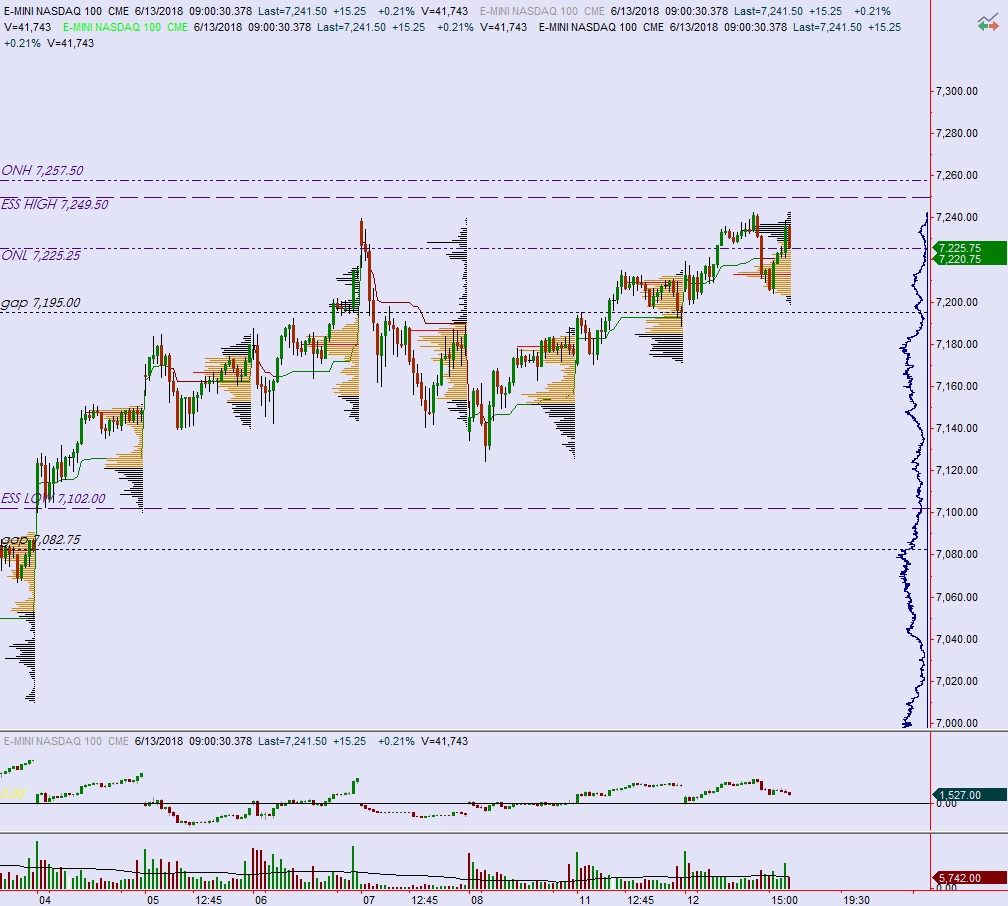

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring elevated volume on normal range. Price worked higher overnight, briefly tagging but not exceeding the record high, forming a double high in the process. As we approach cash open, prices are hovering along the Tuesday high.

On the economic calendar today we have crude oil inventories at 10:30am. Then at 2pm the FOMC will release their rate decision. The decision is followed by a 2:30PM press conference with Fed chairman Powell.

Yesterday we printed a normal variation up. The day began gap up and with sellers unable to fill the open gap during a choppy, slow, two-way morning auction. Instead buyers stepped in and initiated higher prices, briefly exceeding last Thursday’s high before two way trade ensued.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7225.75. From here we continue lower, down to 7200. Then look for the third reaction after the FOMC decision to drive direction into end-of-day.

Hypo 2 buyers gap-and-go higher, trading up through overnight high 7257.50 and drifting into open air. Then look for the third reaction after the FOMC decision to drive direction into end-of-day.

Hypo 3 stronger sellers sustain trade below 7190.50 setting up a move to target 7156. Then look for the third reaction after the FOMC decision to drive direction into end-of-day.

Levels:

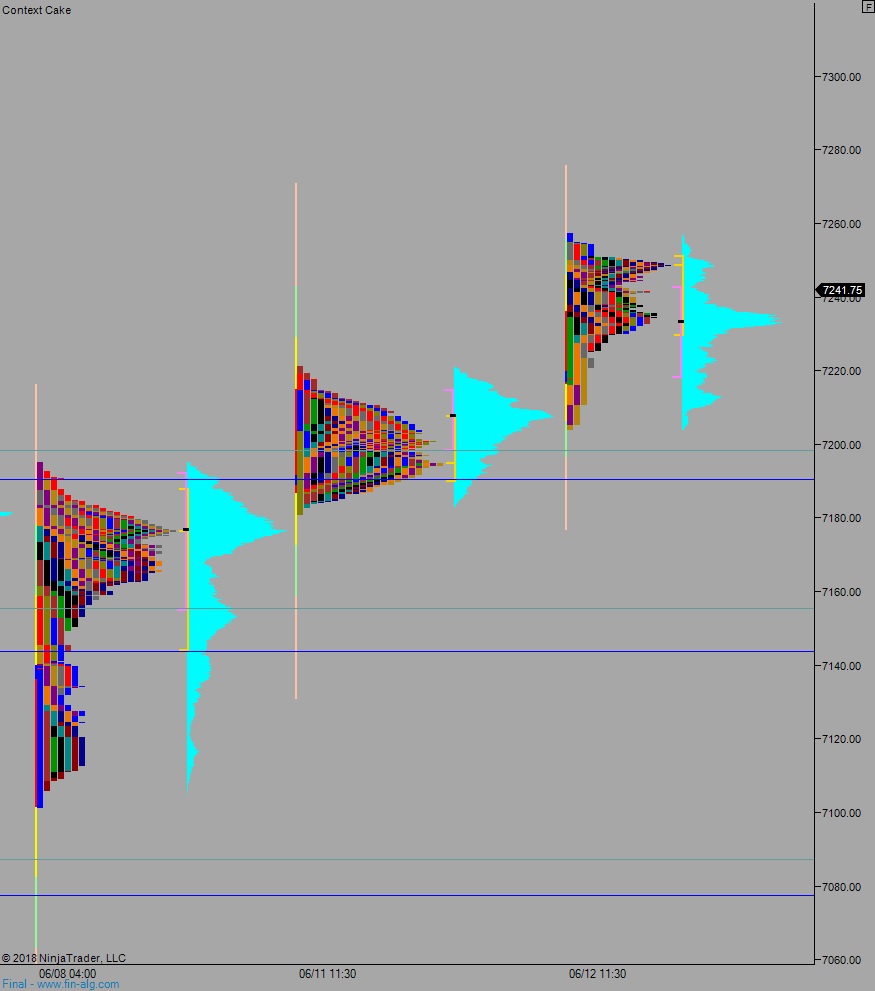

Volume profiles, gaps, and measured moves: