NASDAQ futures are coming into the week gap pro gap up after an overnight session featuring elevated volume and range. Price worked higher during all of extended trade, trading up into last Wednesday’s range.

The economic calendar is extremely light this week and today is no exception. The only scheduled events today are T-bill auctions, 3- and 6-month auctions at 11:30am.

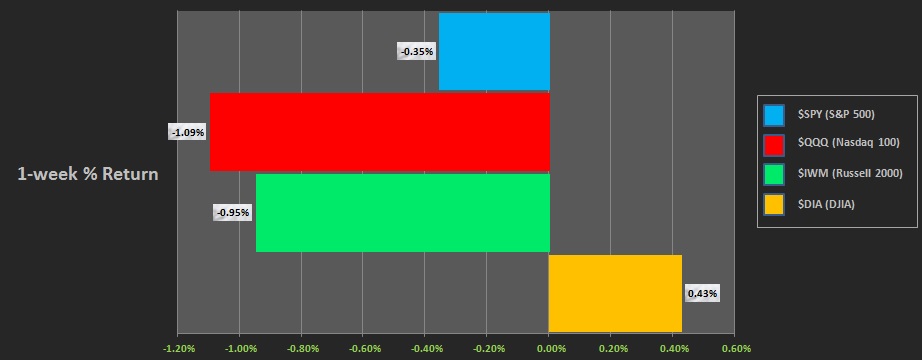

Last week we traded sideways, more-or-less. The week began with a hard sell then we drifted. During this time the Dow Jones diverged higher. Below is the performance of each major index last week:

On Friday, the NASDAQ printed a normal variation down. Price opened nearly flat, just a slight gap down which buyers were unable to close. Instead we drove lower early on. Sellers ultimately could not take out the Thursday low and we instead settled into two-way trade.

At the open the /NQU7 (September ’17 contract, current front-month) printed an open-test-drive up. Price traded up the the Exodus Strategy Session’s weekly ATR band before churning sideways for a bit.

Heading into today my primary expectation is for sellers to defend the measured move level at 5725.75 sending us lower to test last Friday’s high 5707.50. Buyers defend ahead of 5700 and two way trade ensues.

Hypo 2 buyers sustain above 5752.75 setting up a move to target 5775.25 before two way trade ensues.

Hypo 3 pole climb. Price sustains above 5777 setting up a trend up to 5876 before two way trade ensues.

Levels:

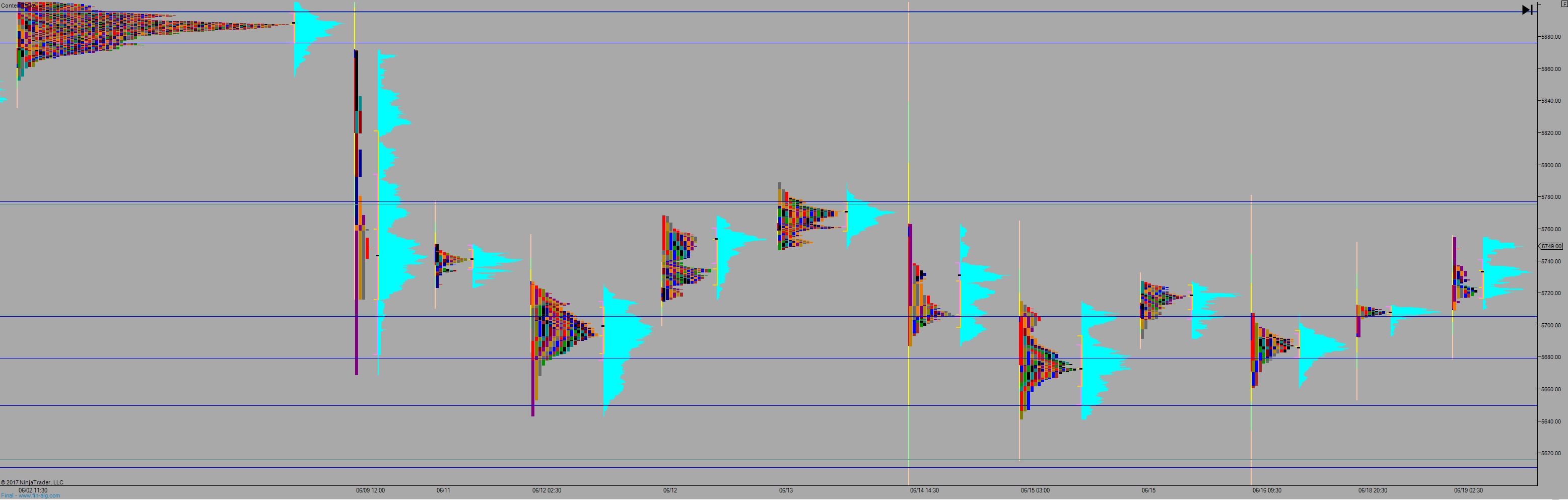

Volume profiles, gaps, and measured moves: