Season’s greetings lads, and lassies. There has been much to-do over the prevalence of try-too-hard ugly sweaters, SANTACON, and the gluttonous consumers who fiendishly file into the shopping centers nationwide to feed from the cinnabon trough.

And while your Christmas proclivities merit appreciation for keeping this dream we call capitalism alive, it comes with a risk. The risk is too much of a good thing.

Markets are behaving the same way. Higher. More, give me the gains.

Inside iBankCoin labs we have precision instruments to measure human behavior and objectively assess whether trouble is afoot. Below are the findings from our Sunday review. Collectively they provide conviction to short the market early and often next week.

The Feds raised interest rates last week. After the announcement, third reaction analysis yielded the sell:

Markets were choppy for the rest of the week. A slow boil perhaps.

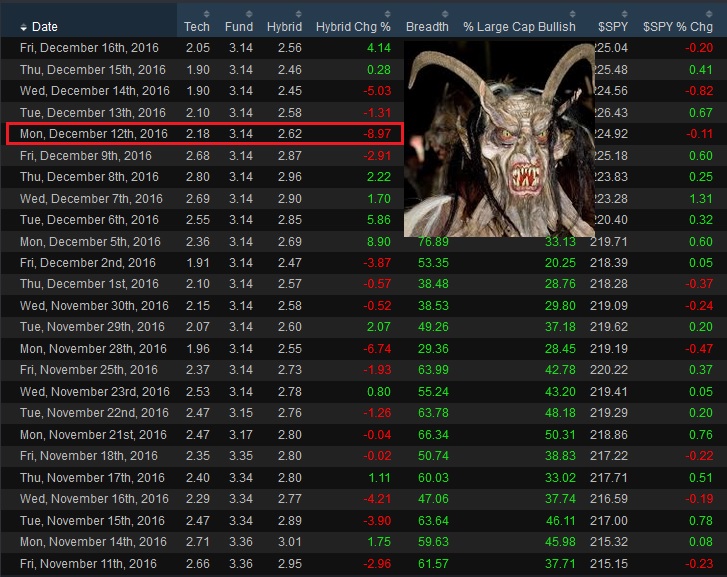

Before all of this happened, back on Monday, Exodus registered a significant Hybrid Change % on the system-wide algorithm:

*Note the 7 basis point size vs December 5th

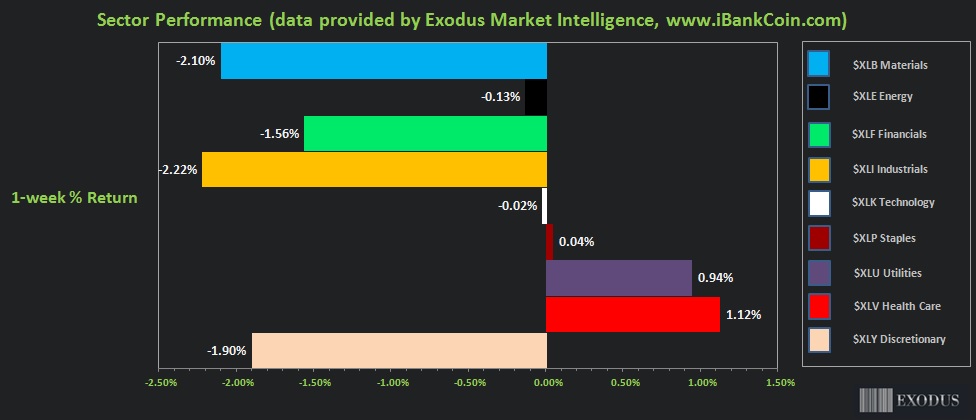

Last week’s sector rotations had a bearish tone, an undercurrent if I may be so bold:

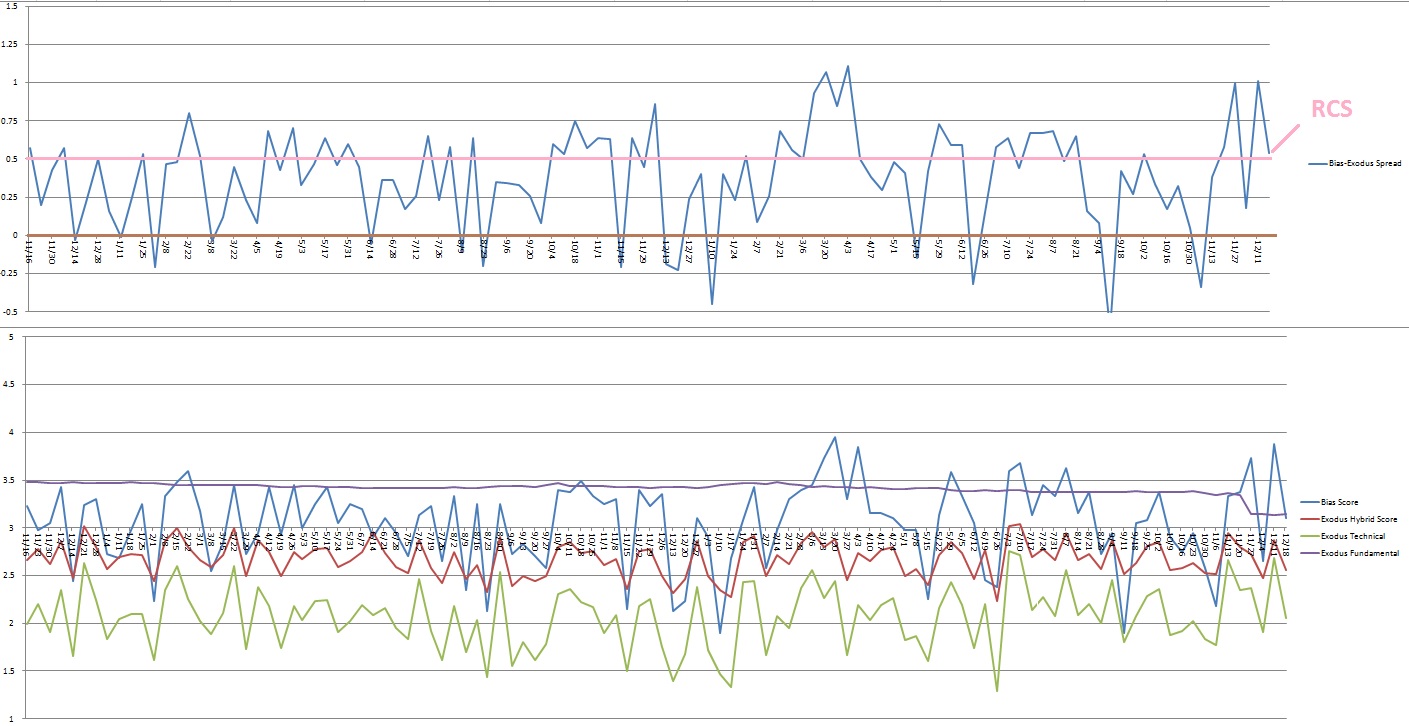

The S&P 500 triggered a short bias. The model has 109 samples and currently boasts a 65.1% win rate. It says we see /ES_F 2238 before 2272.50 next week. Bearish.

Rose Colored Sunglasses [RCS] short bias triggered on the auction theory model. The name of the signal came from the behavioral condition it highlights. It’s a toast to the overall index painting a rosy image of the markets despite the decay being detected by Exodus. It’s sort of like wearing rose colored sunglasses which have been shown to enhance ones mood when worn.

Life’s always better with rose colored sunglasses. But the lenses hinder our ability to form objective judgement, which we need now at this very moment. Bearish

This is the first RCS short signal since 7/31/16. STAMINA.

The PHLX semiconductors index printed an ominous Red Dawn candle Friday which suggests more selling pressure could come in next week:

These are the key findings after completing the 110th consecutive Exodus Strategy Session. Collectively they form the conviction to hopefully initiate a NASDAQ position short via QID into some early week strength and to press intra-day shorts in the /NQ_F and be extremely cautious with /NQ_F longs.

There is only one data point missing—an extreme NYSE TICK. We haven’t had one since November 7th.

There you have it. iBankCoin labs is issuing a Krampus alert this week. Be on the lookout for large, hairy man-beasts with long tongues. They seek to plunder from your purse and snatch away Christmas cheer.

Areas of elevated Krampus risk include YHOO, TWTR, and FB.

If you spot Krampus, be sure to report the time and location to the good folks at iBankCoin laboratory so we may issue a PSA. Good luck and godspeed.

If you enjoy the content at iBankCoin, please follow us on Twitter

Awesome write up Raul. In relation to your point about third reaction analysis from interest rate announcement, how do you determine what’s considered a “reaction”? Is it based on volume and/or direction? I ask because just to the right; it looks like there’s a big move to the upside. Thanks in advance for the help.

It’s the first 3 detectable rotations after the news. The 4th reaction is of no significance to the analysis. I use the renko chart to spot them

This is all bullshit.

Like your face

TWTR and FB may have elevated risk, even if the market keeps rising. They are trying to counteract fake news. But people love fake news and lies. They can’t get enough of it. And they will reject any attempts to deprive them of it.

Precicely

They reverse engineered Exodus, hence its inability to provide any meaningful market calls this year. Fly touts the performance of his GARP portfolio instead of taking ownership of his TLT roundtrip, failed long gold trades and every other poor market call coming out of here.

After such a horrific year you guys are really going to raise prices????!!!

Why not critique my work? What am I, chop liver?

You looking 38’s as a hold? Seems a potential for some speed in that zone below.

Mojo

Exodus didn’t produce any TLT or gold trades. That was all core these macro stuff, all of which were working out fine until Election Day.

Garp has always been my personal portfolio for Exodus buy and hold types. Why wouldn’t I promote such stellar performance.

Lastly, Exodus nailed all OS signals in 2016. There just wasn’t many of them. And it’s more than me and my picks. It’s a damned good tool.

Sub rates are at all time highs and it’s priced 50% market. Hence, prices are rising a little. We’re running trials this week. You should check it out.

How is yhoo still around? 1 billion hacked?

Motif looks sweet btw. Good work