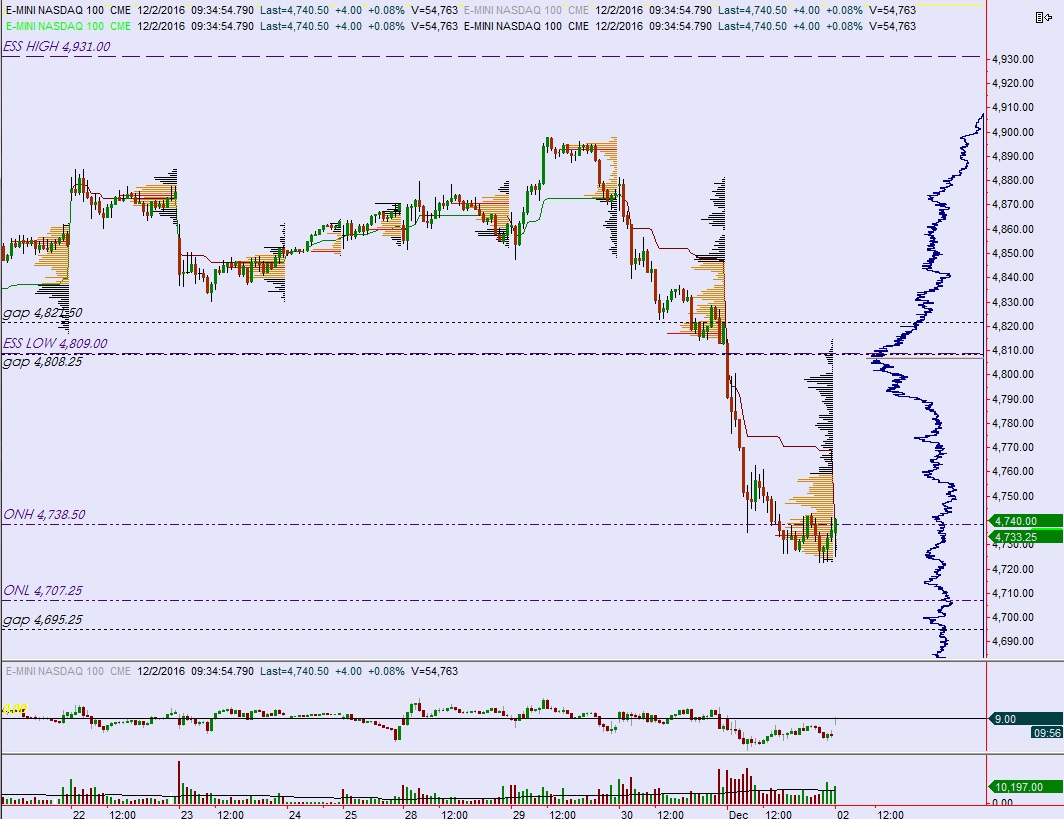

NASDAQ futures are coming into Friday flat after an overnight session featuring elevated volume on normal range. Price worked down through the Thursday low before finding a bid ahead of the 11/14 open gap. At 8:30am Non-farm payroll data was stronger than expected:

USA Unemployment Rate for Nov 4.60% vs 4.90% Est; Prior 4.90%

USA Non-farm Payrolls for Nov 178.0K vs 175.0K Est; Prior 161.0K

Third reaction yielded a buy signal off the data.

The only other economic event today is Baker Hughes rig count at 1pm.

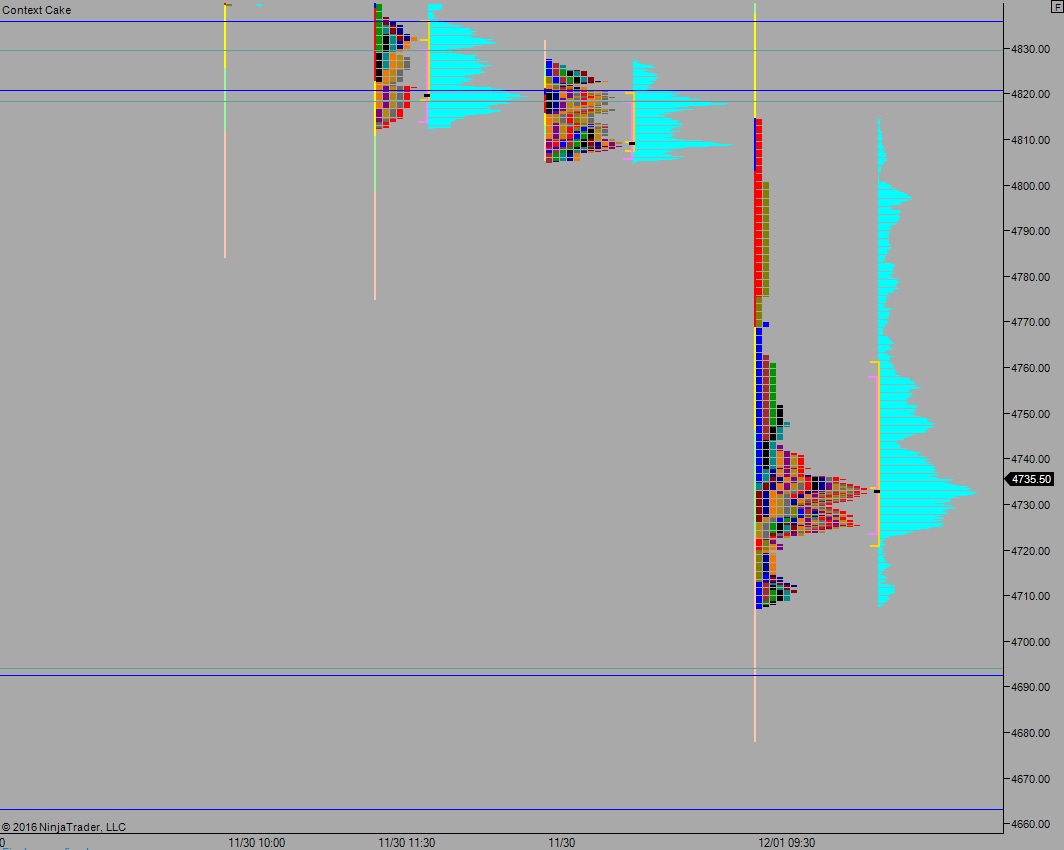

Yesterday we printed a trend down. Price opened gap down and drove lower. The selling lasted all session.

Heading into today my primary expectation is for sellers to work down through overnight low 4707.25 to target the open gap at 4695.25. Look for buyers down at 4694.25 and two way trade to ensue.

Hypo 2 buyers work up through overnight high 4738.50 and trade up to 4760 before two way trade ensues.

Hypo 3 strong buyers reverse Thursday, leaving a globex swing low behind, trade all the way up to the Wednesday gap 4808.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: