NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range and volume. Price made a new weekly high overnight before driving lower. As we approach cash open, price is hovering in the upper quadrant of Thursday’s range.

On the economic calendar today we have Markit manufacturing/service/composite PMI at 9:45am, existing home sales at 10am, and monthly budget statement at 2pm.

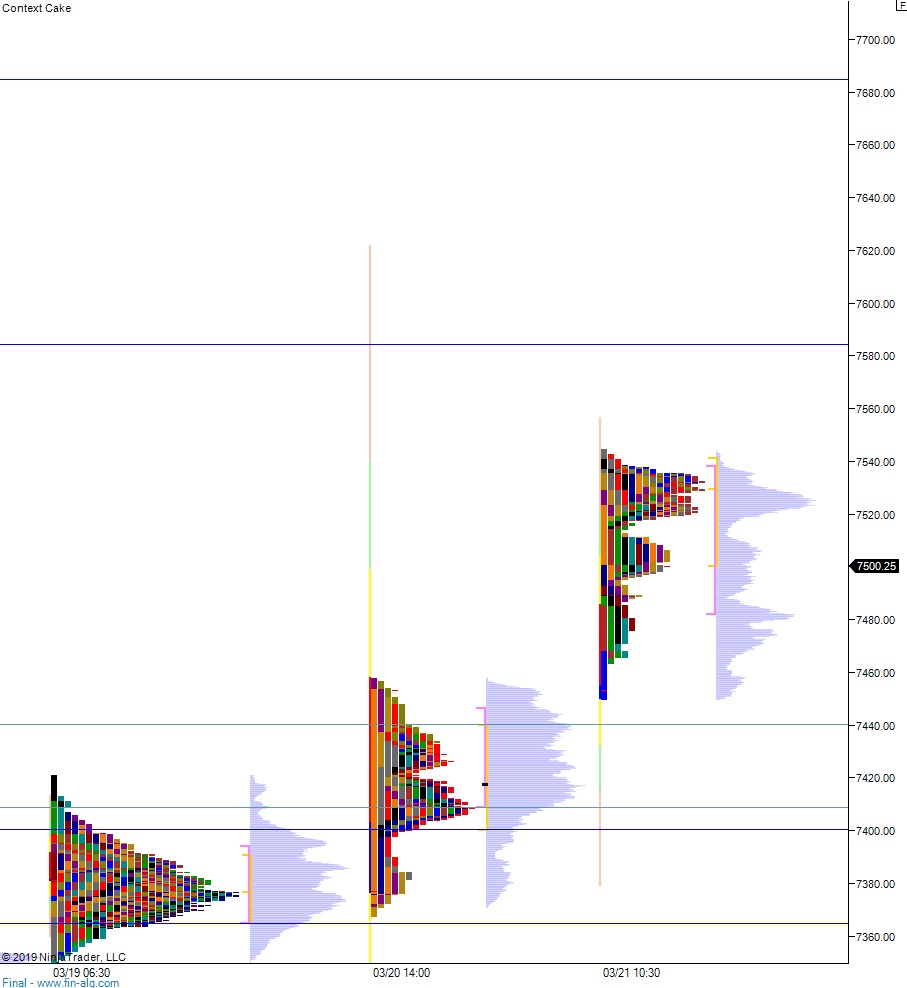

Yesterday we printed a trend day. The day began with a gap down that erased much of the reaction higher Wednesday afternoon after the FOMC rate decision. Buyers drove higher off the open, closing the overnight gap, taking out overnight high, then continuing higher, trading up into price levels unseen since October 4th (the first day of hard selling on the NASDAQ at the beginning of Q4’18. The volume point of control shifted up near the high near the end-of-day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7535. From here we continue higher, up through overnight high 7544.75. Look for sellers up at 7584.25 and two way trade to ensue.

Hypo 2 sellers gap-and-go lower, trading down to 7440.50 before two way trade ensues.

Hypo 3 stronger sellers erase much of the trend up, trading down to 7409.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: