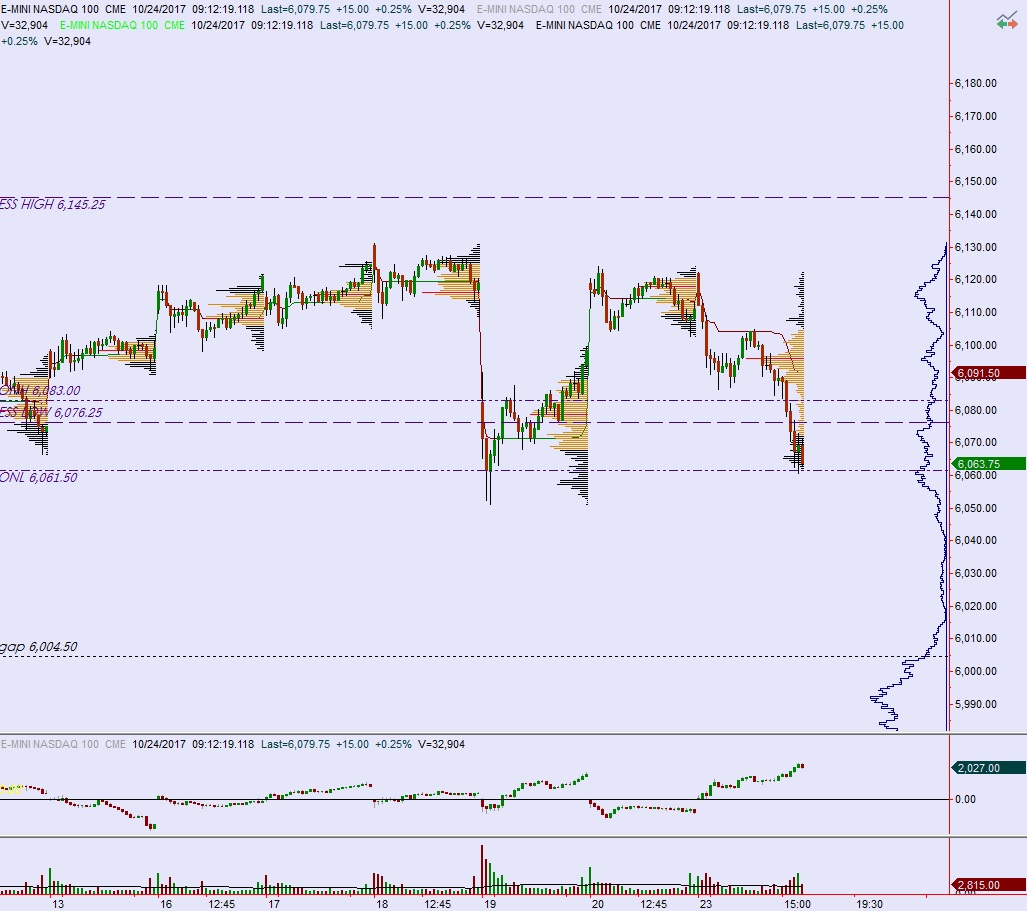

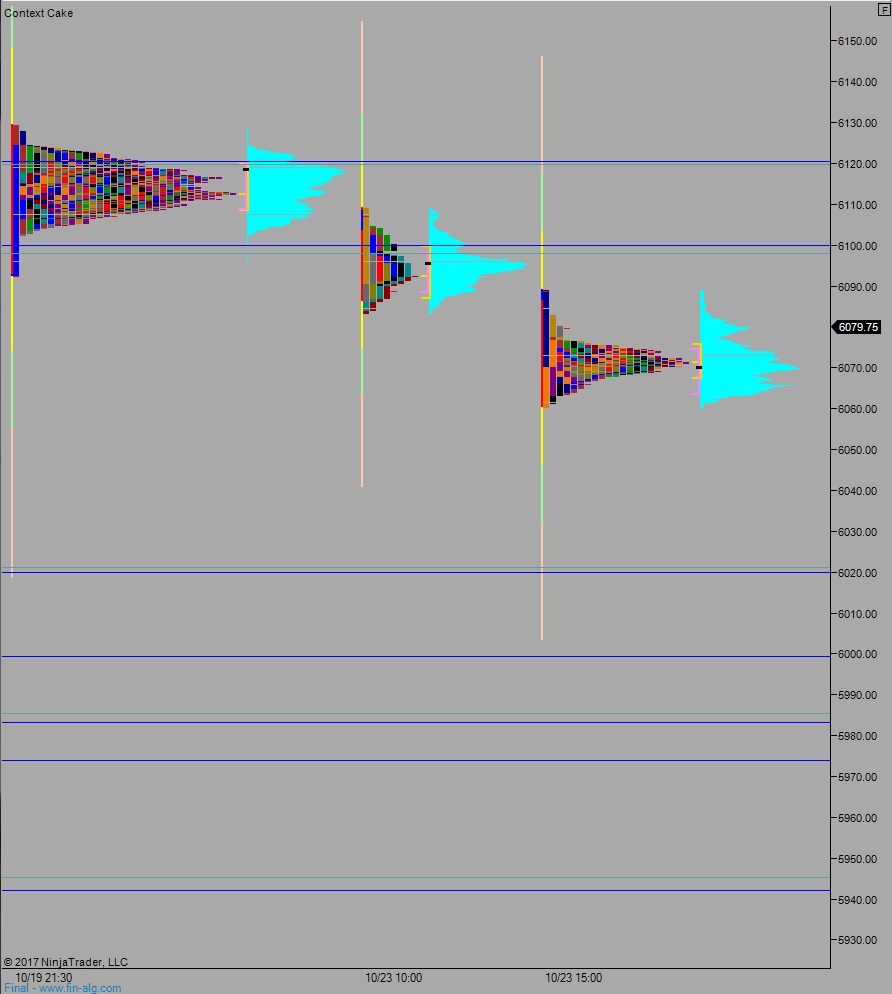

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, sustaining trade inside of the Monday range in balanced trade that broke higher during the morning.

There are a few items on the economic calendar today. We have Markit putting out manufacturing, service, and composite PMI at 9:45am. At 11:30am the US Treasury is auctioning off 4-week T-bills. Then at 1pm they are auctioning off some 2-year notes.

Yesterday we printed a double distribution trend down. The week began with a gap up that sellers quickly faded. The selling continued down to 6089, which was the target level of our primary hypo before settling into 2-way trade ahead of lunch. Then sellers engaged the market again, making new lows and pressing deep into last Thursday’s range. We closed near the session low.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6063.75. From here we continue lower, down through overnight low 6061.50. This triggers a move down to 6021.25 before two way trade ensues.

Hypo 2 buyers work up through overnight high 6083 and target 6098 before two way trade ensues.

Hypo 3 stronger buyers press up to 6119.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: