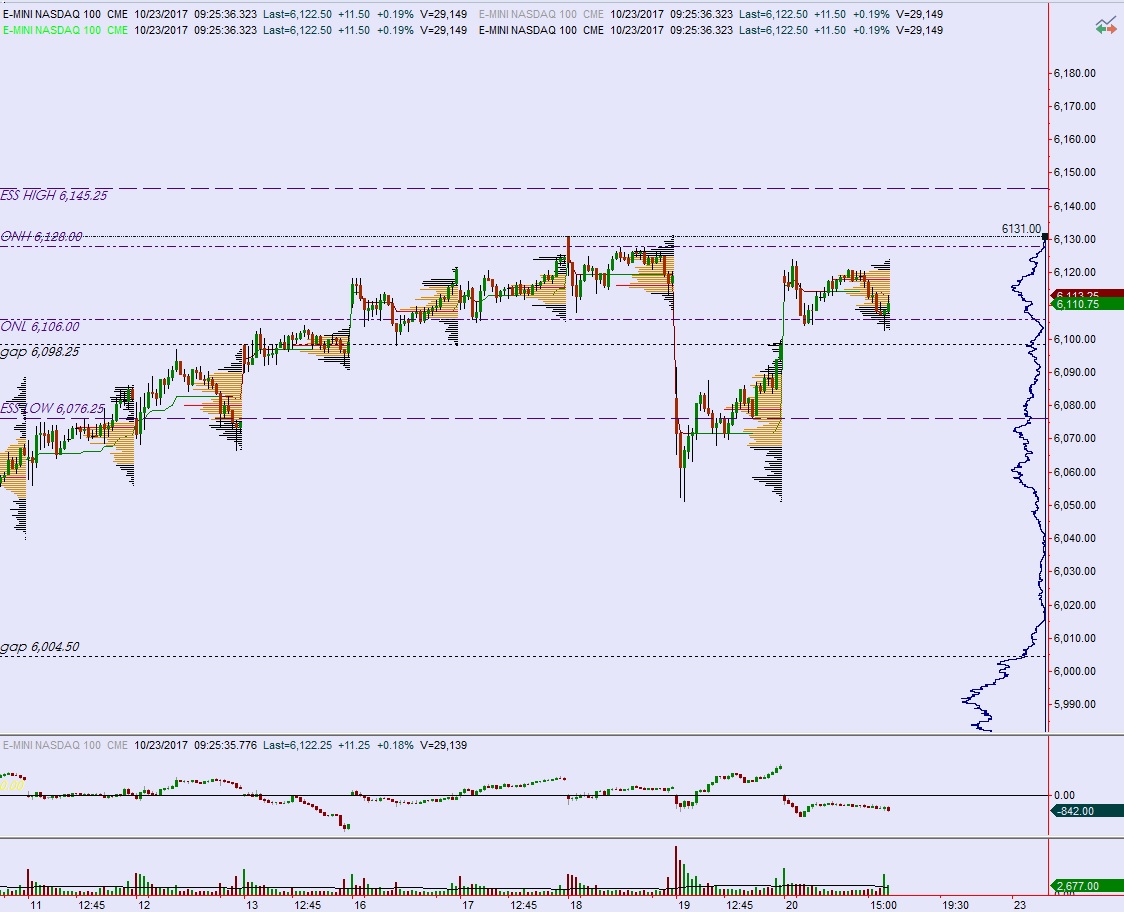

NASDAQ futures are coming into the last full week of October with a slight gap up after an overnight session featuring normal range and volume. Price worked sideways overnight, traversing last Friday’s range a few times and briefly exceeding to the upside.

The economic calendar is light today. The only scheduled event is a 3- and 6-month T-bill auction at 11:30am.

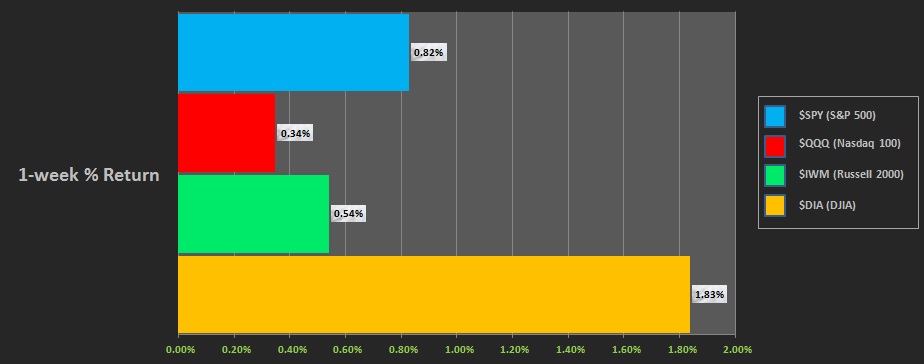

Last week we rallied. The Dow rallied hard. The other indices made a bit of progress early in the week, saw a gap and drive lower Thursday morning, then a recovery, and ultimately closed out the week higher. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down. The day began with a gap up. After a brief two-way auction price went range extension down. Buyers defended an attempt back down into the Thursday range and two way trade ensued.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6110.75. From here we continue lower, down through overnight low 6106. Then we continue lower and close the gap down at 6089.25 before two way trade ensues.

Hypo 2 buyers refuse any moves into last Friday’s range and we go take out overnight high 6128. From here we continue higher and probe record high 6131 before two way trade ensues.

Hypo 3 stronger sellers press down to 6076.25 before two way trade ensues.

Levels:

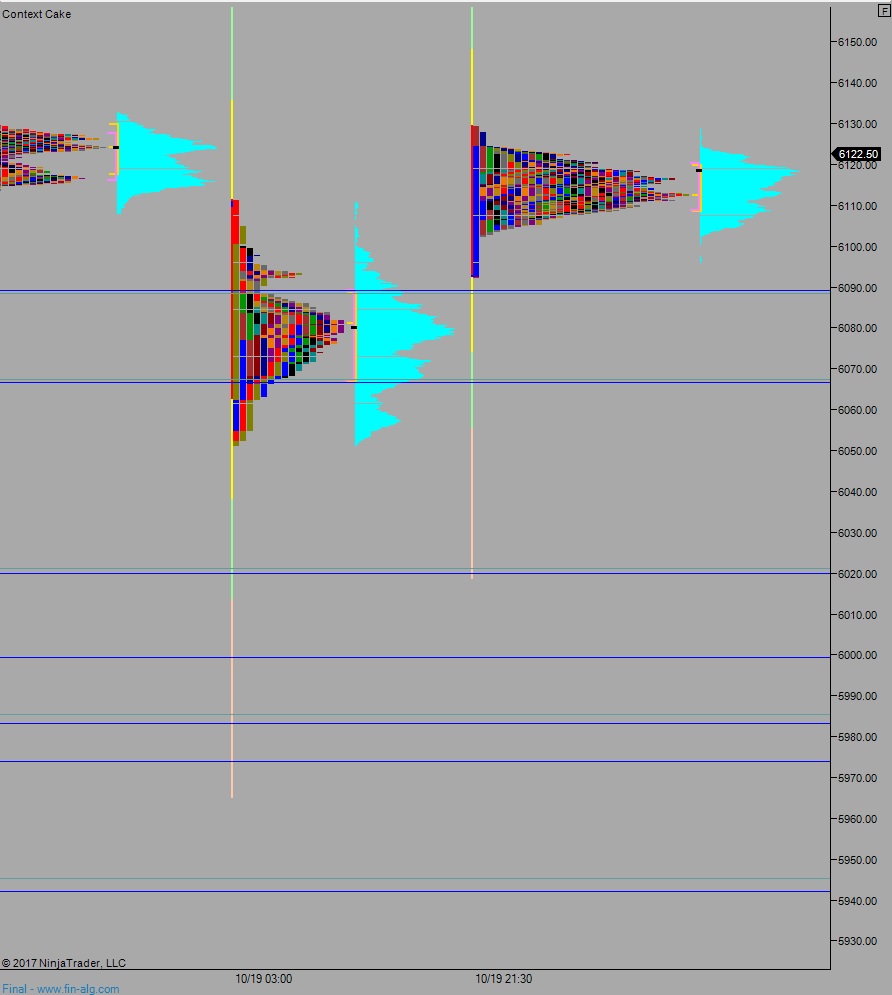

Volume profiles, gaps, and measured moves: