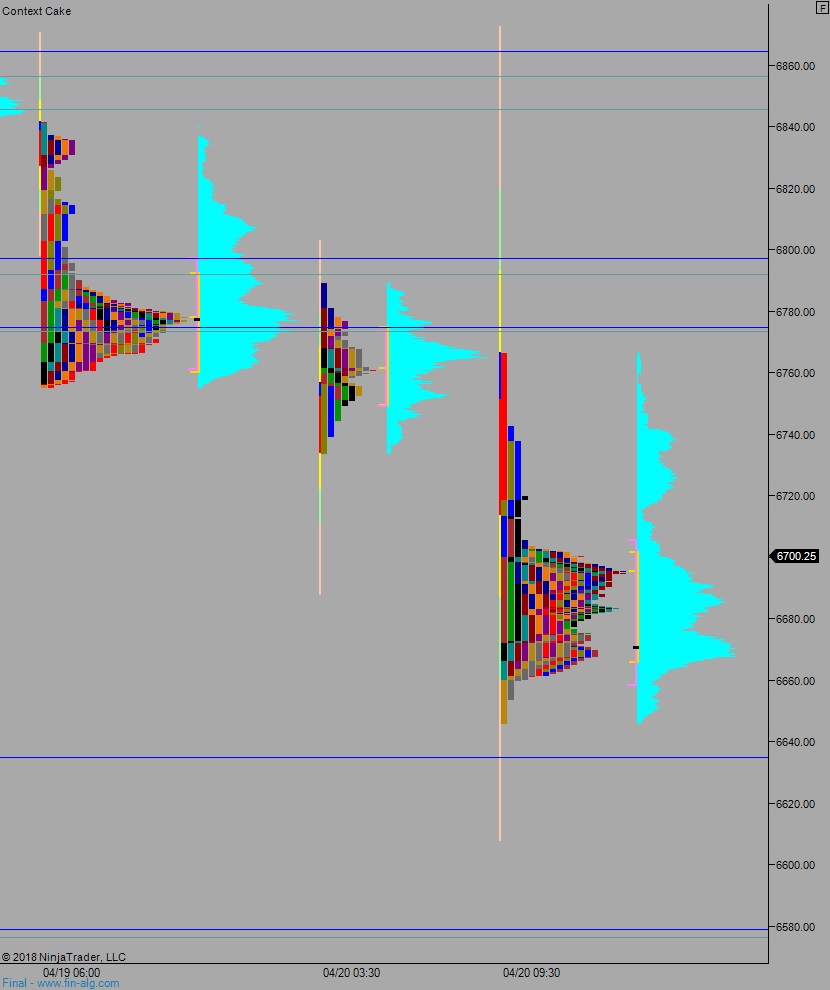

NASDAQ futures are coming into Monday gap up after an overnight session featuring elevated range and volume. Price was balanced overnight, sustaining trade in the lower quadrant of last Friday’s double distribution trend down.

On the economic calendar today we have MARKIT manufacturing/service/composite PMI at 9:45am, existing home sales at 10am, and a 3- and 6-month T-bill auction at 11:30am.

Also be aware Google parent Alphabet, Inc is reporting earnings after-market-close. This is a NASDAQ mover.

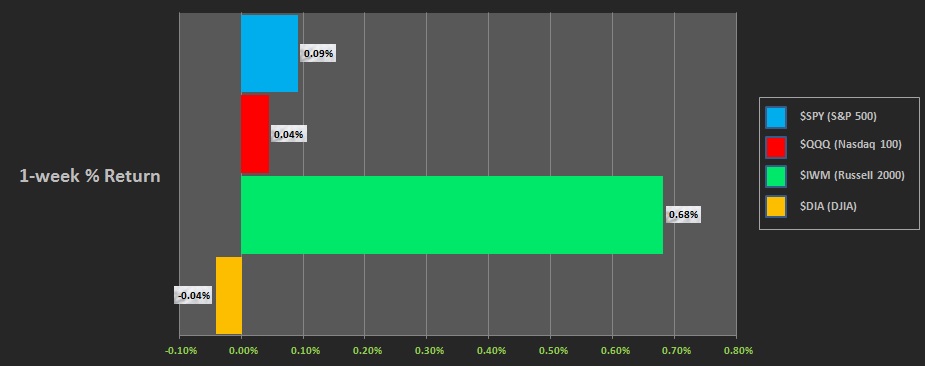

Last week we chopped. Some gap ups early in the week, gap downs later in the week. Chop. The Russell showed relative strength. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap down then a selling drive away from Thursday range. Price continued lower before coming into balance just ahead of the week’s low.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6676.75. From here sellers continue lower, down through overnight low 6660. Look for buyers down at 6635 and two way trade to ensue.

Hypo 2 buyers gap and go higher, up to close the gap at 6777 before two way trade ensues.

Hypo 3 stronger sellers take price down to 6580 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: