NASDAQ futures are coming into Tuesday pro gap down after an overnight session featuring extreme range and volume. Price worked lower, down into the range from two Friday’s back before settling into balance. As we approach cash open price is hovering near Globex low. At 8:30am housing starts came out above expectations and building permits below.

At 11:30am the US Treasury will auction off 4- and 52-week T-bills. There are no other important economic events today.

Yesterday the NASDAQ printed a normal variation up. The week began with a gap down, after a choppy open buyer stepped in and worked a full gap fill to the tick before settling into balance.

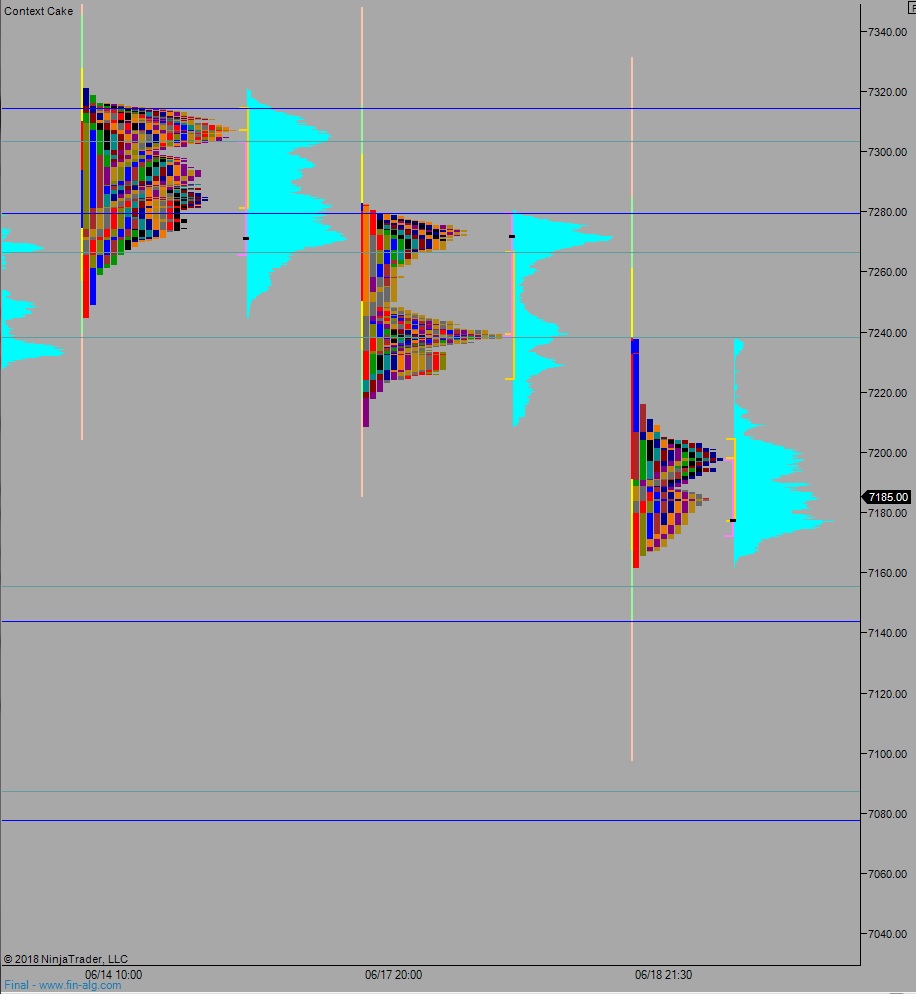

Heading into today my primary expectation is for buyers to work into the overnight inventory and test up to Monday low 7208. Sellers reject a move back into range, triggering a move down through overnight low 7162. Look for buyers down at 7155.50 and two way trade to ensue.

Hypo 2 sellers gap-and-go lower, down through overnight low 7162 and sustaining trade below 7143.75, setting up a move to target 7100 before two way trade ensues.

Hypo 3 buyers regain Monday low 7208.75 and trade up to 7266.50, setting up a full gap fill up to 7275.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: