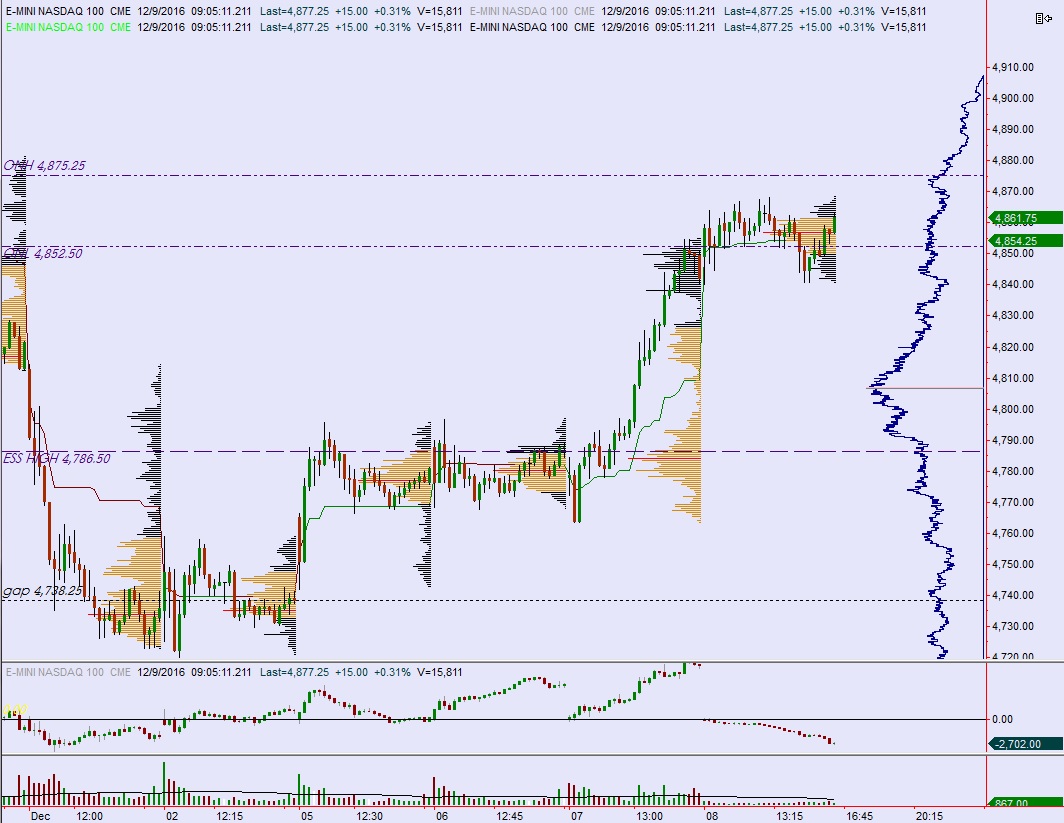

Note: Yesterday, December 8th active traders rolled forward to trading the March 2017 futures contract. For the sake of the IndexModel, today’s price levels will be reported using the December /NQ contract.

NASDAQ futures are coming into Friday gap up after an overnight session featuring normal range and volume. Price worked up to new weekly highs overnight, and as we approach U.S. open prices are holding above Thursday’s high.

On the economic docket today we have the preliminary reading of U. of Michigan confidence. With futures rolling over, this preliminary reading can be used to jostle the market. Be aware of this 10am announcement.

Yesterday we printed a normal variation down. The gap up was quickly sold to fill down to Wednesday’s close before a bidder stepped in. The rest of the session was balanced but sellers did manage to extend the range lower, albeit briefly, toward the end of the day. Prices quickly recovered during the Ramp Capital hour.

Heading into today my primary expectation is for buyers to squeeze higher, up through 4881 triggering a move up to 4895. We are likely to settle into two way trade from here.

Hypo 2 full-on move for the highs, sustain trade above 4895 and a move above 4907 to make new highs. Look for some traffic around 4900.

Hypo 3 sellers push down to 4864.25 before two way trade ensues.

Hypo 4 a liquidation triggers, down through overnight low 4852.50. Look for buyers down at 4847.25.

Levels:

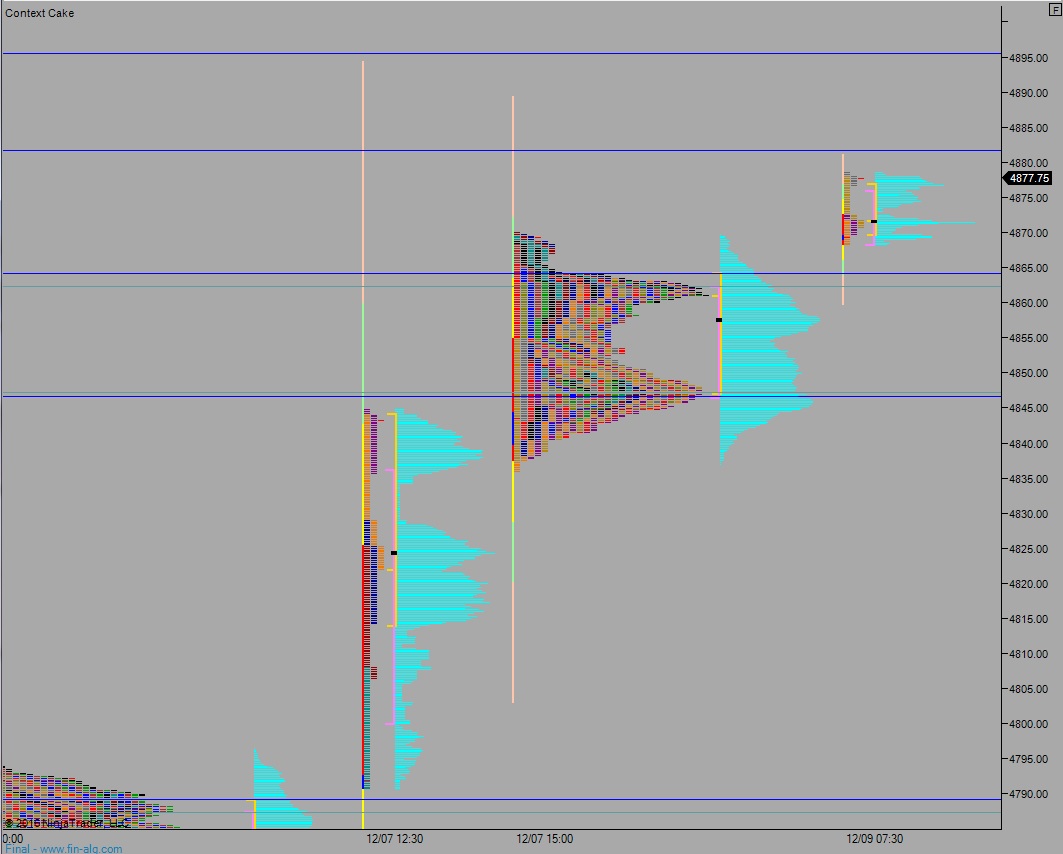

Volume profiles, gaps, and measured moves:

Nasdaquiries for everyone.