*Most active traders have moved on to trading the December /NQ_F futures contract, however the price levels in this report are for the September contract. I will trade the September contract into end-of-week.

NASDAQ futures are coming into the second Friday in September gap up after an overnight session featuring normal range on elevated volume. Price worked higher, probing beyond the Thursday high for several hours. As we approach cash open price is hovering along the Thursday high. At 8:30am advance retail sales data came out below expectations.

Also on the economic docket today we have industrial production at 9:15am then both business inventories and the primary reading of sentiment from the University of Michigan at 10am.

Yesterday we printed a normal variation up. The day began with a gap up and drive higher. Price peaked out by late morning and came into balance for a bit before pushing to a new daily high around lunchtime. We then spent the rest of the session chopping along the daily midpoint.

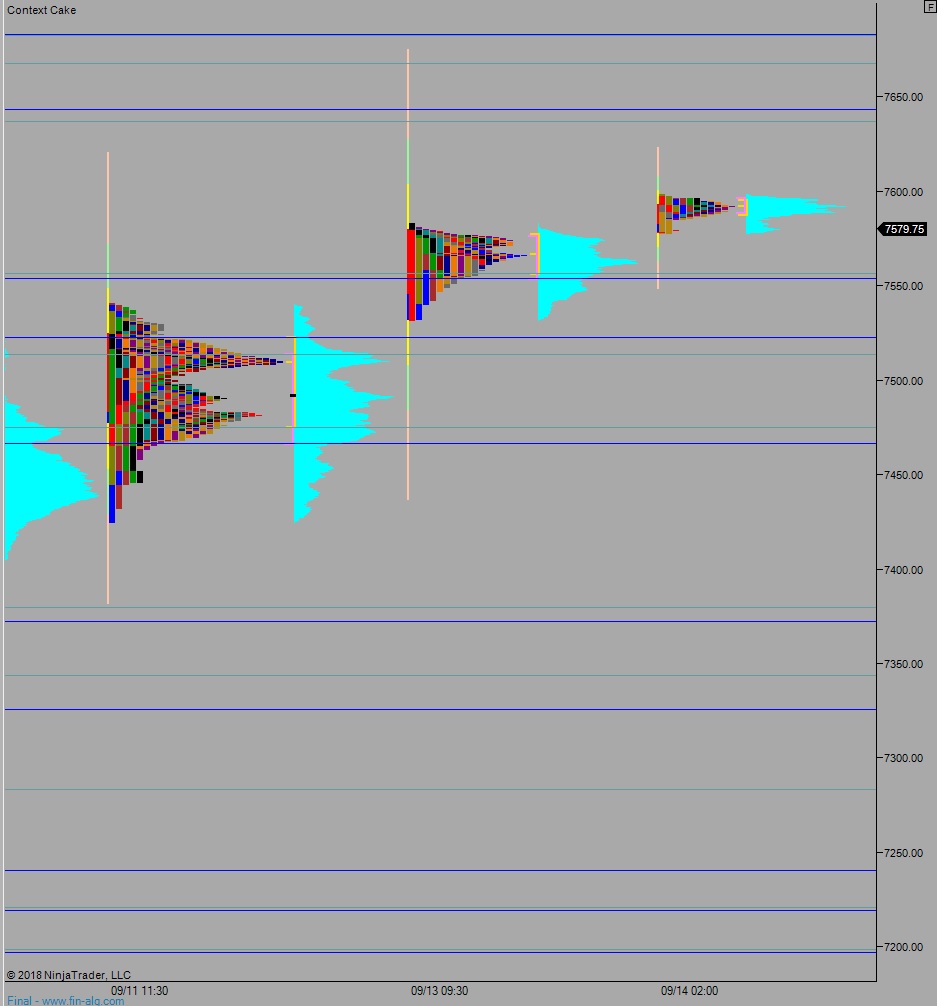

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7567.50. From here we continue lower, down through overnight low 7559.50. Look for buyers down at 7556.50 and two way trade to ensue.

Hypo 2 buyers gap-and-go higher, up through overnight high 7598.75 setting up a move to target 7637 before two way trade ensues.

Hypo 3 stronger sellers trade down to 7623.25 before two way trade ensues.

Levels: