Apparently my finance/trading content sucks. It’s self-serving, unoriginal, and as if that weren’t enough—it’s rude.

The annoying thing is, I’ve been way more ‘right’ in my approach and predictive analysis than all the popular accounts.

A blog that only exists for the sake of improving my own trading game. I’ve been doing this for a real long time, hardcore addicted to trading, studying, learning, blogging and communicating my technique since 2009. I tried to make my words more entertaining for a while. My views went way up, my ego followed alongside, and my trading suffered.

Nowadays I only blog about a news bit or ticker symbol or macro thingy if I think something really needs to be said. The morning reports read like instructions for a universal remote. They are filled with money making goodies, like LITERALLY the best nq_f trading levels in the industry, but you don’t care. You want to be entertained, perhaps to escape an otherwise monotonous job in the wonderful world of finance.

Save yourself the time then and steer clear of the RAUL blog. This is a place for hardcore traders who are determined to take control of every investment/trading decision made on their own behalf (and perhaps for the people they hold dear), and to do so with the explicit intent of extracting fiat from the global financial complex.

MOVING ON

The model is bullish again. It was neutral last week, but all you had to see was Monday morning’s action to know what needed to be done Tuesday. Many a RAUL blog have centered around how to trade the day after a trend day, I’m sorry I wasn’t here to refresh you. I was out east, exploring the snow storm hitting Vermont and snowboarding before global warming reasserts itself and sinks us back into another godawful hot summer. I did tweet, and if you want to follow along with my running mental dialogue, this is the place to do it:

well that was a trend day $nq_f

— RAUL (@IndexModel) March 11, 2019

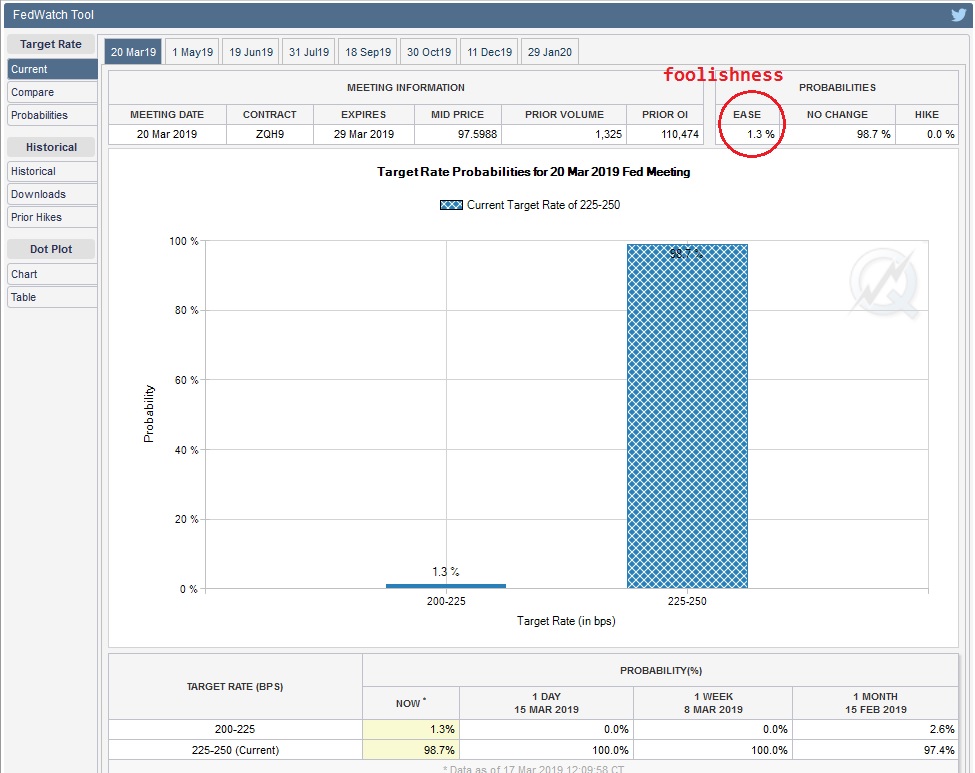

The gambling halls in Chicago are currently placing a 1.3% probability on the Fed to drop interest rates by 25 basis points this Wednesday. Imagine the Fed actually being dumb enough to LOWER interest rates with wonton degeneracy already heating up in the house flipping market. These are not intelligent bets:

In summary, the upcoming Fed meeting is not a live meeting. Rates will stay UNCH. The predictive models prepared and operated here on the RAUL blog expect a calm drift, perhaps with an upward bias—drifting until Wednesday afternoon. Then we will use third reaction analysis after the rate decision to predict direction into the second half of the week.

IT REALLY IS THAT SIMPLE HAHAHA, YES!

If you want complexity, and confusion, there are lots of chart loving, statistic spouting, podcast jaw-jackin’ accounts for you to spend your precious time on.

YEAH JAW JACKIN’ BEATIN’ IT YEAHHH

If you want simplicity, you can stop by the RAUL blog weekdays around 9am and Sunday afternoon for the absolute minimum amount of communication on how to make money.

RAUL SANTOS – March 17th, 2019

Exodus members, the 226th edition of strategy session is live. I am slowly warming up to trading bitcoin futures, or perhaps just trading the underlying bitcoin but using the futures trading data to drive decisions. Keep an eye on Section III. Also, check out exactly what I expect from the PHLX semiconductor index, for it will likely tell the whole story, even if the broad indices seem murky.

If you enjoy the content at iBankCoin, please follow us on Twitter

I really enjoy your writing. It’s colorful, informative, and fun to read. I am however, guilty of enjoying your work silently for the most part. Keep doing what you do.

you are maybe a bit of a masochist then 😉