NASDAQ futures are coming into Thursday with a slight gap up after an overnight session featuring extreme range and volume. Price worked sideways overnight, balancing out above the daily midpoint while trading inside the Wednesday range. As we approach cash open, prices are hovering right along the Wednesday midpoint. At 8:30am initial/continuing jobless claims data came out mixed.

Also on the economic agenda today we have both construction spending and ISM employment/manufacturing data at 10am.

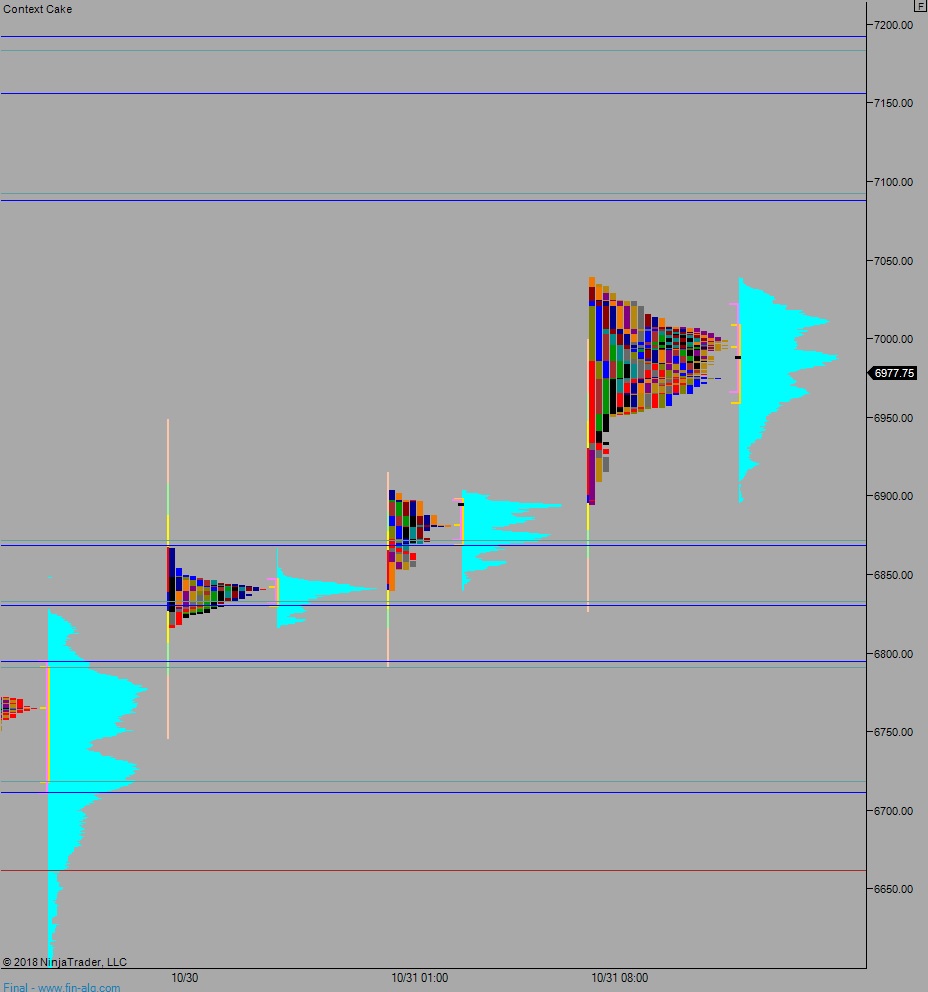

Yesterday we printed a normal variation up. The day began with a pro-gap up, which erased what was left of Monday’s trend down. Buyers rejected us up-and-out of the Monday range early on and defended an early attempt to push neutral after going range extension up shortly after 10:30am. Then another buyer rotation worked through, pushing to a new high-of-session before we succumbed to selling late in the session. The daily VPOC never managed to shift lower despite the afternoon selling.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6957. Buyers do not allow the overnight low 6951 to be taken out. Instead we work up through overnight high 7015.75 setting up a move to target 7050 before two way trade ensues ahead of Apple earnings.

Hypo 2 tighter chop. We close the overnight gap 6957 then go down through overnight low 6951. We then chop along the composite VPOC at 6945.50 as we await Apple earnings.

Hypo 3 strong buyers thrust higher on the open, sustaining trade above Wednesday high 7039.25 early on, setting up a move to target 7087.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: