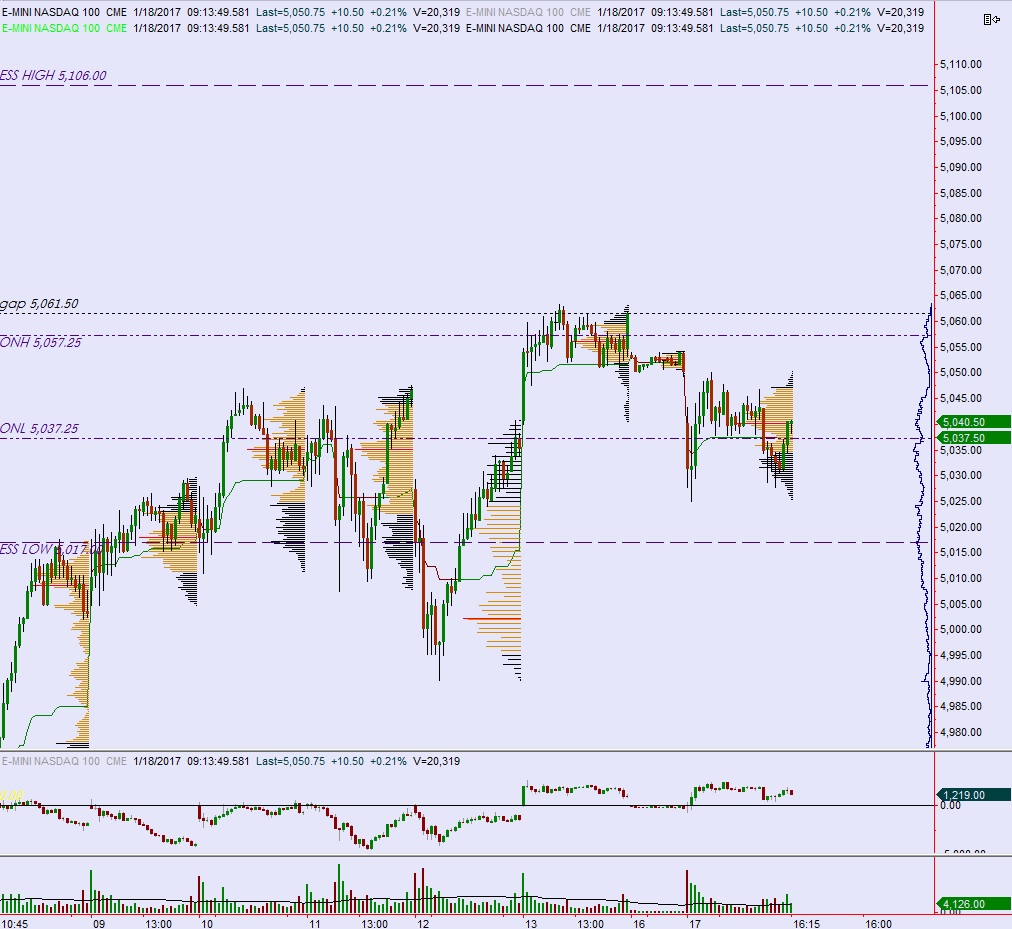

NASDAQ futures are coming into Wednesday gap up after an overnight session featuring normal range and volume. Price worked higher overnight, continually rising until finding sellers up near value high from late-last week. At 7am MBA Mortgage applications came in worse than last week. At 8:30am CPI data was in-line with expectations. It appears earnings from Goldman Sachs $GS may have been the early market-moving event, however.

Also on the economic docket today we have Industrial/Manufacturing production at 9:15am, NAHB housing market index at 10am, Fed chair Yellen is speaking in San Fransisco at 3pm, and long term TIC flows at 4pm.

Yesterday we printed a normal variation up. After beginning the holiday shortened week gap down we experienced an early selling drive. However buyers stepped in and defended the upper-quad of last Thursday’s trend day and we worked range extension up. Then price settled into two-way balance.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 5040.50. From here we take out overnight low 5037.25. Look for buyers ahead of 5030 and two way trade to ensue.

Hypo 2 stronger sellers work us down to 5021.25 before two way trade ensues.

Hypo 3 buyers press up through overnight high 5057.25 to target 5059.50 before two way trade ensues.

Hypo 4 strong buyers sustain trade above 5059.50 setting up a trend day. Stretch target is 5106.

Levels:

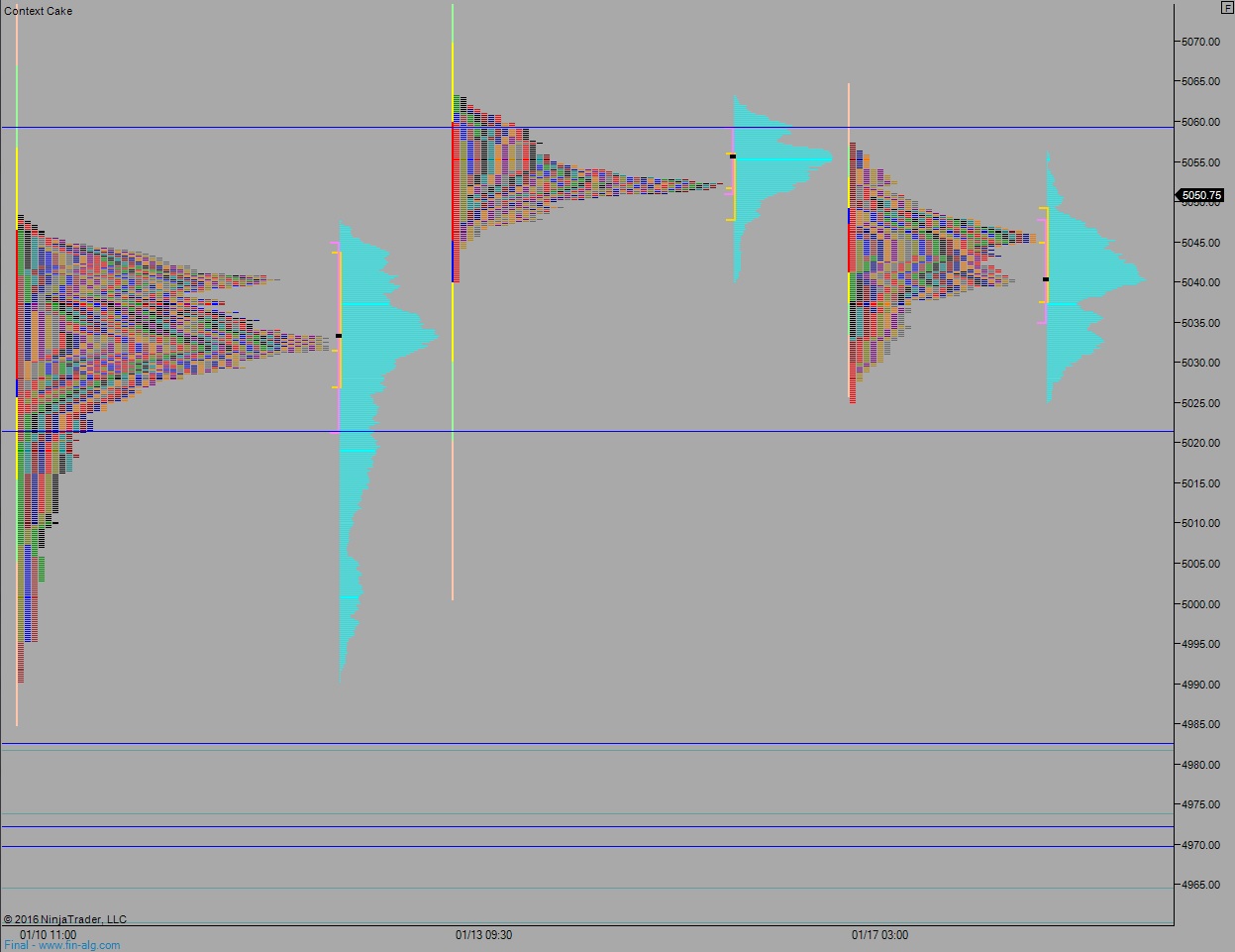

Volume profiles, gaps, and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter