NASDAQ futures are coming into Wednesday gap up after an overnight session featuring elevated range and volume. Price worked higher after several hours of balance. As we approach cash open, the market is hovering just above the midpoint from Tuesday’s range. At 7am MBA mortgage applications came in lower than last week.

Also on the economic agenda today we have industrial production/manufacturing capacity at 9:15am, NAHB housing market index at 10am, the Fed’s Beige book at 2pm, and long-term TIC flows at 4pm.

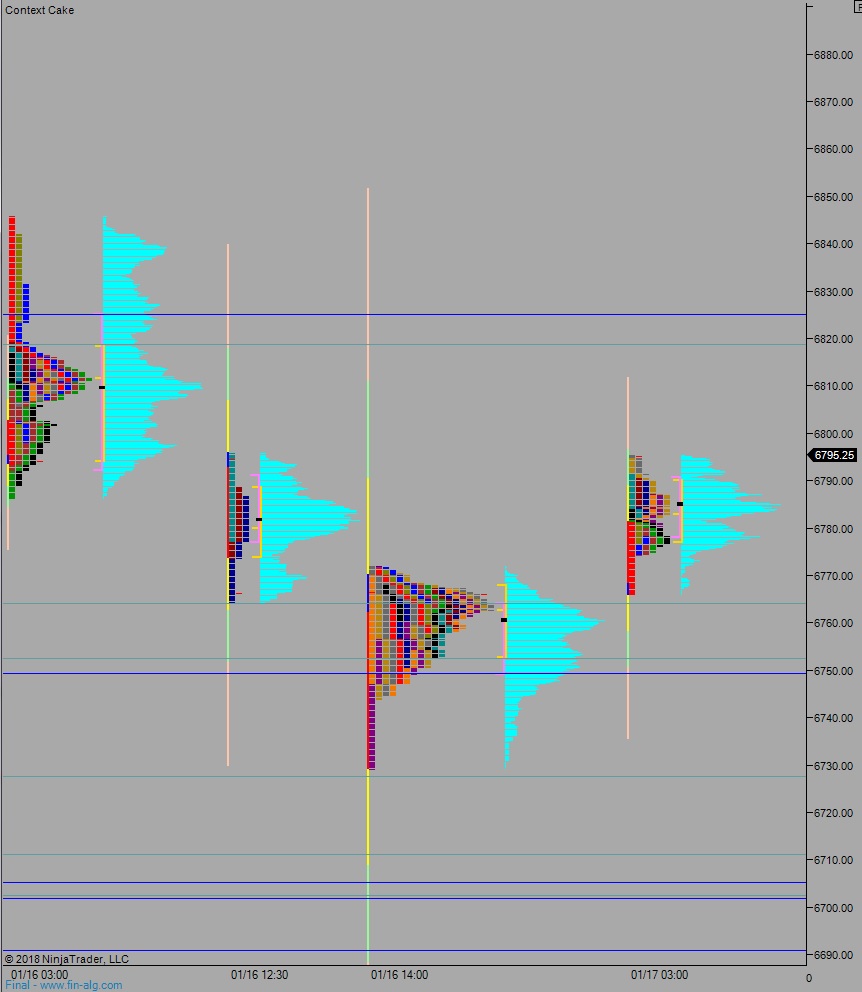

Yesterday we printed a double distribution trend down. The day began with a pro gap up and early drive higher. A strong responsive sell stepped in within 30 minutes of cash open and reversed the entire drive higher. Then, sellers became initiative on the day and closed the entire weekend gap. Then, the continued lower, pushing into the lower quadrant of the trend from last Friday, eventually finding a responsive bid towards the end of the day.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6763.25 before two way trade ensues.

Hypo 2 we drive higher off the open, trade up to 6818.50 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 6825 setting up a move up to 6830.

Levels:

Volume profiles, gaps, and measured moves: