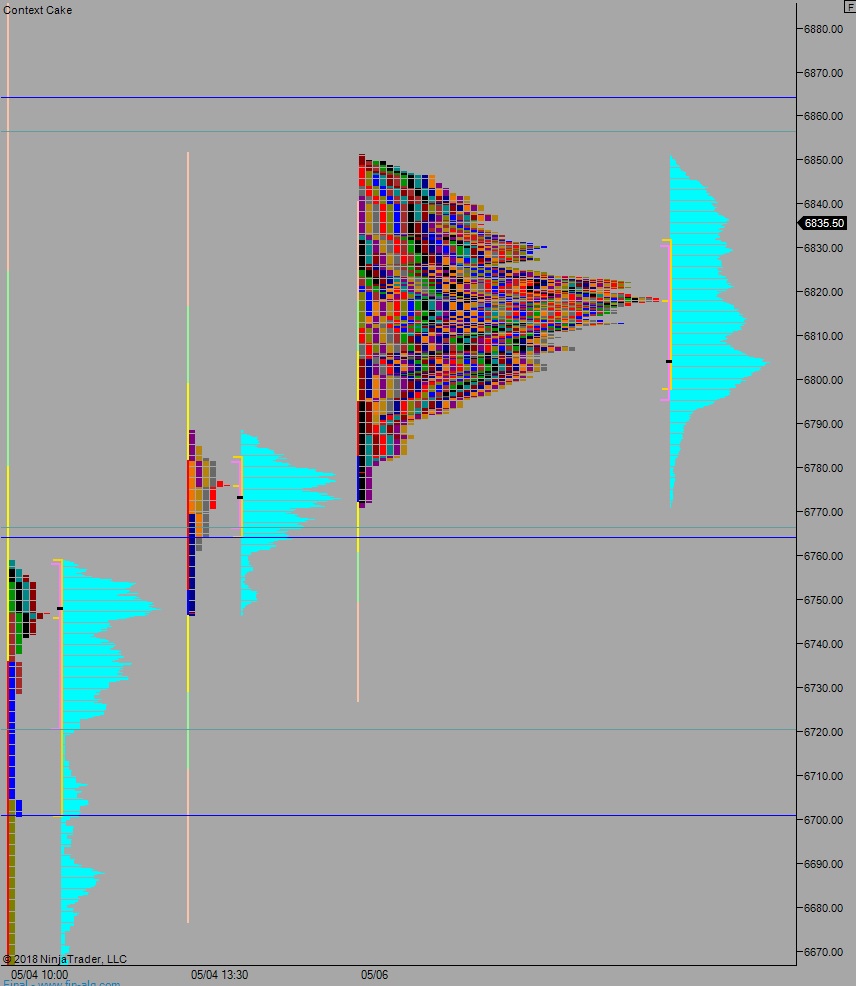

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring normal range on elevated volume. Price worked higher overnight, stalling just below the Monday cash high. Overall the globex auction stayed contained in the balance that has been forming since Sunday.

On the economic calendar today we have crude oil inventories at 10:30am and a 10-year note auction at 1pm.

Yesterday we printed a neutral extreme up. The day began gap down and sellers made the first move, pushing lower but failing to close the Friday gap. Instead responsive buyers (responsive relative to the Tuesday open, initiative relative to the Friday close) stepped in and pushed higher, closing the overnight gap. This put us range extension up. Responsive sellers stepped in and formed a sharp excess high before we went range extension down, putting us neutral. After closing the Friday gap we again traversed the entire range and closed near session high.

Neutral extreme. Choppy.

Heading into today my primary expectation is fro sellers to work into the overnight inventory and close the gap down to 6821.50. From here we continue lower, down though overnight low 6812.50 before two way trade ensues.

Hypo 2 buyers take out overnight (weak) high at 6850 setting up a move to target 6856.50 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 6864.25 setting up a move to target the open gap at 6883.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: