NASDAQ futures are coming into Thursday flat after an overnight session featuring normal range and volume. Price worked higher, stalling out and finding responsive sellers just ahead of 5823.

5823 is the price that marks where the 0.68% retracement is of the selling that began June 9th and concluded June 12th. It is the ‘golden ratio’ discovered by Italian mathematician and all-around-good-guy Leonardo Pisano Bigollo aka Fibonacci.

Since nearly tagging the level, the NASDAQ sold off for 34 points then found a bid stabilized into two-way trade just below 5800.

* * *

The most important thing to keep in mind regarding this ratio is that is provides a pivot. Should sellers fail to maintain prices below 5823, then the June hissy fit was another short-lived dip. If instead sellers defend the zone, we may be in for another leg lower.

* * *

At 8:30am Initial/Continuing jobless claims data came out below expectations.

Also on the economic calendar today we have Housing Price Index at 9am, Leading Indicators at 10am, and a 30-year TIPS auction at 1pm.

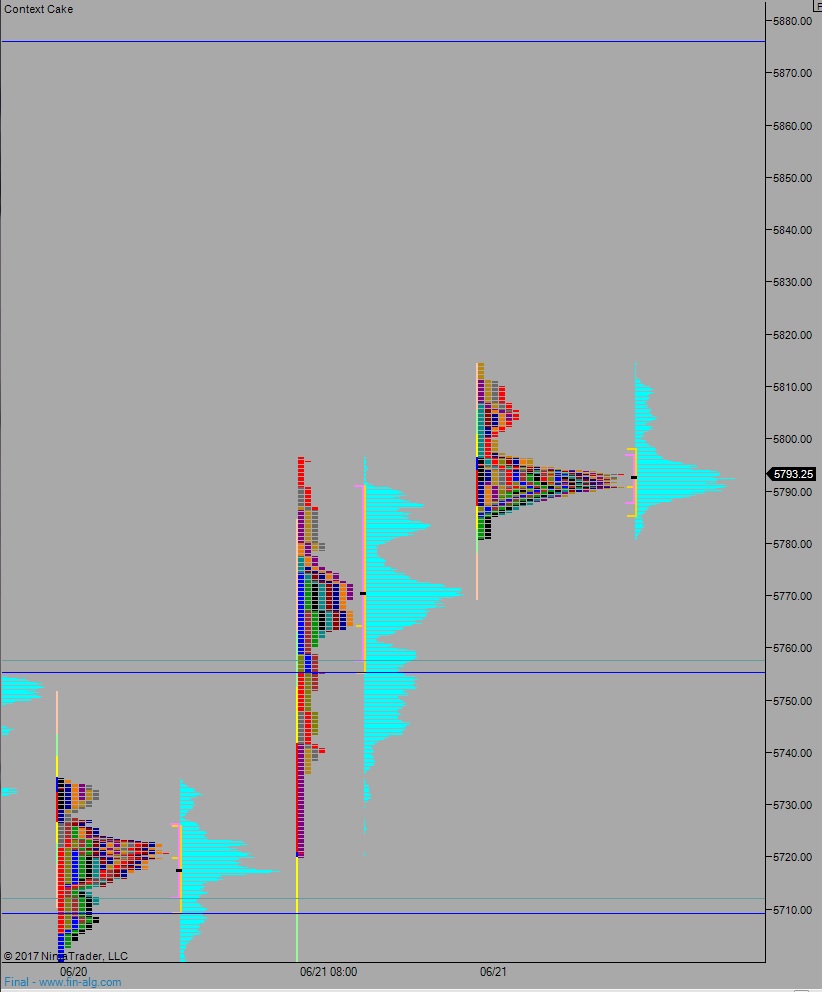

Yesterday we printed a double distribution trend up. The day began with a small gap up—a small gap up sellers should have easily closed, but they didn’t. This sent price racing higher. After a lunchtime lull (common place in the summertime and reason in-itself to avoid day trading most of the day) we saw a second leg higher to end the day, putting us at fresh weekly highs.

Heading into today my primary expectation is for sellers to press lower, down through overnight low 5780.75 setting up a move to target 5757.25 before two way trade ensues.

Hypo 2 buyers work up through overnight high 5814.50 and probe then Fibonacci level at 5823. They find sellers and two way trade ensues.

Hypo 3 stronger sellers close the gap down to 5733.50 then continue lower, down to 5712.50 before two way trade.

Hypo 4 pole climb. Buyers sustain trade above the fib level at 5823 triggering a fast move higher to 5876.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Summer markets are so choppy. I have always found it difficult to latch onto anything June-Aug unless the market gets oversold.