NASDAQ futures are coming into the third week of May flat after an overnight session featuring normal range and volume. Price made new record highs during Globex trade, but returned to flat soon after.

The economic calendar is light all week and today is no different. At 10am we have the Housing Market Index, at 11:30 the US Treasury is auctioning off 3- and 6-month T-bills, $39B and $33B respectively. Also at 4pm we have Long-term TIC flows.

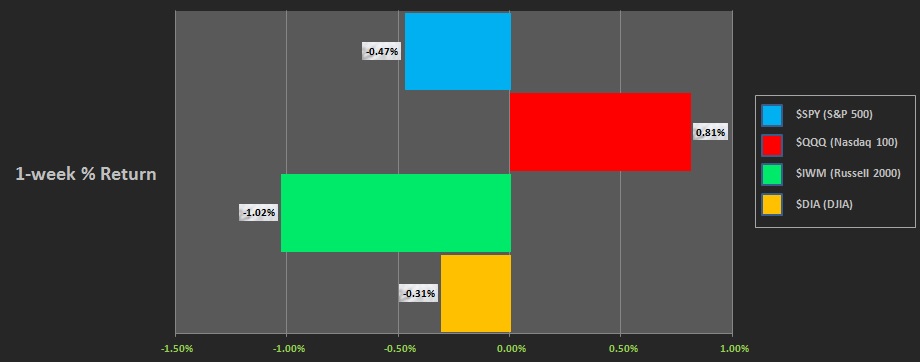

Last week markets worked sideways more-or-less, with the NASDAQ on a slight drift higher. The performance of each major index is shown below:

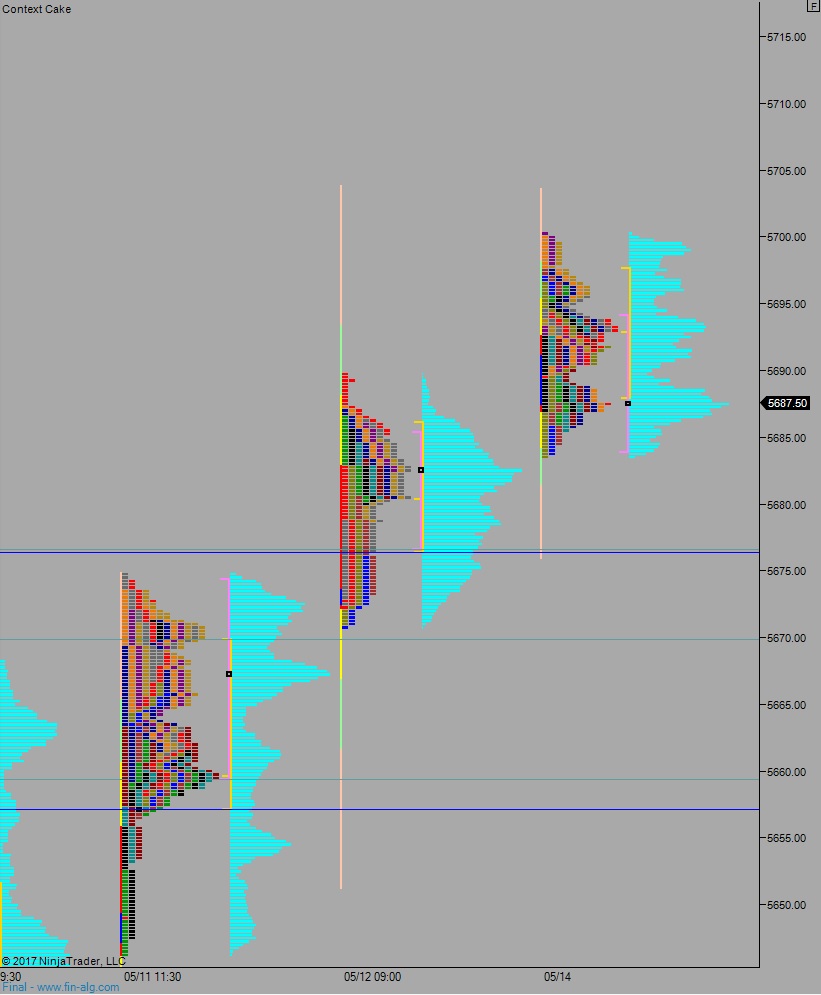

On Friday the NASDAQ printed a neutral extreme up. After a choppy initial balance [first hour of trade] sellers briefly pushed price range extension down, but the market caught a bid before closing the overnight gap and traversed the entire daily range eventually close at record highs.

Heading into today my primary expectation is for sellers to work down through overnight low 5683.50 and trade down to 5676.75 before two way trade ensues.

Hypo 2 buyers press up through overnight high 5700.25 and explore open air.

Hypo 3 stronger sellers press down to 5670 before two way, balance trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

Good write up