NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range and volume. Price held inside the upper half of Thursday’s range overnight, spending the majority of the evening rotating lower. As we approach cash open price is hovering above the Thursday midpoint.

On the economic calendar today we have industrial/manufacturing production at 9:15am followed by long-term TIC flows at 4pm.

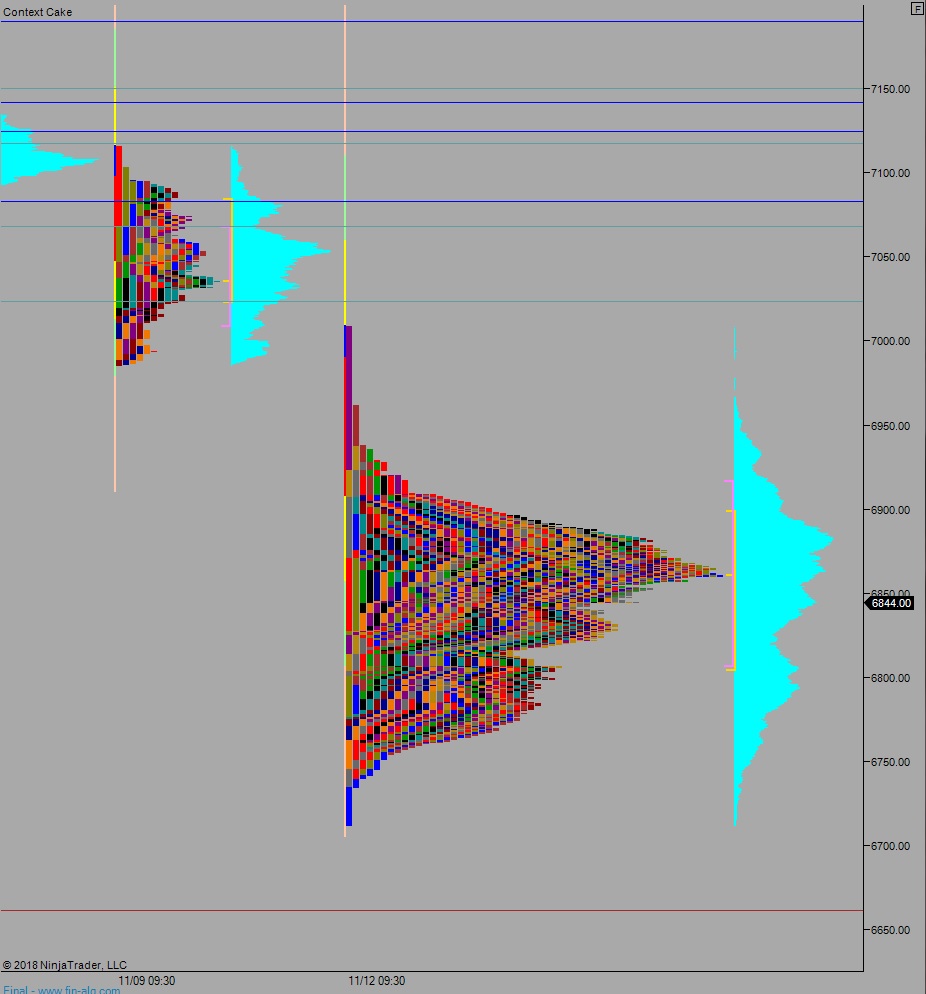

Yesterday we printed a double distribution trend up. The day began flat. An early two-way auction gave way to selling and we made a new low on the week. This low discovered a strong responsive bid and we pressed back up through the day’s range, going neutral before lunch. Then, buyers defended a throwback to the mid point which setup a strong afternoon rally. Despite sellers stepping in ahead of the Tuesday high, buyers managed to drive price back up near daily high before closing bell.

Double distribution trend up.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6916.25. Buyers continue higher, trading through overnight high 6917.75 to target the composite VPOC at 6950 before two way trade ensues.

Hypo 2 buyers press through composite VPOC 6950 and sustain trade above it, setting up a move to target 7000.

Hypo 3 sellers gap-and-go lower, down through overnight low 6806.25. Look for buyers down near 6800 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: