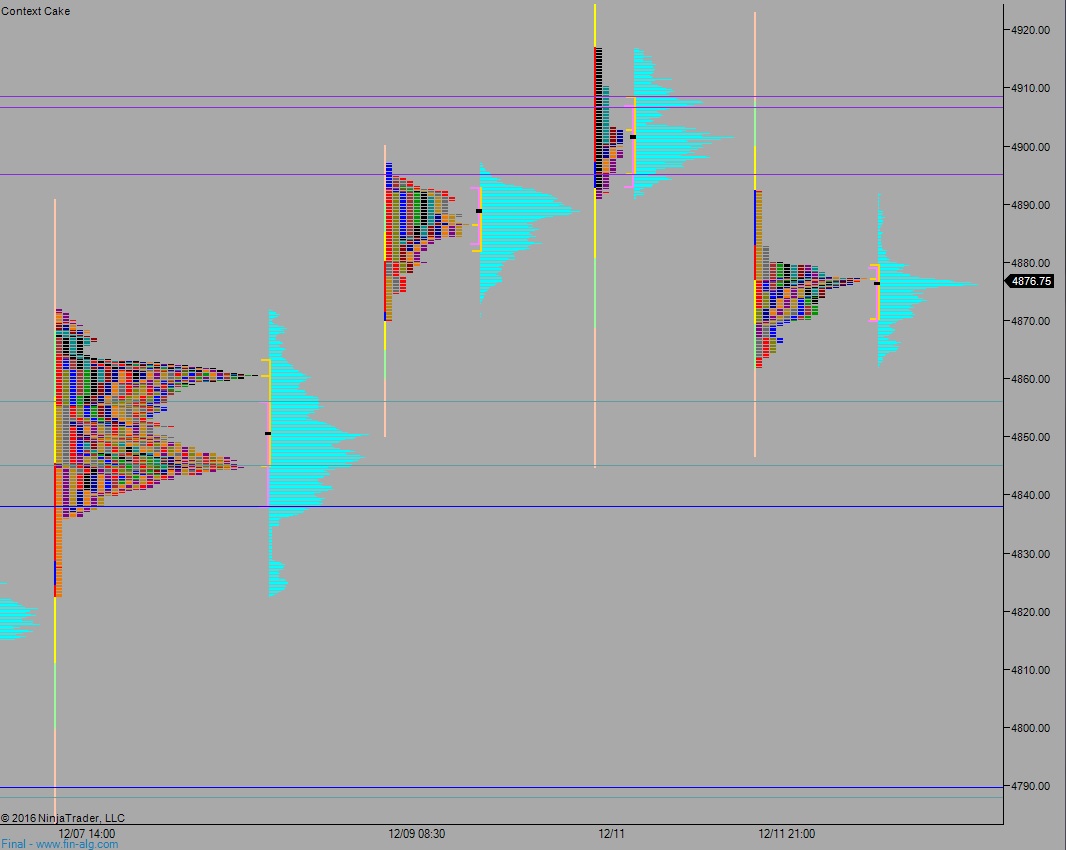

NASDAQ futures are coming into the week gap down after an overnight session featuring abnormal range and volume. Price rallied to new all-time highs before reversing down through the entire Friday range and gap before finding responsive buyers down at last Thursday’s close.

The economic calendar is loaded with US Treasury activity including a 3- and 6-month T-bill auction at 11:30am, and also a 3-and 10-year Note auction at 1pm. There’s also a 2pm Monthly Budget Statement.

However investors have their eyes on Wednesday afternoon when the Federal Open Market Committee is set to lift interest rates by 25 basis points. As soon as this afternoon, we are likely to enter a holding pattern ahead of the decision.

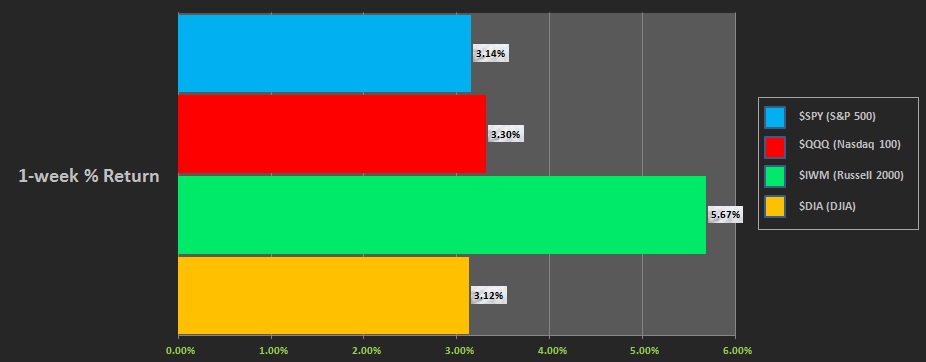

Last week saw US equity market in rally mode. We gapped up into the week and held the move through Wednesday when we began to trend higher. The buyers pressed for the rest of the week. Here’s the performance of each major index during the first full week of December:

On Friday the NASDAQ opened gap up and printed a normal variation up.

Heading into today my primary expectation is for buyers to work into the overnight inventory to close the gap up to 4892.25. Look for sellers up at 4895 who work price down through overnight low 4862. Buyers down at 4856 and two way trade ensues.

Hypo 2 sellers work down through overnight low 4862 to target 4856 before two way trade ensues.

Hypo 3 strong buyers press overnight gap fill up to 4892 then take otu overnight high 4916.75 before two way trade ensues.

Hypo 4 strong sellers press down to 4847 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: