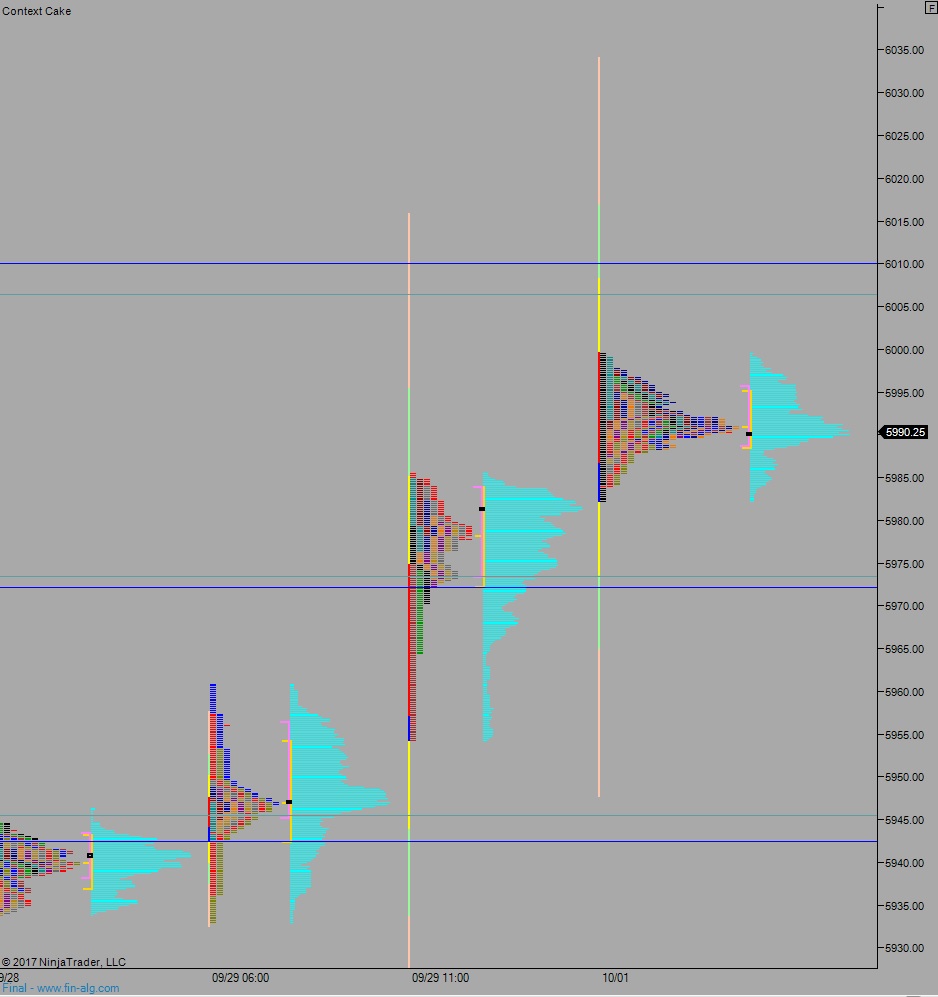

NASDAQ futures are coming into October with a slight gap up after an overnight session featuring normal range and volume. Price worked higher overnight, breaching last Friday’s high before coming into balance.

The economic calendar starts off slowly this week. At 10am we have ISM employment/manufacturing data. Also we have a 3- and 6-month T-bill auction at 11:30am.

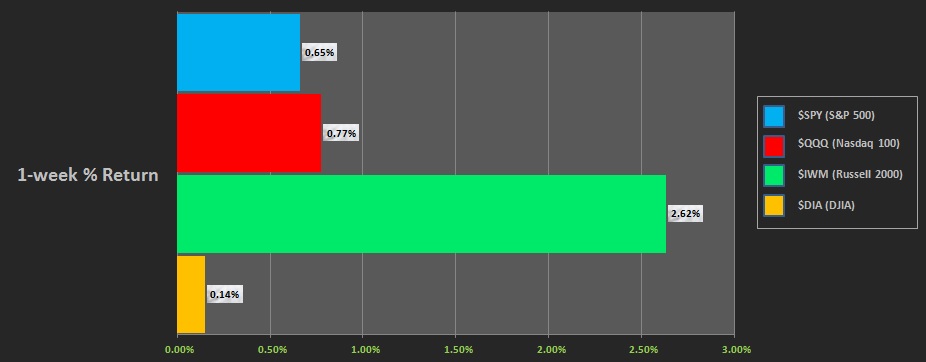

Last week we had weakness on Monday. The selling discovered a strong responsive bid and we spent the rest of the week rallying. The Russell was particularly strong. The performance of each major index last week is shown below:

Last Friday the NASDAQ printed a double distribution trend up. The gap up was sold into, closing the overnight gap before discovering a strong responsive bid and rallying to a new high for the week. Price balanced out after closing the gap left behind on 9/20.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5977.75. From here we continue lower, down to 5973.50 before two way trade ensues.

Hypo 2 stronger sellers press us down to 5945.50 before two way trade ensues.

Hypo 3 buyers work up through overnight high 5999.50 and continue higher, up to 6006.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: