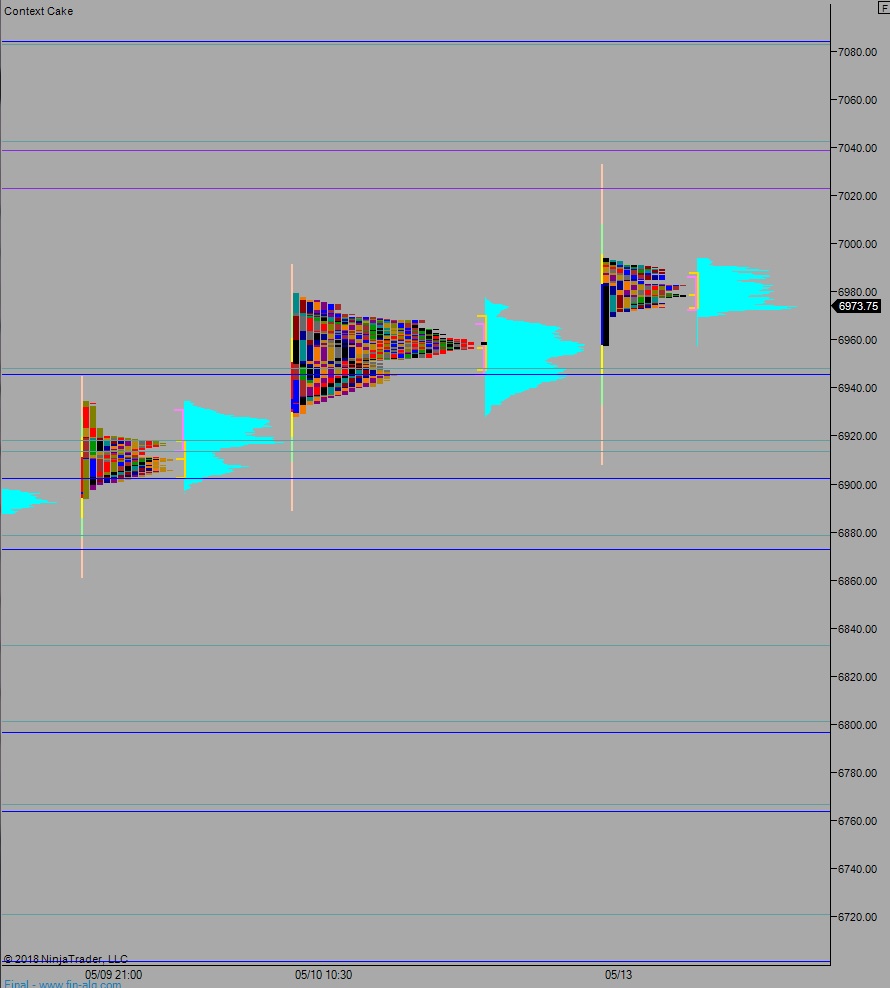

NASDAQ future are coming into the week gap up after an overnight session featuring elevated range and normal volume. Price worked up beyond the Friday high overnight before settling into balance right along the Friday range high.

The economic calendar is light this week. Today we have only to be aware that the US Treasury is auctioning off $48Bln in 3-month and $42Bln in 6-month T-bills.

Crypto currency traders will likely be paying close attention to New York city this morning. At 9:40am Federal Reserve banker Bullard is speaking at a crypto conference in the city. Central banking meets ‘decentralized’ money supply.

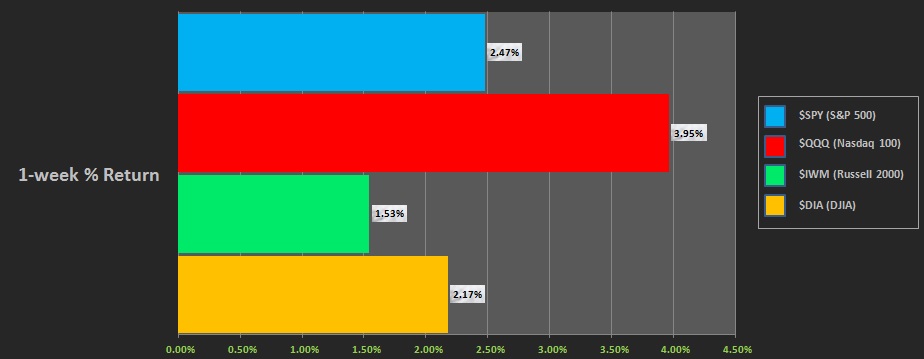

Last week kicked off with a rally. Buyers extended beyond the trend day printed two Friday’s back then the week became quite choppy. Wednesday afternoon buyers reasserted themselves then we went gap up into Thursday. After rallying through Thursday morning we chopped our way into the weekend. The 1-week performance of each major index is shown below:

On Friday the NASDAQ printed a neutral day. The day began gap down, in-range, and after a choppy open buyers stepped in and closed the overnight gap then briefly made new highs before discovering a responsive seller. Then we went range extension down, putting us neutral, before ultimately rallying back to the mean late in the session.

Neutral day.

Heading into today my primary expectation is fro sellers to work into the overnight inventory and close the gap down to 6960.25. From here we continue lower, down through overnight low 6953. Look for buyers down at 6948 and two way trade to ensue.

Hypo 2 stronger sellers take us down to 6918 before two way trade ensues.

Hypo 3 buyers work up through overnight high 6994.25 setting up a move to close the open gap up at 6999.25. Look for sellers around 7000 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: