NASDAQ futures are coming into Thursday gap up after an overnight session featuring elevated range and volume. Price steadily campaigned higher overnight in a manner akin to 2017 when volatility was nonexistent. As we approach cash open price is hovering near the high from February 28th, the last day of last month. At 8:30am initial/continuing jobless claims data came out mixed.

There are no other important economic events today.

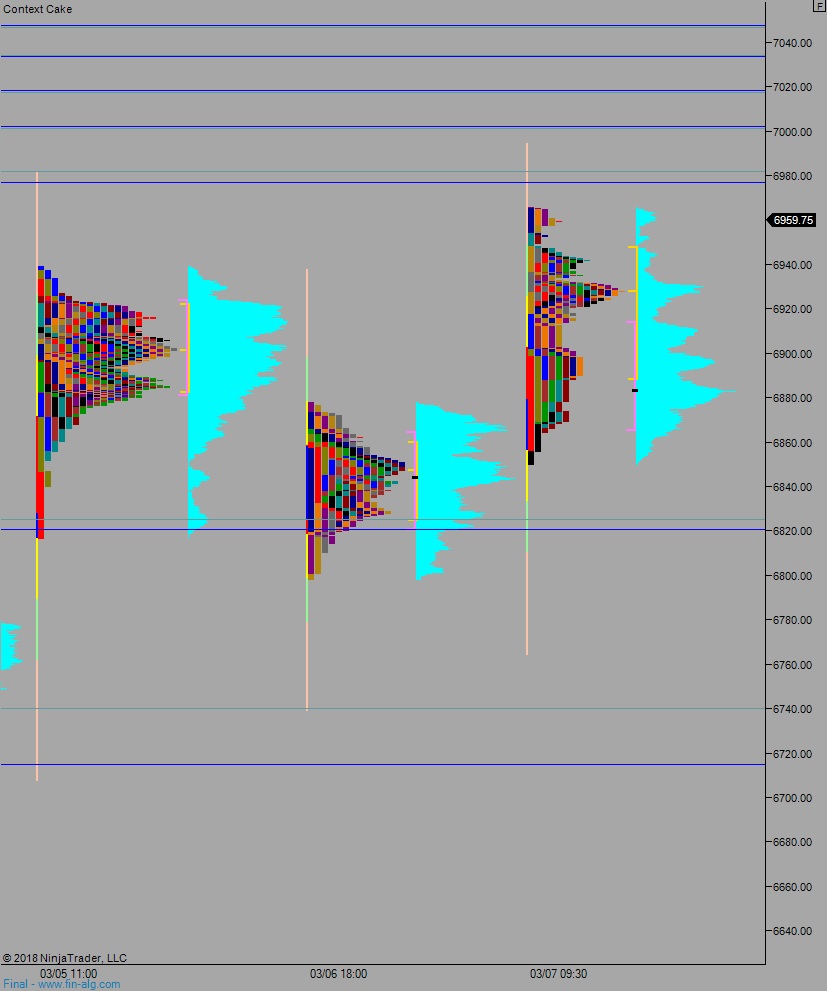

Yesterday we printed a neutral extreme up. The day began with a gap down that buyers quickly filled. Then we traversed the entire range and took out IB low pushing us neutral. The next move was back to the mean, like most neutral days do. Then buyers rallied the market into the bell.

Heading into today my primary expectation is for sellers to work into the overnight inventory and attempt a move back into the Wednesday range 6937. Buyers defend and reject a move back into Wednesday range and we go higher, up through overnight high 6965.75. Look for sellers up at 6976.50 and two way trade to ensue.

Hypo 2 sellers work a full gap fill down to 6923 then continue lower, down through overnight low 6913.50. Look for buyers ahead of 6900 and two way trade to ensue.

Hypo 3 buyers gap-and-go higher, triggering a rally up to 7000 before two-way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: