NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Also, volume appears to have mostly shifted to the September futures contract. Price worked lower most of the night, finding a bid just ahead of the Monday low. At 8:30am Initial/Continuing jobless claims came out mixed.

Also on the economic calendar today we have NAHB Housing market index at 10am and Long-term TIC flows at 4pm.

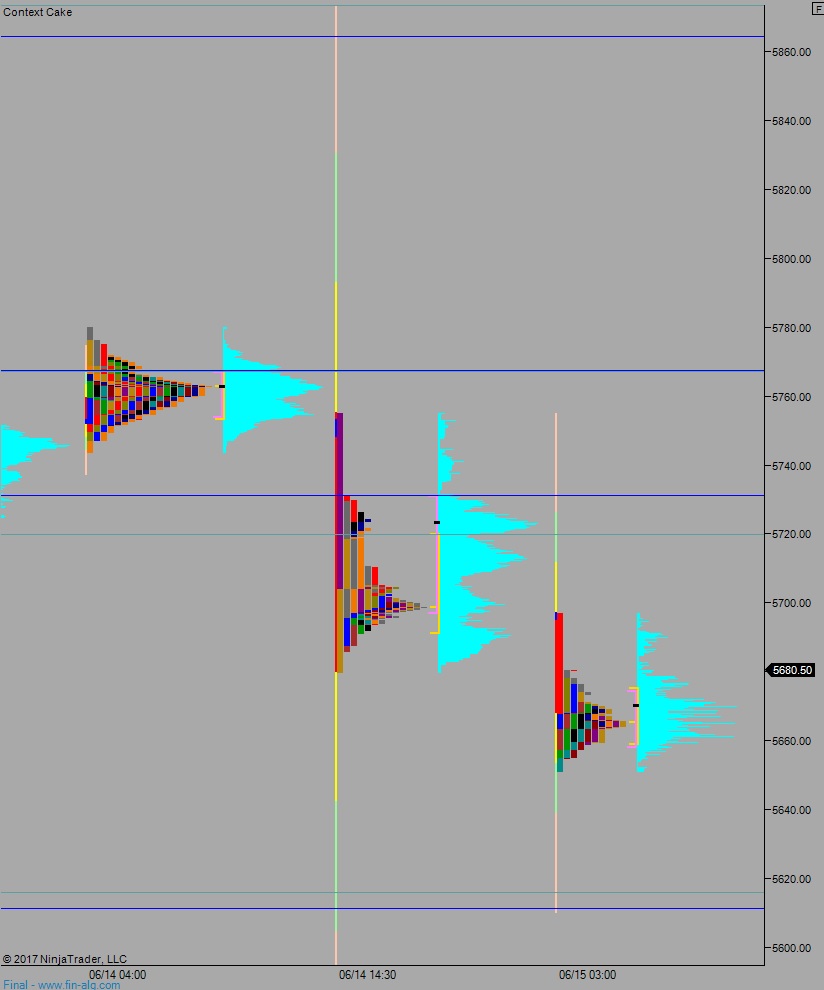

Yesterday we printed a normal variation down. The day began with a gap up that was sold early morning. We then spend the rest of the day in a tight auction before the FOMC rate decision. After the feds raised interest rates, third reaction analysis yielded the sell signal. Price sold off until the end of the day, when a strong snap back rally occurred.

Said ‘snap back’ has been erased during extended trade.

Heading into today my primary expectation is for buyers to attempt a move back into the Wednesday range. Look for sellers to reject a move back up through 5700, leading to a move down through overnight low 5651.25 that continues lower, down to the open gap at 5629.50 before two way trade ensues.

Hypo 2 buyers regain 5700 and continue higher, up to 5720, then up through overnight high 5726.50. Look for buyers just above at 5731.50 before two-way trade ensues.

Hypo 3 stronger sellers press down to 5616 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: