sellers to attempt a rejection down and away from the Friday low 7353. Look for price to move down through overnight low 7290. Look for buyers down at 7280.75 and two way trade to ensue.

Hypo 2 buyers close overnight gap up to 7368.25, regaining the Friday range. Then we continue higher, up through overnight high 7390.50 setting up a move to tag 7400. Look for sellers up at 7414.75 and two way trade to ensue.

Hypo 3 stronger sellers trade down to close the gap at 7266.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

You’re going down. James Dalton said so.

I don’t believe you