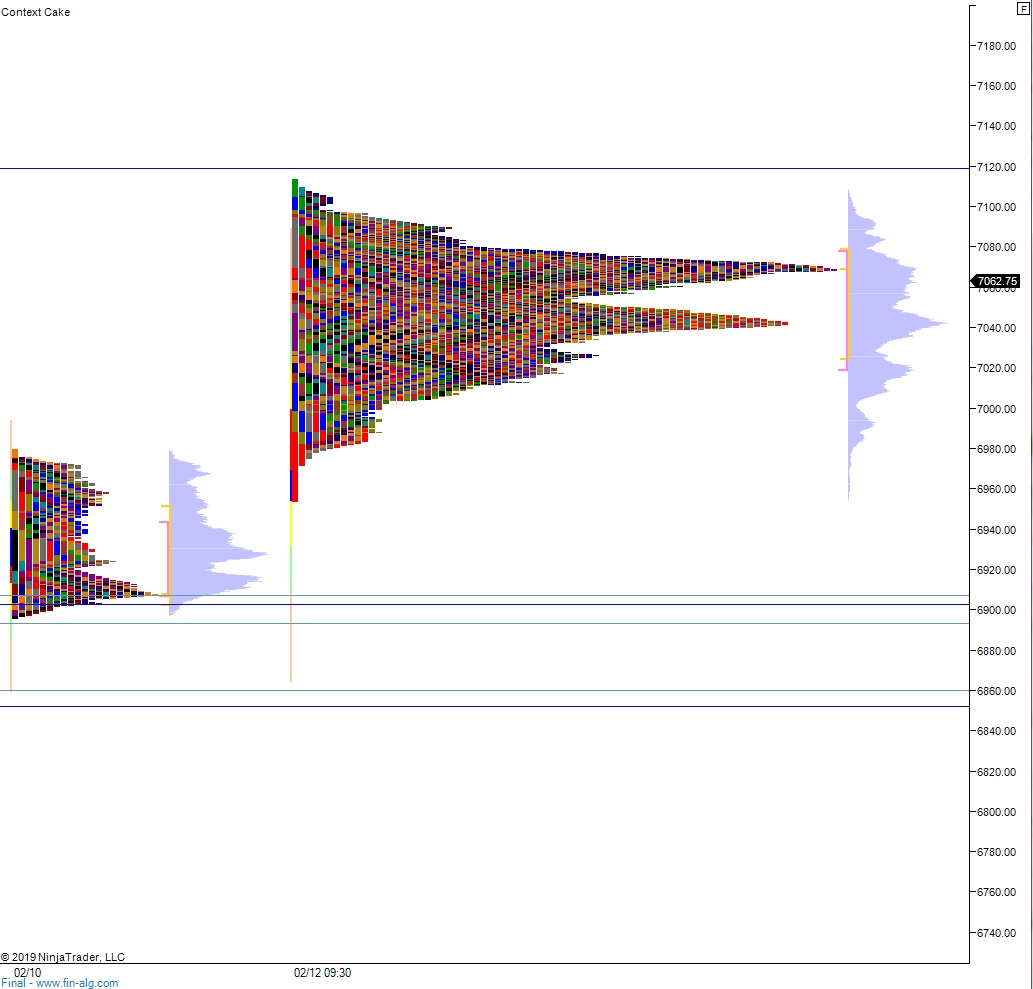

NASDAQ futures are coming into Friday gap up after an overnight session featuring elevated range on extreme volume. Price worked higher overnight, slowly rotating up through the Thursday high. As we approach cash open, price is hovering right along the Thursday high.

There are no important economic events today.

Yesterday we printed a normal variation up. The day began with a gap down and drive lower to new low-of-week. Just below the gap left behind last Thursday (2/14), buyers stepped in, and did so before the NASDAQ could go range extension down. Instead price worked higher, up through the daily midpoint, then range extension up, but unable to fill the overnight gap before falling back down through the daily mid again. Eventually the market closed right at it’s midpoint.

Choppy normal variation up.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 7079 which sets up a move to target 7118.75 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 7035.25. Sellers continue lower, down through overnight low 7019.25. Look for buyers down at 7000 and two way trade to ensue.

Hypo 3 stronger sellers trigger a liquidation down to 6967.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: