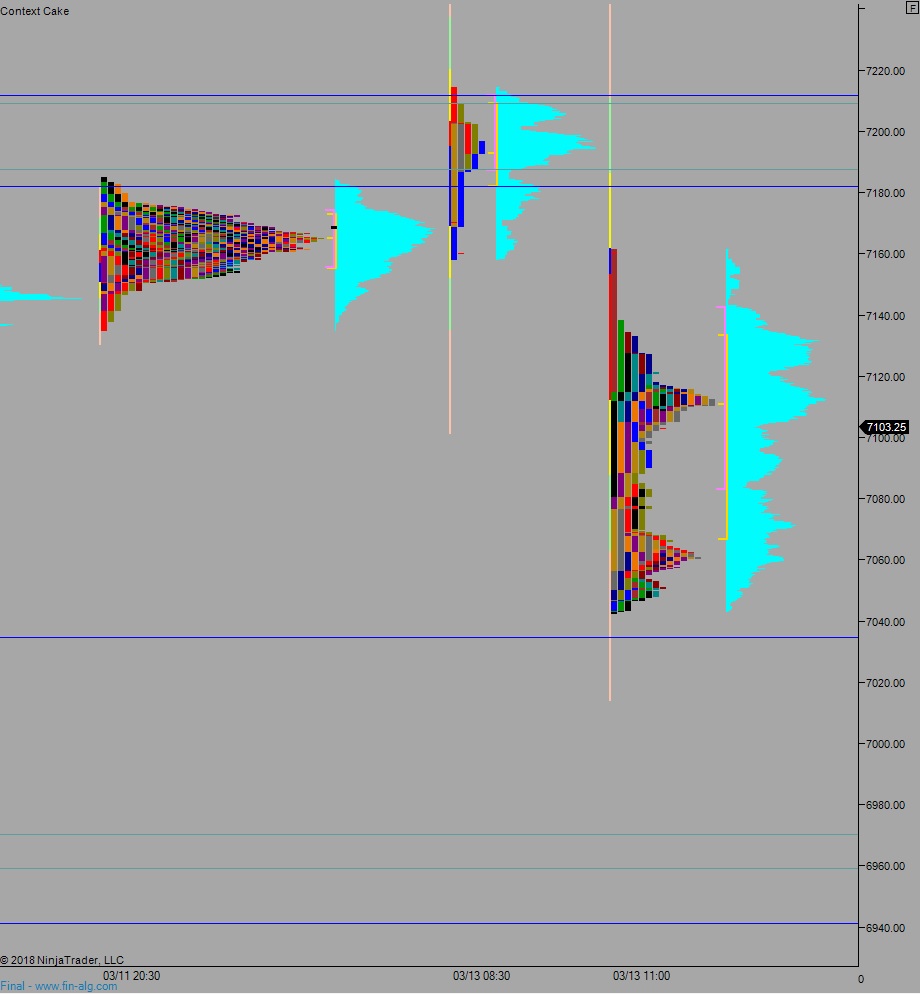

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme range and volume. Price briefly took out the Tuesday RTH low overnight before spending the rest of the session working higher. As we approach cash open price is trading below the midpoint of Tuesday’s trend down. At 8:30am advance retail sales data came out below expectations.

Also on the economic agenda today we have business inventories at 10am and crude oil inventories at 10:30am.

Yesterday we printed a trend down. The day began with a brief push higher which took out overnight high, establishing a more ‘quality’ higher before reversing and going trend down for the rest of the day. Responsive buyers showed up near last Friday’s open.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 7082.75. From here we continue lower through overnight low 7042.50. Look for buyers down at 7034.75 and two way trade to ensue.

Hypo 2 buyer continue their overnight campaign, pushing higher, up through overnight high 7121.50. Look for sellers up at 7142.50 and two way trade to ensue.

Hypo 3 stronger buyers trade all the way up to 7182 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

What is the reason why yesterday was a trend day vs a double distribution day? Thanks

suppose it could be a dd down, you’re right, one is a 1-1.5 the other is a 2 so it doesn’t make a huge difference to me

can you explain that to me i dont understand? thanks