NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, briefly taking out the Wednesday high before rotating lower. As we approach cash open price is hovering just below the Wednesday midpoint. At 8:30am durable goods orders came in below expectations.

Also on the economic agenda today we have Markit manufacturing/service/composite PMI at 9:45am, existing home sales at 10am, crude oil inventories at 10:30am, 4- and 8-week T-bill auctions at 11:30am, and a 30-year TIPS auction at 1pm.

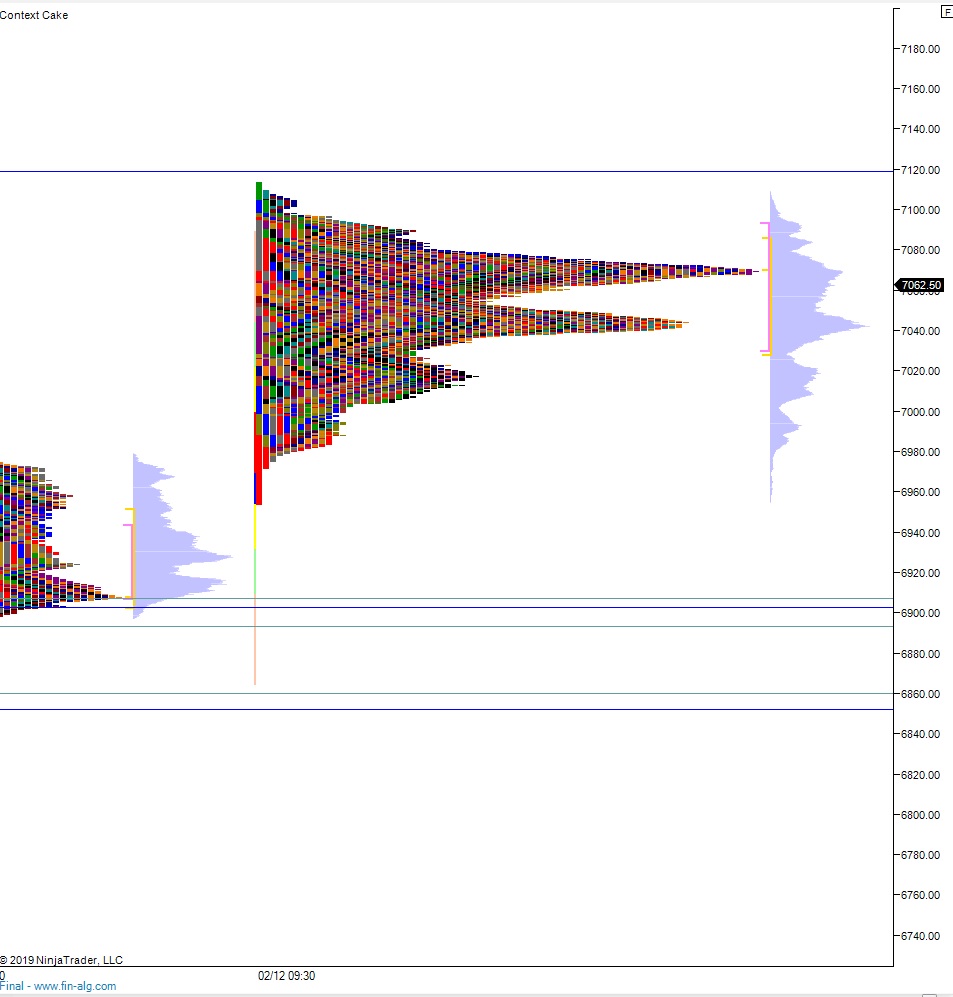

Yesterday we printed a neutral session. The day began with a gap up and push higher, up to around 7100. This put us range extension up before sellers stepped in and traversed the entire daily range putting us neutral. The most logical move after going neutral is to revisit the daily mid, and that is what the market did. THIS IS A METHODICAL AUCTION. Then, at 2pm the FOMC minutes came out and an EKG burst ripping through the market. Third reaction was a buy and we spent the rest of the session working back to the daily mid after briefly making a new low on the week.

Neutral.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7073. From here we continue higher, up through overnight high 7113.75. Look for sellers up at 7119.50 and two way trade to ensue.

Hypo 2 sellers step in right around the gap fill 7073 and work us lower, down through overnight low 7051.25 setting up a move to target the open gap at 7020.25 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 7120 setting up a move to target 7159.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: