One year ago I set out to convince you robots are better investors than humans, myself included. Robots are better suited for certain tasks than a human will ever be. Like stock picking.

I have only two ways of buying a stock. The first is what we are reviewing today—a quantitative system of choosing and acting upon stocks. If you want to see exactly how the quant is built you can watch my YouTube video but here is a recap:

At the end of every quarter, a quick, top-down style analysis is performed using Exodus. We start at the sector level—seeing which performed the best—then drill down to specific stocks within the best performing sectors that we will then hold for a 12 month period.

The second way to buy a stock is a bit more heavy. It involves drinking to proverbial koolaid and going ‘all-in’ on an organization. This type of investment is long term and based off of deeply held convictions. Some call it faith. Or tribalism. I embellish how bizarre people can become from religion when I talk about Tesla. It means you read every news article, the SEC filings, the production reports, executive arrivals, departures…everything. Each stock you hold is like a side hustle. You need to keep up with it or it starts to lose money.

Faith-based investing is mentally taxing, and overall a human life is far too short to be stressed all the time. Stress is good. So is weight training. Both need to be done for a short duration with good form. This is why we are loving quant approaches more.

The quant chooses. The quant wins or loses. Either way I take no credit for their performance. I am here to keep their cooling fans clean and rooms cool, like a custodian.

Anyhow the first live year of stock picking will be complete at close-of-business today, and on Tuesday morning the second adjustment of 2018 will occur. The system will also turn 1 year old! Baby’s first birthday, so cute.

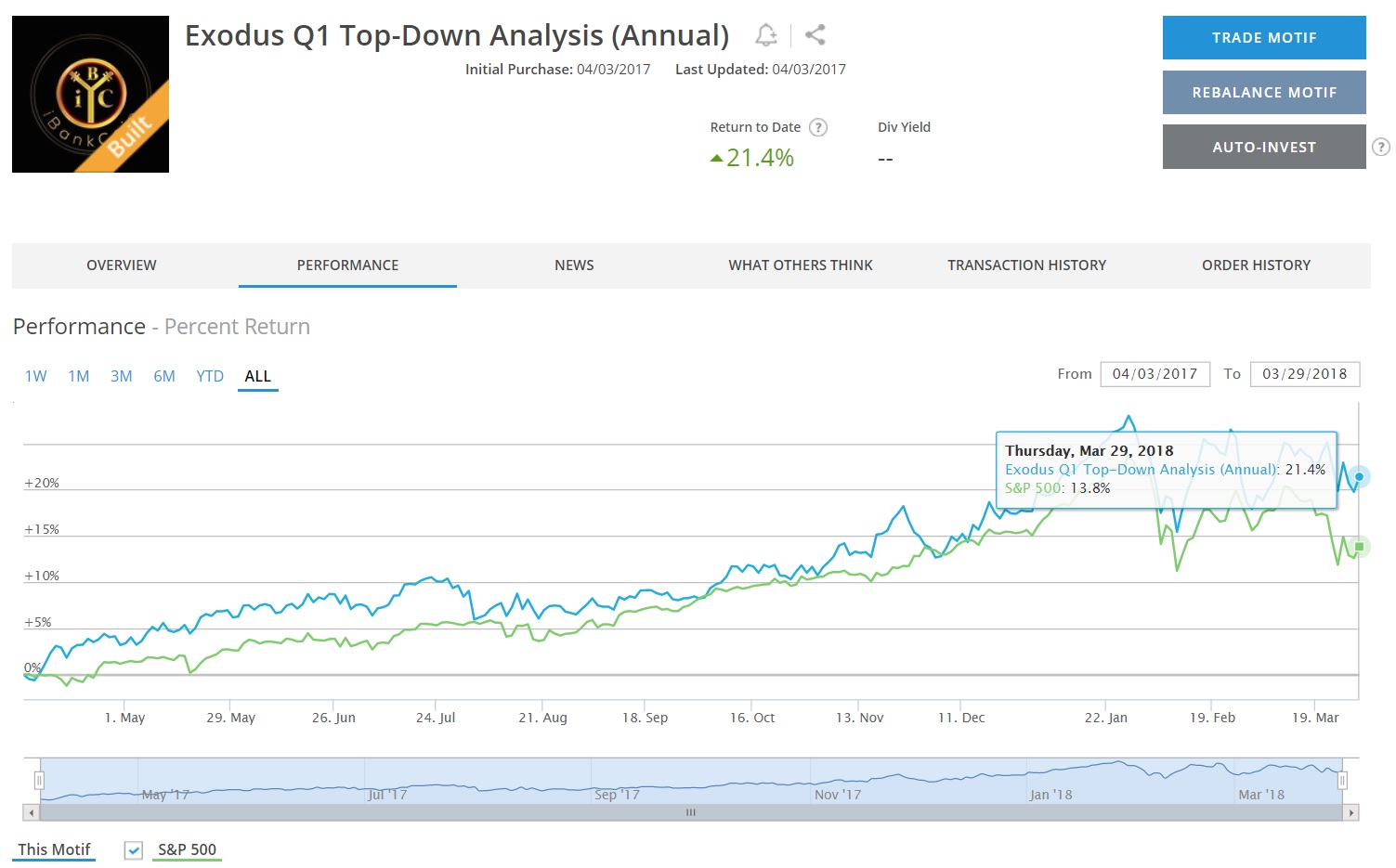

So far the quant is absolutely laying waste to the S&P 500, besting it by more than 7% hallelujah:

Top 3 best performing quant stocks: $ATHM +170.5% $PAYC +85.2% $NOAH 80.6%

In summary, China. If you would have told #MAGA fanatics on April 1st, 2017 that China stocks were going to crush, they would spit in your face and have a parade down your street.

Worst 3: $IMAX -43.1% $AKRX -22.7% $EDR -19.3%

Going into this portfolio, I considered EDR the safe play. I was happy the quants chose EDR because I wanted safety. We had just ripped tits to the upside for four continuous months after the November 2016 Trump win. Look how bad my monkey brain was at picking stocks!? One of the worst ones, pathetic.

By proving to myself time-and-time again that robots are better than me, I keep my rambunctious ego contained. I appreciate the ego, but not when it comes to business execution. Success in business is about making one good decision after another, patiently stacking those decisions atop one another. If presented with the right information it is my belief that anyone can make good decisions. The right information to observe in the financial markets is raw data. The more pure your data the better. It is the clay from which your bricks are molded.

The foundation stones that you build on are millions of years old but only discovered by humans in the last 2500 years. They are the tenants of philosophy lads. Choose wisely.

Over the weekend, perhaps Monday, I will go live on YouTube and build the next adjustment to my quarterly quant portfolio. Hopefully you can tune in live, that way if you have any questions along the way I can address them. But I will do my best to make a recording available.

Enjoy the the holiday weekend. A somber Good Friday and exhilarating Easter to those who celebrate it. May you be safe, and happy, and as healthy as you can be. And may you have ease of being.

If you enjoy the content at iBankCoin, please follow us on Twitter

Ease of being- I like that.

There is someone on stock twits with “ZQuant” handle. They only made short calls that were unbelievable. I think he/she is going subscription only. People are begging him/her to come back.

I will never understand having a subscription service if you’re a good trader/quant. Don’t your trades make you enough money? Must you really build a wall around your information? Fuck that guy he’s everything that’s wrong with this world.

Please tell me who beats the market consistently on an annual basis over a 20 year period.

That interval ensures a couple of recessions.

yesterday when crypto was tanking, I turned a franklin into 5g’s in a matter of a few hours. left it in thar to play more areas, so no pocket change but i did grab a 4loco to celebrate

AI is great, but there is a fundamental problem with it that is very hard to see. it is the same problem that people don’t see when they read professional stock reports, and it is actually the same problem that is often seen in science. The problem is although the logic, math, formulas, and other “technical” parts of the analysi and models may be right o nthe moeny, they are often built on a foudnation of assumptison, amny of which are not explicitly know or stade.

For example, crime predictions models blindly take in the reality that African Americans are more likely to be convicted of crimes and extend that to predicting that African Americans are more likely to *commit* crimes (all other factor beiing equal). The missing link is that the AI algorithms assume that the convictions were made without biases, when studies show otherwise.

Simirlarly, it is well known that ETFs often outperform professional stock pickers. This is not necessarily because the experts made *bad* calls, just *incorrect* ones. Many experts saw the bubbles in 1999 and 2006, yet the bull amrket continued onwards.

Here’s something to consider about AI stock pickers: how many of them have been tested in environments where a bull market was ending with 10-year interest rates under 3%? Falling interest rates is a vastly underrated driver of asserts prices over the last 40 years. They may be waiting for an inverted interest rate curve that never appears.

Had the same thought numbers. Perhaps adjusting the quant holdings more frequently would help.

Not sure that would help. The fundamental flaw is that 99% of price-action based stock algorithms are based on the assumption that stock prices – and correlations to other indicators – will behave exactly as they did in the past, ignoring that macroeconmic factors – aging populations , higher national debt level and interst payments, etc. – are fundamentally different this time.