NASDAQ futures are coming into Thursday gap down after an overnight session featuring normal range and volume. Price worked lower overnight but held inside the Wednesday range. At 8:30am several economic data were released including GDP, advance goods trade balance, and initial/continuing jobless claims. All were better than expected save for initial/continuing claims data which were mixed.

The only other economic event is a 7-year note auction at 1pm.

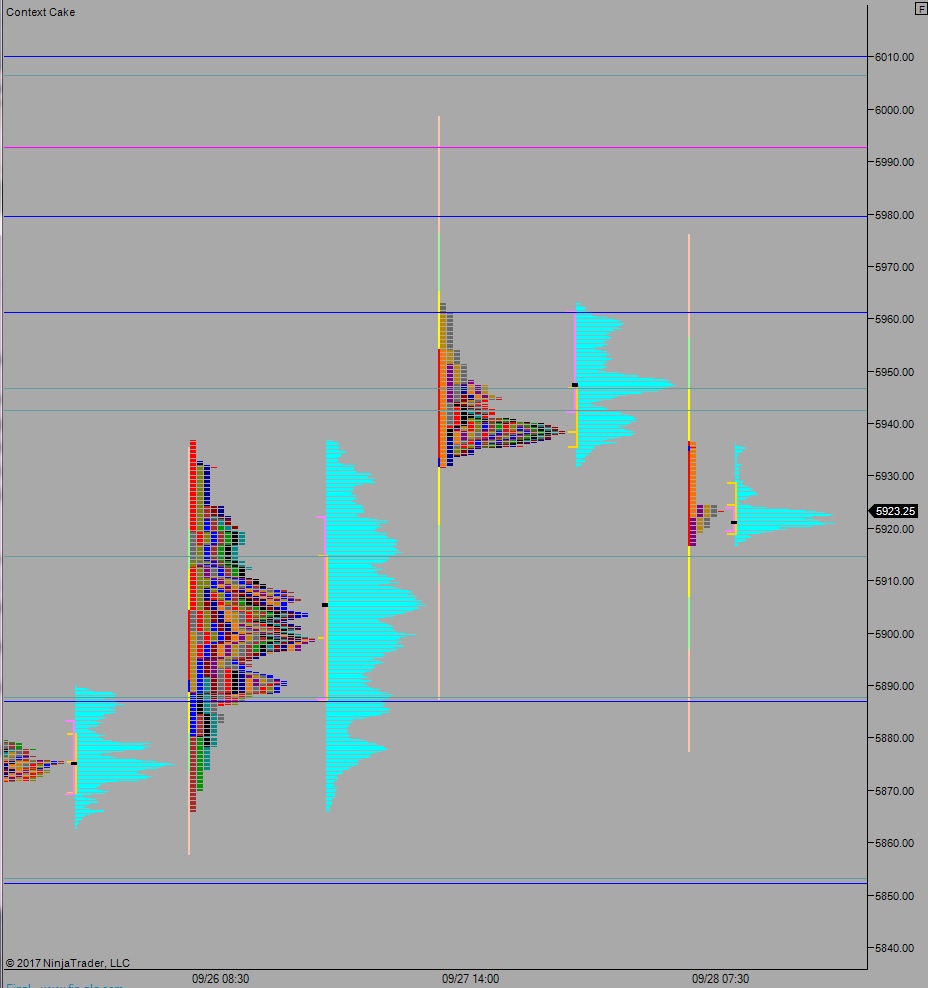

Yesterday we printed a neutral extreme up. The day began with a gap up and drive higher, up into resistance noted in hypo 2 from the Wednesday morning report. Then sellers began working lower, eventually going range extension lower late in the morning. However, buyers defended an attempt back into the Tuesday range and this triggered a rally back up through the days range to press up into neutral territory and eventually to a close in the upper quad of the day’s range earning the neutral ‘extreme’ designation.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 5941. From here we continue higher, up through overnight high 5948.25 which sets up a move to 5961.25 before two way trade ensues.

Hypo 2 stronger buyers press to close the gap at 5978.25 before two way trade.

Hypo 3 sellers press down through overnight low 5916.75 and find buyers down at 5914.50 before two way trade ensues.

Hypo 4 stronger sellers press down to close the gap at 5892 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: