I just put down the nastiest morning trade session so far in 2018 and I am taking to the pen instead of using this chest full of courage to give back any gains.

Fuck.

Was long in the pre- per the primary hypothesis. Let’s dissect the plan and take a magnifying glass to it, shall we? First:

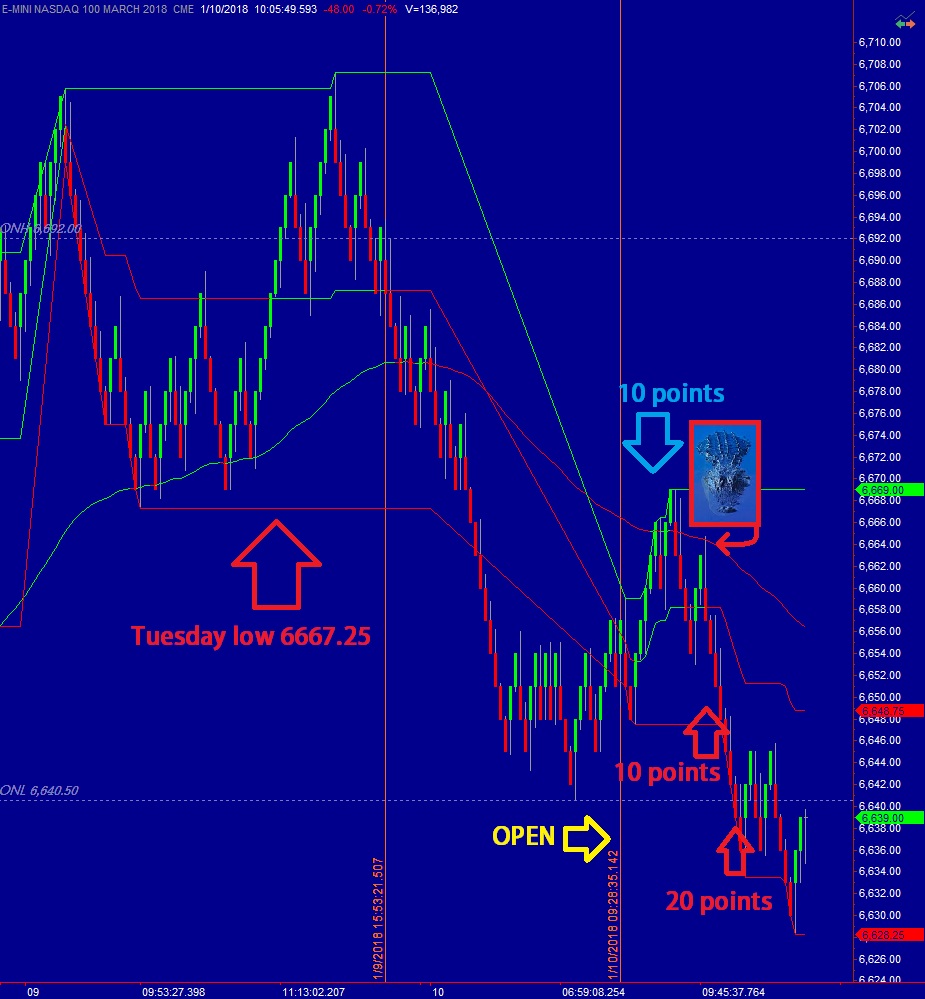

Heading into today my primary expectation is for buyers to work into the overnight inventory and test re-entry into the Tuesday range 6667.25.

This expectation, that we would push into the overnight inventory had me long ahead of opening bell, targeting the Tuesday low. Then I watched 6666 because I am weird but also because I wanted to see sellers step in. THEY DID. And then, a gift from the tape gods, a retracement for me to sink my teeth into, crocodile style. Look:

I had time to think but not much. Why would I go short around 6662? Because of some EMA or other chart magic? Not really, the renkos just help to time entries and manage risk. I went short because of the next part of the primary hypothesis:

Sellers defend here and we go down to take out overnight low 6640.50.

This is why I blog. This is why I write a morning trading report before I even think of stepping into the arena. I could not care less if the gen-pop reads my reports. I hope some of you, the ones who really are totally immersed into investing and trading start to see how helpful this approach to trading is. But I know there aren’t many hardcore trading nerds out there.

The morning plan clarifies my vision. It has one piece left, but I will not engage. I will take my quick 600 bucks and go pursue other interests. If I were still trading, I would look for this action to continue lower, eventually tagging 6623. Why? Sentence three of the primary hypothesis:

From here we continue lower, down to 6622.75 before two way trade ensues.

It could be wrong, how we trade the daily midpoint around 6650 is the pivot. And I do not feel like mucking around inside choppy value.

Listen, this post is a bit robust and braggiose, I suppose I am happy that I stuck to my plan and did so with the tenacity of a crocodile. I do not seek your admiration. Just hoping to inspire anyone struggling to gain a grasp of how the auction works.

MOVING ON

We do not have much to go off of over on bitcoin. The CME instrument is only a few weeks old. These are the two hypotheses I laid out on Monday:

So here we go:

- 2-3 day trend : 2

- 2-3 week trend: 2.5

- magnets: 3.5

- strongest volume: 2.5

- Excess high/low: 2.5

- SCORE: 2.6 MEDIUM BEAR

It looks like primary hypo (hypo 1) is on the table. We are bouncing along the range-lows of a messy balance. Keep an eye on 14,340 as a pivot back to neutral, otherwise look for more selling.

Listen, like all facets of life we take trading one step at a time. On Sunday we form a bias. Every morning we write a plan. Then we take it one trade at a time. Trade THIS TRADE RIGHT NOW, then once it is complete, reassess the plan and get ready for the next trade. THEN TRADE THAT TRADE. I believe this is how best to achieve the coveted ‘zone’ so many professional athletes talk about.

Up in the mountains, there is no better feeling then when all your equipment is dialed in, a good song is playing in your helmet, a couple of bros are with you, and the mountain has good conditions below. There is a similar feeling when trading.

Bias, plan, execution.

If you enjoy the content at iBankCoin, please follow us on Twitter

Nice.

I’m a big fan and love your work. I’d much rather clip a few hundred bucks just with futures than scanning 4000 stocks to see which pops next.

Brilliant

Thank you

You mentioned waiting for weeks for a trade in the Monday post. Is that for a trade of a size like 20 points? I ask because I have traded futures in the past and fell victim to over trading and not adhearing to stops. How do you avoid overtrading? Is there a filter you use other than the daily scenarios for trade initiation?

Also, since btc is traded 24/7 there are “volume gaps” from the underlying when futures are not traded. Not saying auction theory won’t work, just something basic I noticed.

Totally. I’m trying to build a 24 (or 23.5 hour) market profile chart. Been asking ninja to support it. I used to over trade also. What helped me was only trading weeks I have a directional bias. Or if I really want to trade, only scalping market profile levels from morning report. And only trading for 1-2 hours/day. Hope some of that helps. I’m not trading BTC yet need more information