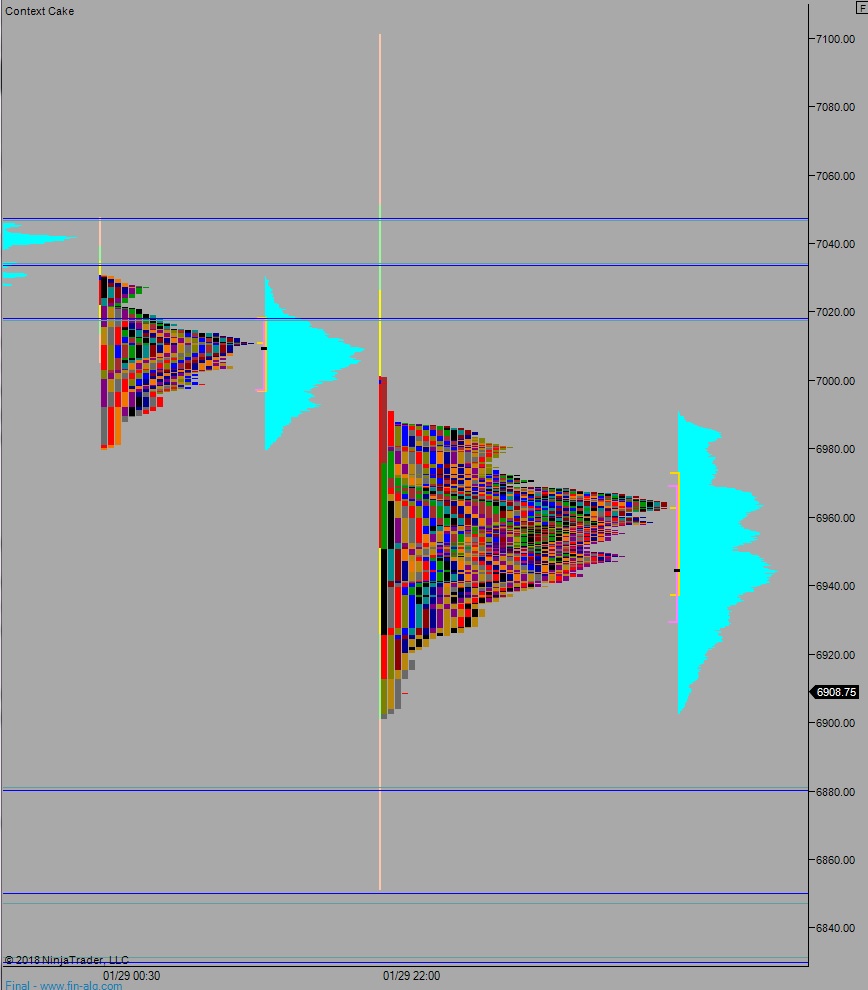

NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price was all over the place during extended trade. We briefly took out the Wednesday cash low then rallied back up near the highs as investors reacted to earnings out of Facebook and Microsoft. Then, as the evening progressed we sold off, non-stop, traversing the entire range of a large balance that has been building since January 29th. At 8:30am Initial/Continuing jobless claims data came out mixed.

Also on the economic docket today we have ISM manufacturing/employment at 10am.

After the bell Apple, Google, and Amazon report earnings. These are major, market moving events.

Yesterday we printed a normal variation down. The day began gap up. And after a “farewell Yellen” morning raly up through overnight rally we stalled. We stalled just 1.5 points ahead of the open gap left behind on 1/29. This was a slight hint of weakness. From then on the market began working lower, closing the overnight gap before finding a responsive bid late in the day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and test back up into the Wednesday range 6922. Look for buyers to succeed and continue higher, up to close the overnight gap up at 6950.75 before violent, choppy two-way trade ensues.

Hypo 2 sellers press down to 6880.75 before violent choppy two way trade ensues.

Hypo 3 stronger sellers take us down top 6850 before violent choppy two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: