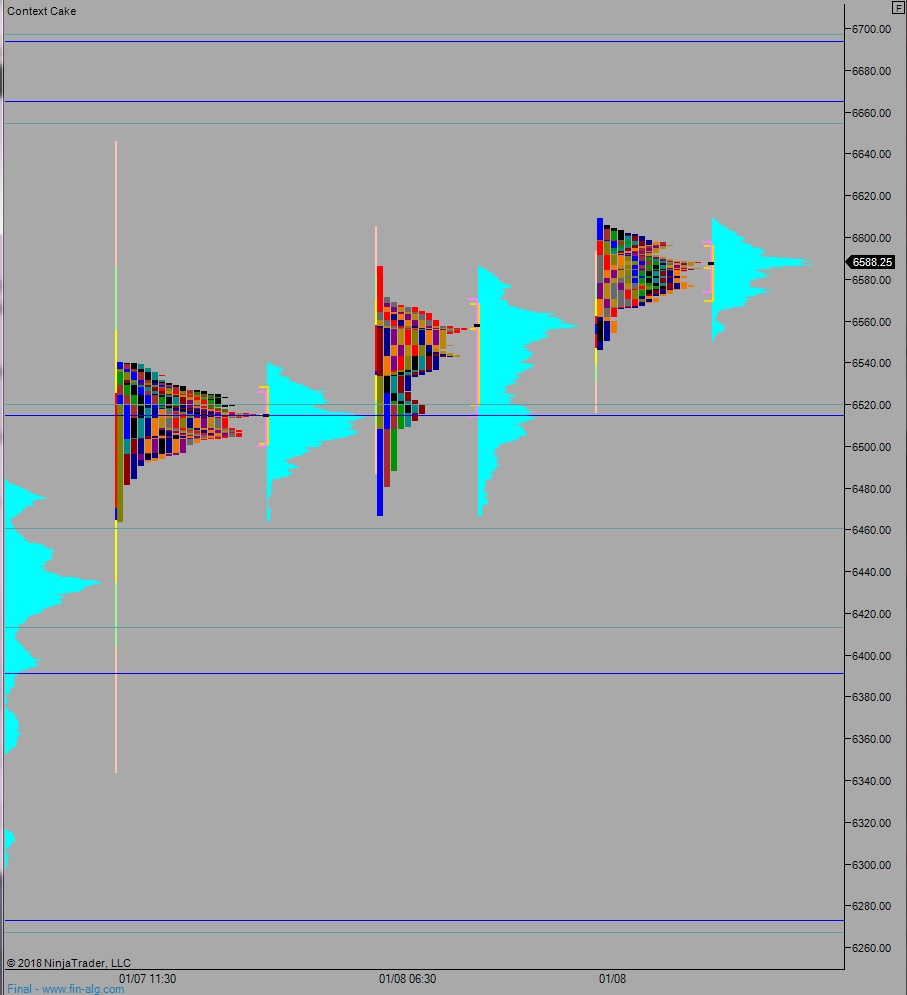

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, taking out the Tuesday high around 8pm New York before discovering some responsive sellers. The rest of globex was spent flagging and forming balance along Tuesday’s high. As we approach cash open price is hovering just above the Tuesday range.

On the economic calendar today we have crude oil inventories at 10:30am followed by the FOMC minutes at 2pm.

Yesterday we printed a normal variation down. The day began with a gap up and push higher to tag the naked vpoc from 12/12. Price went a few ticks beyond it before sellers stepped in and close the overnight gap . We then spent the rest of the day working higher, slowly reclaiming the daily midpoint and closing above it.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up to 6666 before two way trade ensues. Then look for the third reaction after the FOMC minutes to dictate direction into the end of the day.

Hypo 2 seller work into the overnight inventory and close the gap down to 6554.75. Look for buyers down at 6520 and two way trade to ensue. Then look for the third reaction after the FOMC minutes to dictate direction into the end of the day.

Hypo 3 stronger buyers sustain trade above 6666, setting up a move to target 6693.25 before two way trade ensues. Then look for the third reaction after the FOMC minutes to dictate direction into the end of the day.

Levels:

Volume profiles, gaps, and measured moves: