NASDAQ futures are coming into Thursday, ROLLFORWARD, with a 30 point gap up after an overnight session featuring extreme range and volume. Price was balanced overnight, gyrating around inside the Wednesday range in a balanced manner. As we approach cash open price is hovering at the Wednesday midpoint. At 8:30am initial/continuing jobless claims data came out mixed.

Also on the economic calendar today we have a 4- and 8-week T-bill auction at 11:30am, a 30-year bond auction at 1pm, and a monthly budget statement at 2pm.

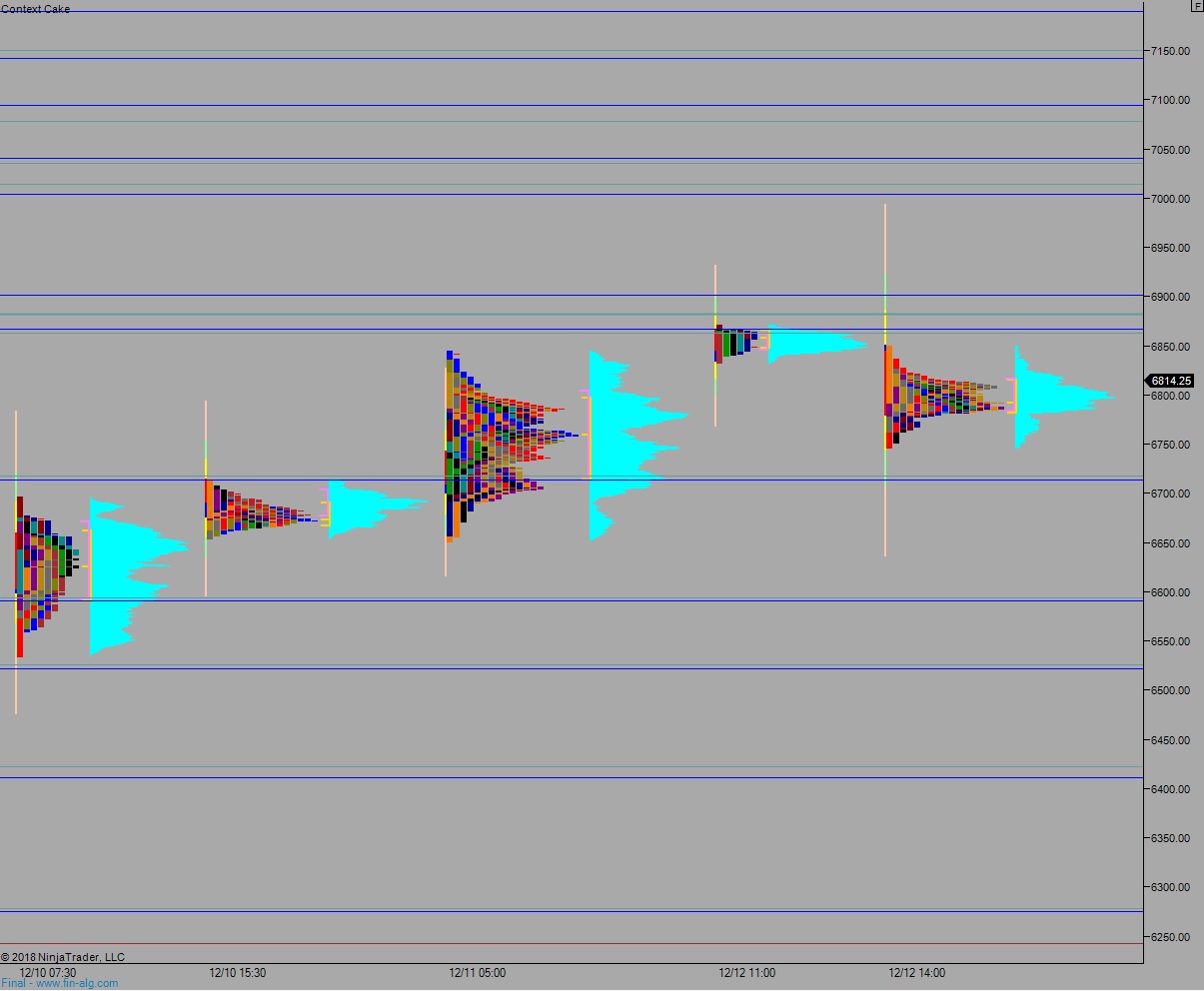

Yesterday we printed a neutral extreme down. The day began with a gap up just beyond the Tuesday range. Sellers attempted to trade back down into the Tuesday range but were rejected, setting up a drive higher that briefly took out last Friday’s trend down high and sustained trade above it for several hours. Then, late in the session responsive sellers stepped in and reversed the day’s entire range. We ended up pushing neutral late in the session and closing on the lows—still positive on the day due to the overnight gap.

Neutral extreme down.

Heading into today my primary expectation is for a gap-and-go higher, up through overnight high 6837.75. Look for sellers up at 6868 and two way trade to ensue.

Hypo 2 sellers work into the overnight inventory and close the gap down to 6766.25 setting up a move down through overnight low 6752. This sets up a move to close the Tuesday gap down at 6715.75 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 6868 setting up a move to target 6900. Stretch upside target is the composite VPOC at 6950.

Levels:

Volume profiles, gaps, and measured moves: