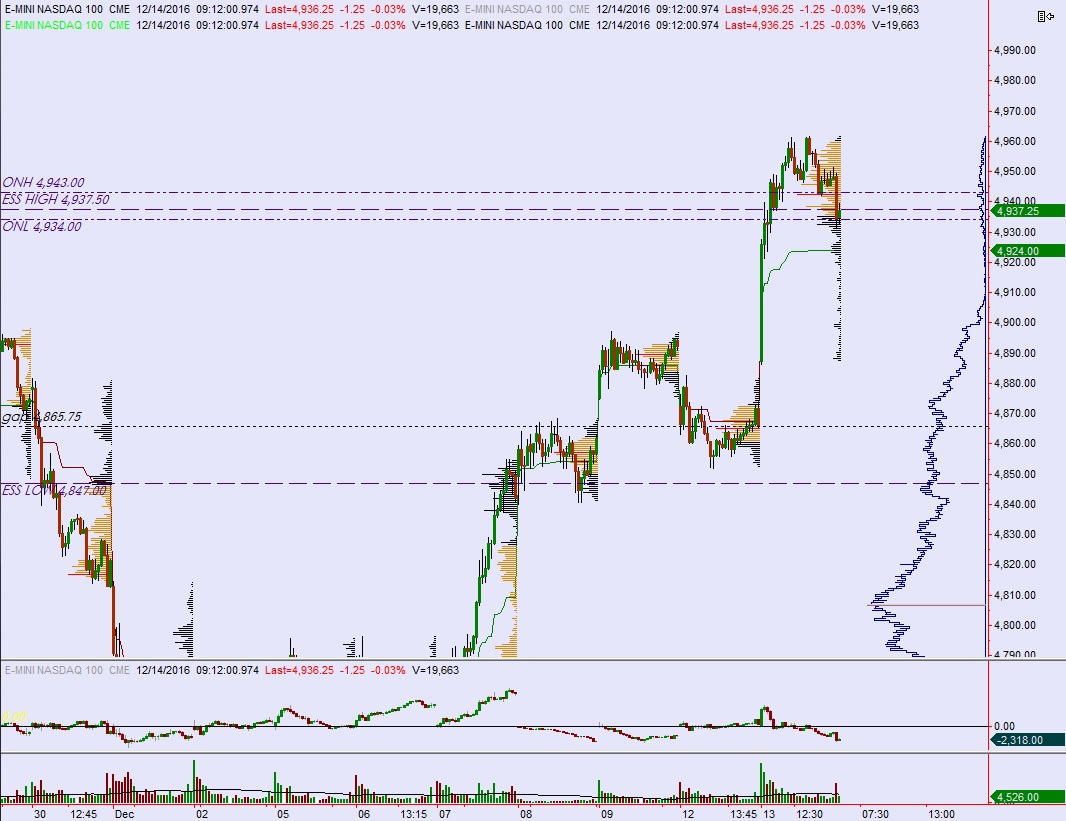

NADAQ futures are coming into Wednesday flat after an overnight session featuring a (barely) normal range on normal volume. Price held a 9-point range overnight, near the closing print from Tuesday. At 8:30am Advance Retail Sales data came out below expectations.

Also on the economic calendar today we have Business Inventories at 10am, crude oil inventories at 10:30am, but who are we kidding, all eyes are on 2pm when the FOMC rate decision will be released.

Consensus among investors is that the Fed will raise interest rates by 25 basis points. The key is to gauge the reaction after the announcement for market direction into the rest of the week, and possibly the year.

Yesterday we printed a short squeeze. There was a strong driver higher off the open, up to new all-time highs. The rallying continued through lunchtime before some profit taking came in. Overall the profile resembles a P-shape, a formation often seen when a short squeeze takes place.

Heading into today my primary expectation is for sellers to take out overnight low 4934 and trade down to 4923 before two way trade ensues ahead of the Fed.

Hypo 2 buyers work up through overnight high 4943 and up to 4953 before two way trade ensues.

Watch for the 3rd reaction after the 2pm rate decision to give direction into the close.

Levels:

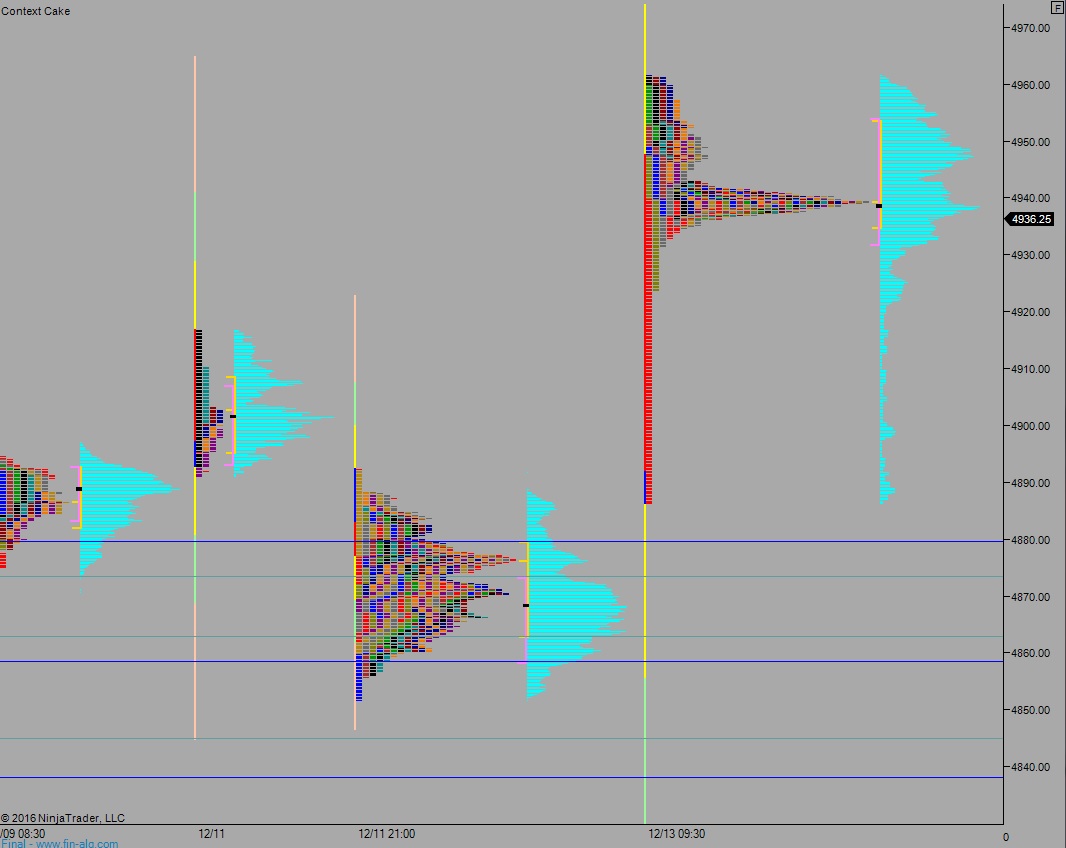

Volume profiles, gaps, and measured moves: