NASDAQ futures are coming into Monday gap up after an overnight session featuring elevated range on normal volume. Futures opened gap up, with the behavior being attributed to news that ‘trade wars’ were on hold. We then spent most of the evening working sideways before sellers stepped in. Their attempt back into the Friday range was rejected by buyers. As we approach cash open prices are holding about 20 points above the Friday high.

The economic calendar is light to start the week. At 11:30am we have a 3- and 6-month T-bill auction. There are no other economic events.

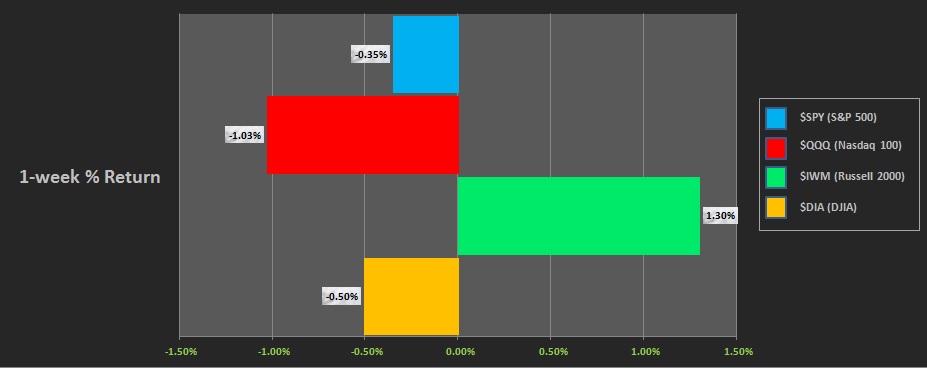

Last week was the third choppy week in a row. Strong Monday, gap down Tuesday, then consolidation. Meanwhile the Russell demonstrated divergent strength. The last week performance of each major index is shown below:

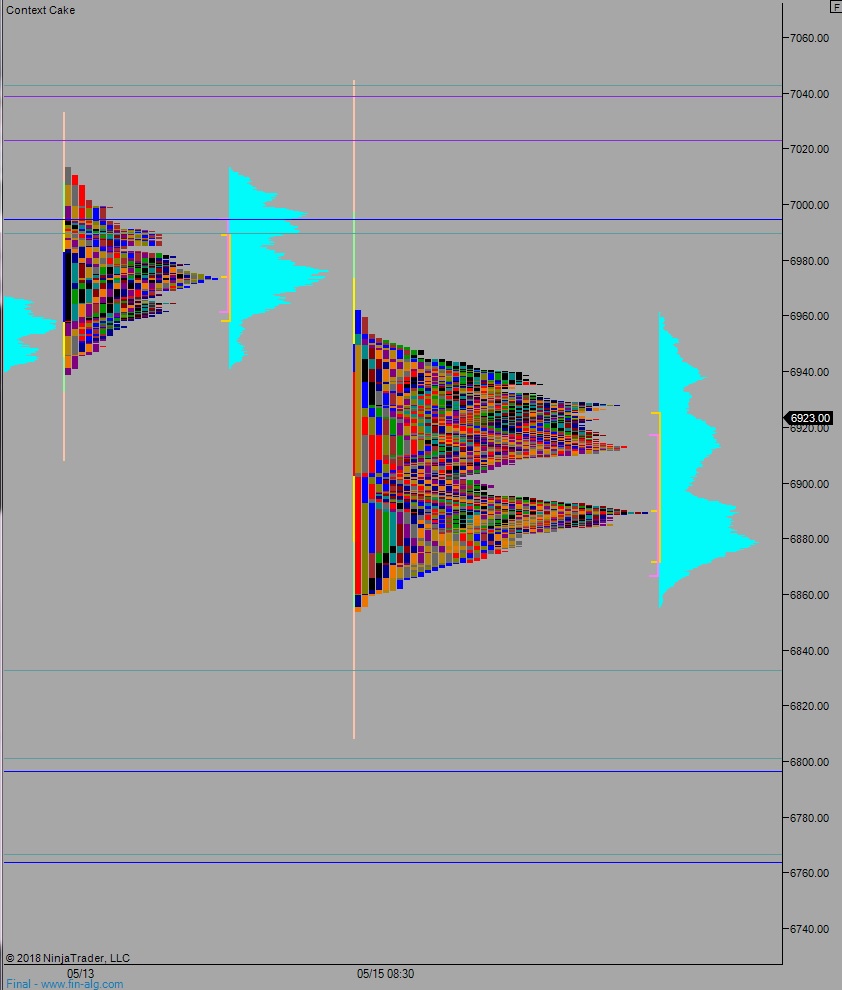

On Friday the NASDAQ printed a neutral extreme down. The day began gap down in range. The morning was spent attempting lower but with sellers being absorbed on the bid. Then we went up and closed the overnight gap before drifting into the lower quadrant by the end of the day.

Neutral extreme.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6874.25 before two way trade ensues.

Hypo 2 buyers defend ahead of overnight low 6898.75 setting up a move to take out overnight high 6947.75. Look for sellers up at 6963 and two way trade to ensue.

Hypo 3 stronger sellers trade us down to 6832.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: