NASDAQ futures are coming into Monday gap down after an overnight session featuring extreme range and volume. Price worked higher overnight, taking out the Friday high before falling back into the upper-quadrant of Friday’s range. As we approach cash open, price is hovering in the upper quadrant while some morning selling works into the tape.

On the economic calendar today we have ISM manufacturing at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

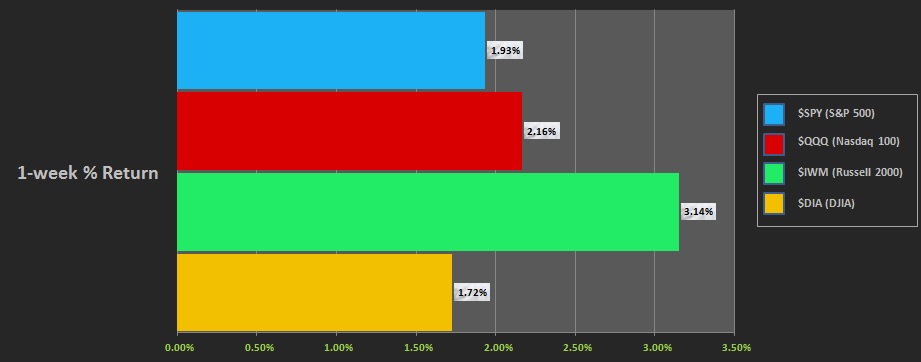

Last week started out with a balance day, then we we closed Tuesday for New Years Day. We went gap down into 2019 and found a strong bid for most of the day. Thursday went gap down and erased most of the Wednesday gain but the Russell began to bullishly diverge. Friday say a gap up and trend higher. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a trend up. The day began with a gap up and drive higher. The buying took us to a new two-week high, probing up in the the 12/19 distribution day before finding any sellers. Sellers did show up near end-of-session and we flagged into the close.

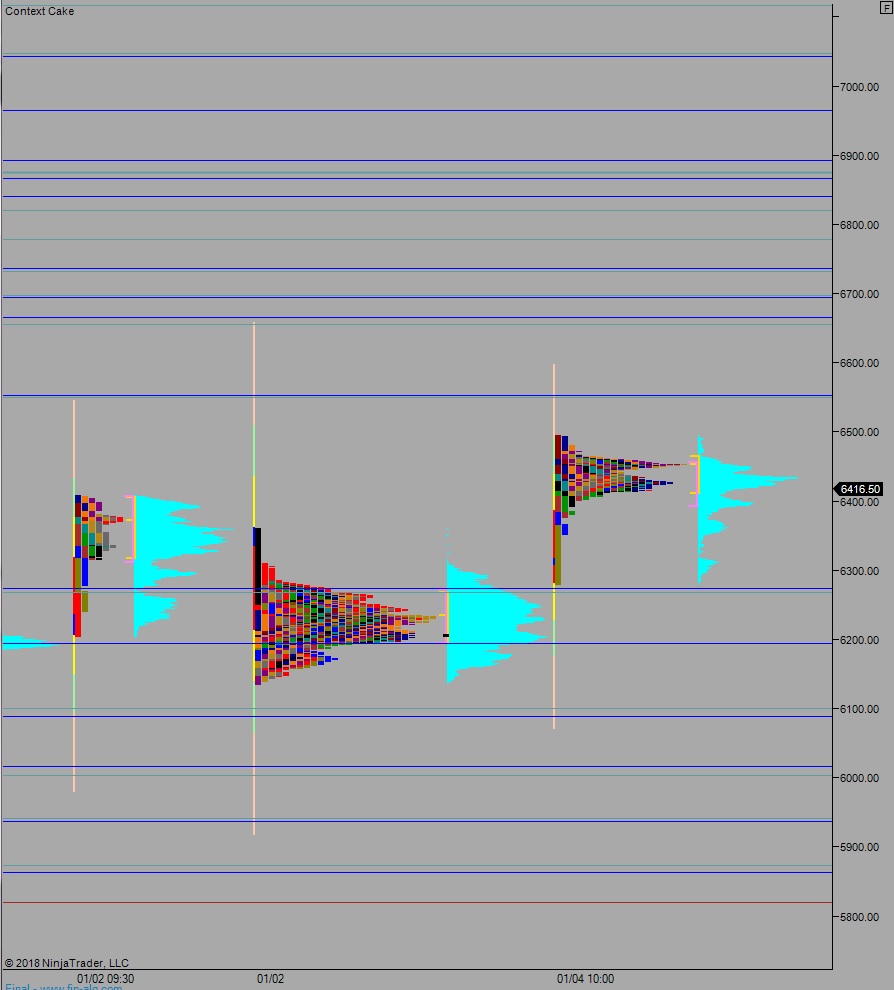

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6432.25. From here we continue higher, up through overnight high 6495.50. Look for sellers up at 6550 and two way trade to ensue.

Hypo 2 sellers press down through overnight low 6402.50 setting up a move to target 6273.50 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 6550 setting up a move to target 6600 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: