Let the record show my Sunday analysis, which suggested US markets had a ‘scary look to them heading into OPEX’ was off base.

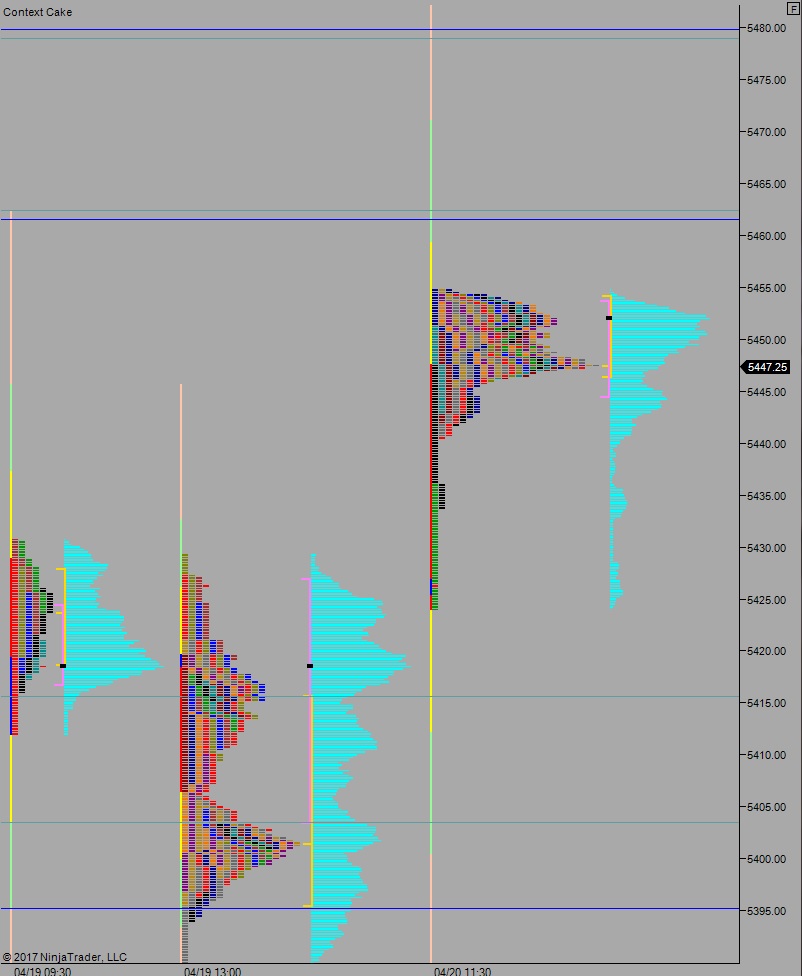

NASDAQ futures are coming into Friday, option expiration Friday, gap up after an overnight session featuring normal range and volume. Price worked up to the Thursday high, and has been treading water right at the high since. The high has been tagged many times but so far not exceeded. Therefore the profile has taken on a blunt shape on top, suggesting the high is ‘weak’ and prone to a test above it.

The economic calendar is light today. We have Markit Manufacturing/Service PMI at 9:45am, Existing Home Sales at 10am, and the Baker Hughes Rig count at 1pm.

Yesterday we printed a double distribution trend up. Price opened gap up for the third time this week, and for the third time this week sellers were unable to close the gap. Instead the market pushed higher off the open, at one point before lunch trending up into the 04/05 liquidation zone before settling into two way trade.

Heading into today my primary expectation is for buyers to work up through overnight high 5454.75 continue up to 5461.50 before two way trade ensues.

Hypo 2 sellers work down through overnight low 5440 triggering a liquidation down to 5415 before two way trade ensues.

Hypo 3 choppy range from 5430 – 5455.

Levels:

Volume profiles, gaps, and measured moves: